Company Info

Risk Management

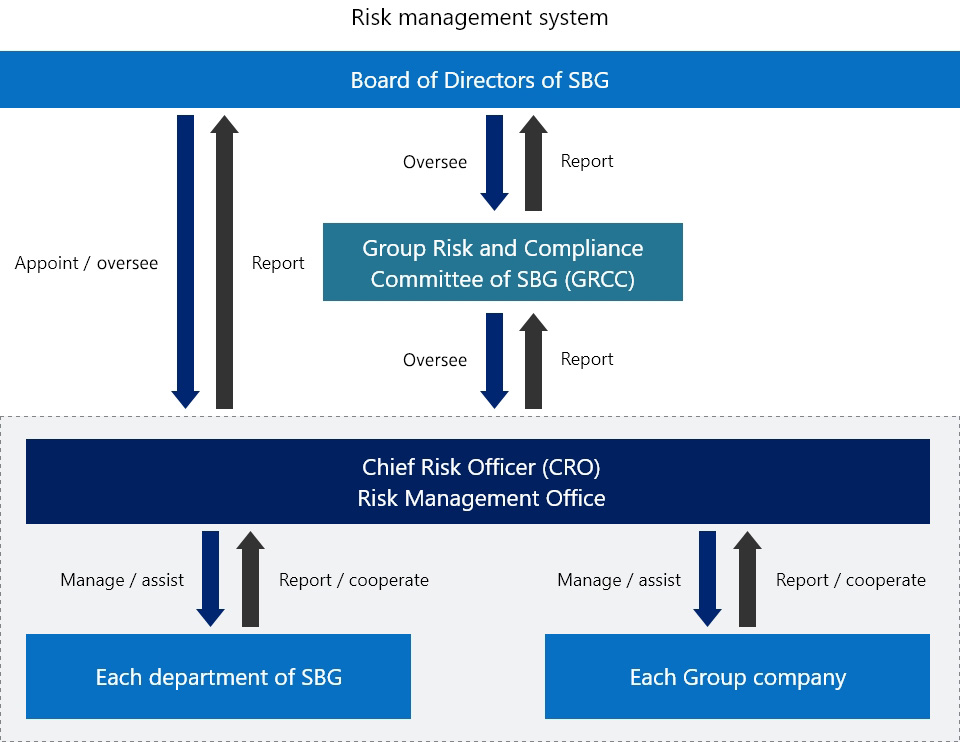

Risk management system

At SBG, the Risk Management Office spearheads Group-wide risk management activities cooperating with Group companies and departments. The office is supervised by the Chief Risk Officer (CRO), who is appointed by the Board of Directors with responsibility for Group-wide risk management.

SBG established the Risk Management Policy to ensure a Group-wide understanding of the purpose of risk management and to clarify the basic roles of officers, employees, and risk managers. This policy applies to all officers and employees of SBG and the Group companies to encourage their active involvement in risk management activities. Under this policy, and in accordance with SBG’s Risk Management Regulations and the Group Company Management Regulations, we appoint risk managers at SBG and its Group companies, comprehensively identify financial and non-financial risks that might arise during business activities, and monitor the countermeasures and their implementation status on at least a quarterly basis.

The Risk Management Office ensures the effectiveness of Group-wide risk management by receiving reports on material matters from risk managers and confirming compliance with the regulations. These policies and regulations are periodically reviewed and approved by the Board of Directors of SBG and other bodies. The Risk Management Office quarterly reports identified risks that are material to the Group and their countermeasures to the Board of Directors and the Group Risk and Compliance Committee (GRCC), respectively. Accordingly, both governance bodies oversee the Risk Management Office. The GRCC consists of Board Directors and Corporate Officers of SBG and provides oversight of the risk management and ethics and compliance programs of the Company.

Risk management initiatives

The Risk Management Office works to strengthen risk management activities by identifying and addressing risks, with the aim of eliminating and reducing impediments that adversely affect the Group’s sustainable growth.

Identifying risks

The Risk Management Office is pursuing the following initiatives to gain a comprehensive understanding of financial and non-financial risks across the entire Group.

Key agenda confirmation

When decisions are to be made about new investments or other material matters by the Board of Directors, Investment Committee, or other decision-making bodies in SBG, the Risk Management Office confirms the agenda items in advance and consults with the relevant departments, if necessary. It also ensures that risk-related information that needs to be considered is reflected in the agenda.

