Investor Relations

ANNUAL REPORT 2021 Message from Our CFO

The pandemic has highlighted our strength of being a strategic investment holding company

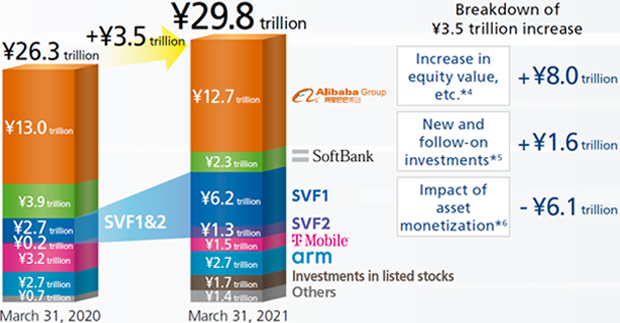

The world underwent significant changes in fiscal 2020 due to the COVID-19 pandemic. The stock market has been highly volatile due to a variety of factors including the initial spread of the novel coronavirus and its negative effects, the economic stimulus measures by governments around the world, and the prospect of the resumption of economic activity. Under these circumstances, we posted consolidated net income*1 of ¥4,988 billion, a record high for any company in Japan, driven by the investment businesses particularly SoftBank Vision Funds. In addition, the equity value of our holdings grew to ¥29.8 trillion (as of March 31, 2021) despite the large-scale asset monetization. I believe that the efforts of each Group company contributed to this result amid the adverse conditions imposed by the pandemic. While we are pleased with the strong performance of the investment businesses, we also acknowledge the importance of ensuring that we sustain this trend going forward.

-

*1: Net income attributable to owners of the parent

Carried out our commitment by completing the ¥4.5 trillion program

In March of last year, just before the start of fiscal 2020, SBG’s stock price fell by more than half amid deteriorating market conditions caused by the COVID-19 chaos, although there was no significant change in our fundamentals. This in turn caused considerable concern among our shareholders and many other stakeholders. In response to this situation, in the same month, we announced a program to sell or monetize up to ¥4.5 trillion of our assets and to use the proceeds to repurchase up to ¥2 trillion of the common stock and apply the rest for financial improvement (the “¥4.5 trillion program”). Since April 2020, we swiftly executed carefully planned programs while minimizing the impact on the market. By the end of September 2020, we completed the monetization based on the program, with the proceeds totaling ¥5.6 trillion. The success was partly due to the better-than-expected turnaround in market conditions, but also largely because nearly 80% of our equity value of holdings (¥26.3 trillion as of March 31, 2020) consisted of highly liquid, high-quality listed stocks.

We always seek to allocate capital in a well-balanced manner to the three purposes: new investments, shareholder returns, and financial improvements to enhance corporate value as a strategic investment holding company. While we focused on shareholder returns and financial improvements in this program, we managed to monetize ¥1.1 trillion in excess of the initially planned ¥4.5 trillion and were able to allocate the proceeds to new investments and cash reserves for future investments, which also contributed to our consolidated net income.*1

Our share repurchases during the period from March 2020 to May 2021 totaled ¥2.5 trillion,*2 including ¥500 billion announced prior to the ¥4.5 trillion program. I believe this share repurchase on a scale unparalleled in the world at a time when our stock price was declining directly signaled our thoughts on the level of our stock price at the time to the market and was reflected in the performance of the stock price thereafter. Moreover, we repurchased a total of ¥392.5 billion of corporate bonds in Japan and overseas and repaid ¥610 billion in bank loans to provide returns to our creditors.

As a financial indicator of a strategic investment holding company, we place the highest importance on loan-to-value (LTV), which is calculated as net debt divided by the equity value of holdings.*3 Our finance policy is to maintain LTV below 25% under normal circumstances. As a result of completing the ¥4.5 trillion program, our LTV ratio was 12.4% and our cash position was ¥2.9 trillion as of March 31, 2021, far exceeding the ¥1.6 trillion in bond redemptions over the next two years, providing us with further sufficient financial buffer.

