Investor Relations

ANNUAL REPORT 2021 SoftBank Vision Funds: Investment Strategy

Realizing Our Vision

Corporate Officer, Executive Vice President,

SoftBank Group Corp.

CEO, SoftBank Investment Advisers

Rajeev Misra

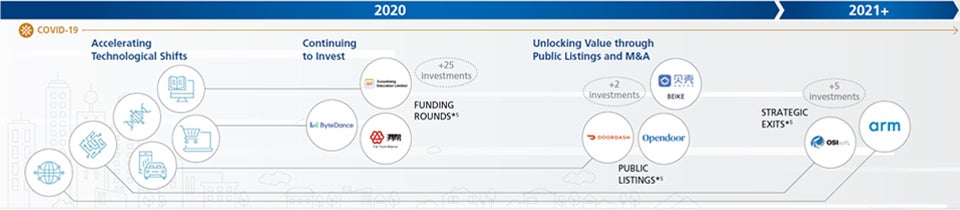

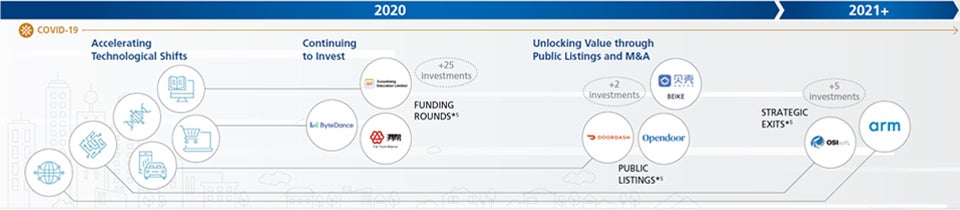

Fiscal 2020 was a transformational year for SoftBank Vision Funds and the world.

The pandemic affected each of us in ways none of us could have predicted.

We have had to be even more agile as individuals and as an organization and pull together to navigate uncharted territory. I truly believe that we have emerged stronger, and I am humbled by the resilience our team has shown in the face of such once-in-a-lifetime adversity. We have worked tirelessly for our firm, our LPs, and our portfolio companies.

SoftBank Group has completed its transition to an investment company, with SoftBank Vision Funds as the centerpiece for private investing. Since inception, SoftBank Vision Fund 1 has had 14 companies go public and as of March 31, 2021, generated cumulative gross investment gains of $55.0 billion*1 and distributed $22.3 billion to LPs.*2 Recent highlights include the IPOs of Auto1, Coupang, DoorDash, Opendoor and Relay Therapeutics, as well as the sale of OSIsoft. We believe the announced SPAC mergers of Grab and WeWork, and the pending acquisition of Arm by NVIDIA, will create additional opportunities to unlock value when those transactions close.

SoftBank Vision Fund 2*3 is also off to a strong start. As of March 31, 2021, we invested $6.7 billion*1 in 44 companies,*4 and we have a robust pipeline of investments globally. The public listings of Beike, Seer, and Qualtrics have already driven up the fund more than $4.0 billion*1 since inception.

I expect that fiscal 2021 will be an exciting year. We now have many arrows in our investing quiver and the flexibility to partner across the life cycle of companies from early stage through to IPO. Our unparalleled ecosystem will only continue to grow and become even more attractive to founders drawn by its potential to accelerate their company’s growth.

-

*1: SBG consolidated basis

-

*2: Distributions include realized proceeds and preferred equity coupon distributed or paid to limited partners from fund inception to March 31, 2021. They are net of return of recallable utilized contributions that were simultaneously retained and reinvested and do not include the return of recallable unutilized contributions.

-

*3: The information included herein is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy limited partnership interests in any fund, including SoftBank Vision Fund 2 (SVF2). SVF2 has yet to have an external close, and any potential third party investors shall receive additional information related to any SVF2 investments prior to closing.

-

*4: Number of investments includes investments in portfolio companies made by SVF2 and joint ventures with existing portfolio companies from fund inception to March 31, 2021. It does not include hedges related to the investments.

Built to last

In just four years, we have built a platform that will enable us to invest in AI companies for decades to come. SoftBank Investment Advisers is now comprised of more than 300 employees across 10 global offices, and we continue to grow.

In addition to our strong investment team, we have built an organization that can support our portfolio companies throughout their life cycle.