Portfolio risk analysis

The Risk Management Office performs risk analysis on the entire Group’s investment portfolio from various perspectives. For example, the Risk Management Office monitors the impacts on SBG’s financial indicators that are caused by changes in the external environment such as economic and monetary policies and other political conditions. It also monitors the concentration of investments in specific countries, regions, and sectors continuously.

Risk information gathering

The Risk Management Office comprehensively gathers information on various risks from major Group companies and SBG departments. When risks materialize, the relevant parties report the issues to the Risk Management Office in a timely manner.

Responding to risks

Based on the information gathered through the above initiatives, the Risk Management Office analyzes and assesses various risks and corresponding countermeasures, considering the likelihood that a risk could materialize and the magnitude of the potential impact. For material risks that could significantly impact the Group’s sustainable growth, the Risk Management Office collaborates with the relevant departments or Group companies in order to understand the implementation status of countermeasures and monitor their effectiveness. To address AI-related risk, which is identified as one of the material risks, the Risk Management Office participates as a member of the AI Governance Working Group, which was established in fiscal 2024, and monitors ongoing developments.

Through this process, material risks and the status of countermeasures are reported to and discussed by the Board of Directors and the GRCC every quarter. Based on the results of those discussions, the Risk Management Office strives to strengthen the Group’s risk management system. In addition, as part of educational efforts and to ensure that external directors, etc., can make informed decisions based on a proper understanding of the Group’s overall risk exposure, the Risk Management Office regularly provides individual briefings on the latest risk trends and other relevant information and facilitates opportunities for dialogue. The feedback obtained from these discussions is used to further enhance risk management initiatives.

Message from Our Chief Risk Officer (CRO)

Q1.Given the changes in the international landscape over the past year, are there any risks that you are particularly keeping an eye on?

In fiscal 2024, the pace of AI progress accelerated, while global uncertainties intensified. Ongoing events such as Russia’s invasion of Ukraine, unrest in the Middle East, and U.S.-China tensions contributed to a deteriorating international climate. In response, many governments introduced policy changes aimed at strengthening economic security, including export controls and tariff measures. As an organization that invests globally and whose portfolio companies operate across diverse countries and regions, SBG is exposed to geopolitical and regulatory risks. For example, with SVF now having more than 400 portfolio companies, rising geopolitical tensions could significantly impact these companies’ growth potential, profitability, and exit opportunities. In addition, as Arm derives a portion of its revenue from China, its business performance could be affected by export controls, sanctions, or tariff actions imposed by various countries.

In view of this situation, the Risk Management Office regularly communicates with government affairs teams in various countries to gather information. Such information includes developments of investment-related regulations that could affect our investment activities, export controls on semiconductors to China, and changes to sanctions or export control lists in the U.S. and elsewhere. The office also engages in discussions with key subsidiaries to help ensure early identification and timely monitoring of such risks across the Group.

Q2.What are the risks associated with investments toward realizing ASI, and how are you planning to address them?

AI made significant advances in fiscal 2024, and the competitive landscape has grown more intense. In this environment, we have been accelerating our investments toward realizing ASI. What may have stood out for many was the announcement of new initiatives in early 2025, particularly the Stargate Project, which involves building dedicated AI infrastructure for OpenAI in the U.S. Beyond that, we have also been investing in a variety of other areas. For example, we established SB TEMPUS to contribute to further advancements of Japan’s healthcare through the use of AI. We also made SBE Global, which constructs and operates solar power plants in the U.S., a subsidiary. In addition, we have invested in companies engaged in robotics, warehouse automation, and autonomous driving. These investments have contributed to the expansion of our portfolio as a strategic investment holding company.

The Risk Management Office monitors the performance of these portfolio companies, tracks SBG’s investment amounts and expected future payment, and gathers information on their business progress and challenges. A reporting structure is in place to ensure this information is regularly reported to our management. We plan to maintain a proactive investment stance in fiscal 2025. Our future investment scale, including follow-on investments in OpenAI, is expected to exceed that of recent years. As such, it will be important to identify a wide range of risks at an early stage—not only financial risks but also those related to the pace of AI technological advancement, the evolving competitive landscape, and regulatory changes. Acting independently from operating divisions, the Risk Management Office will continue to evaluate these risks from multiple perspectives to support efforts to realize ASI.

(As of July 28, 2025)