For example, our operating group is a collection of experienced operators who help our portfolio companies enter new markets, navigate growth, and leverage the SoftBank Group ecosystem. They play a critical role in ensuring our portfolio companies can benefit from working with each other, as well as SoftBank Group companies and investments.

We also have more than 100 colleagues dedicated to control functions, including compliance, investment risk, operational risk, internal audit, valuations, and legal. Every quarter, our valuations team analyzes and values each and every one of our portfolio companies.

Our capital markets group now manages more than $50 billion of public stock. They help ensure we take a disciplined and balanced approach to monetizing our assets. As more portfolio companies list publicly, our public holdings should continue to grow.

A sustainable and equitable future

We are steadfast in our belief that investing in the technology of the future can unlock even greater returns for the economies and societies of tomorrow.

From our investments to our social impact initiatives, we strive to have a positive impact on the world. From the start, we have aligned our work with the UN’s Sustainable Development Goals (SDGs), which provide a mission-led framework we know our founders, employees and LPs value. In fiscal 2020, many of our portfolio companies globally were in the vanguard of the response to COVID-19 through contributions such as developing medical treatments, supporting our frontline workers and supplying basic needs.

We continue to take concrete action to foster a more equitable tech and VC ecosystem that better reflects the societies we serve. Now in its second year, our Emerge program champions diversity by connecting underrepresented founders with the capital, tools and networks needed to help scale their businesses.

Applications recently opened for our second Emerge cohort, this time in Europe.

Drawing on SoftBank Group’s unique convening power, we are pleased to expand this year’s program to bring together a coalition of leading European VCs and seed-stage investors to partner in this critical endeavor.

A vision accelerated

Like Masa, I have always believed artificial intelligence will have a greater impact on the economy than the PC, the Internet or the mobile stages of the Information Revolution. Earlier technologies revolutionized a few industries, like advertising and e-commerce. We believe AI will transform every industry in the world. COVID-19 and the pandemic that followed validated Masa’s vision, and accelerated it.

Looking ahead, it is clear that the pandemic will permanently reshape our economy in ways that we are just beginning to understand. It is our view that most of the acceleration we have seen will be permanent. Once new habits are developed, they tend to stick, especially when they make your life easier.

We believe this will disproportionately benefit our portfolio companies because they are driving innovation forward in many of the industries that are benefiting from this surge in demand, including e-commerce, entertainment, healthcare, education, fintech, food delivery and logistics.

This interim period is a time of tremendous opportunity and risk, and our ability to invest and monetize wisely through this transition, and help our portfolio companies navigate it, will determine the ultimate success of both SoftBank Vision Funds.

Validation of our vision

-

*5: Funding rounds, public listings and strategic exits include investments in SoftBank Vision Fund 1 and SoftBank Vision Fund 2.

Related Contents

ANNUAL REPORT 2021(9.55MB/275 pages)

-

The information herein is provided solely for illustrative purposes, reflecting the current beliefs of SBIA as of the date hereof, is based on a variety of assumptions and estimates that are subject to various risks. Any forecasts, targets or estimates presented herein are subject to a number of important risks, qualifications, limitations, and exceptions that could materially and adversely affect the illustrative scenarios or results presented herein. Accordingly, actual results may differ materially. For the avoidance of doubt, it should not be understood as the ”track record“ or projected performance of SoftBank Vision Fund 1, SoftBank Vision Fund 2 or any other fund or investment vehicle managed by SBIA. There can be no assurances that any plans described herein will be realized on the terms expressed herein or at all, and all such plans are subject to uncertainties and risks, as well as investor consents and regulatory approvals, as applicable. Selected investments presented herein are solely for illustrative purposes and do not purport to be a complete list of SoftBank Vision Fund 1 investments and SoftBank Vision Fund 2 investments. References to investments included herein should not be construed as a recommendation of any particular investment or security. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. See pages 22 and 23 for a more complete list of investments of SoftBank Vision Fund 1 and SoftBank Vision Fund 2. Exit or IPO information is presented solely for illustrative purposes, has been selected in order to provide examples of current and former SoftBank Vision Fund 1 and SoftBank Vision Fund 2 investments that have been publicly listed and do not purport to be a complete list thereof. Individual investors’ results may vary. References to specific investments should not be construed as a recommendation of any particular investment or security.

-

Information on this page is as of the end of July 2021.