I am pleased that we were able to return more to our stakeholders than expected and achieve positive financial results amid volatile global markets, during which our stock price and credit spread were also greatly affected. I feel that we managed to satisfy and reassure our investors through the completion of this program, and more importantly, I am proud that we have demonstrated our ability to execute our business and our commitment to carry out our strategy as articulated.

Results of the ¥4.5 trillion program

-

*1: Net income attributable to owners of the parent

-

*2: Amount of share repurchase totaled ¥2.5 trillion, including ¥500 billion authorized prior to the ¥4.5 trillion program and repurchased between March 16, 2020, and June 15, 2020.

-

*3: See page 65 for the assumptions used in the calculation of net debt and equity value of holdings.

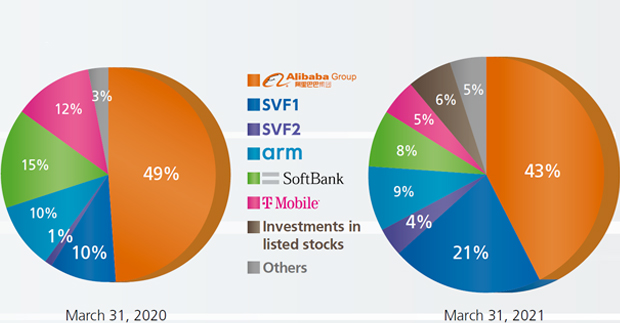

SoftBank Vision Funds’ breakthrough diversified our portfolio

The equity value of our holdings came in at ¥29.8 trillion as of March 31, 2021, up ¥3.5 trillion from the previous fiscal year-end, more than offsetting the decrease in value through the large-scale asset monetization. On top of this, we made progress in diversifying our asset holdings. The value of Alibaba, in which we invested more than 20 years ago, has represented a large portion of the value of our equity holdings. Investors have often pointed out that this proportion is too high. In fiscal 2020, due to the strong growth in the value of SoftBank Vision Funds’ equity holdings, the relative proportion of Alibaba showed a year-over-year decline from 49% to 43% as of March 31, 2021, leading to the diversification of our portfolio.

We hope the asset mix will further improve and move closer to an optimal shape as we continue to work on increasing the value of SoftBank Vision Funds.

The value of SoftBank Vision Funds has increased because many of their portfolio companies benefitted from the accelerated adoption of digital services in the wake of the pandemic. Another factor is the investment style of SoftBank Vision Funds. As they focus on investment in “unicorn” companies, the probability of success tends to be higher than start-ups due to the shorter time horizon until publicly listing, although the timing of public listing and its expected market value are unclear at the time of the investment. Having said that, to maximize investment performance, it is essential to have a system in place for investment decision-making, post-investment monitoring, and risk management, as well as a strong organization to support these activities and the ability to raise funds. We have experienced some difficulties in the past including significant drops in the valuation of some of our portfolio companies. Learning from these experiences, we are now working to create a mechanism that will enable us to generate recurring profits in our investment business.

Equity value of holdings grew despite the large scale monetization

Excluding asset-backed finance

Further diversifying portfolio; Alibaba’s proportion declined as the value of SoftBank Vision Funds increased

Excluding asset backed finance

-

*4: Increase in equity value, etc.: Total change in the equity value from March 31, 2020, to March 31, 2021, less the amount of new and follow-on investments and monetization

-

*5: New and follow-on investments: Total amount of new and follow-on investments made by SBG and its subsidiaries in FY2020

-

*6: Impact of asset monetization: Includes impact of monetization of ¥5.6 trillion and an increase in other assetbacked finance (amendments to some of the contracts and others).

Replicating the growth of the investment businesses on an expanded scale while maintaining financial discipline

We have set our financial strategy for fiscal 2021 as “firmly keeping financial policy” and “financial management to enable reproduction at investment business on an expanded scale.” Our financial policy remains unchanged. In other words, we continue to adhere to the three key policies, as the cornerstone of our defense, of keeping LTV below 25% under normal circumstances, maintaining funds that cover at least two years of bond redemptions, and securing recurring distribution and dividend income from SoftBank Vision Funds and other subsidiaries.

With regard to the new policy of “financial management to enable reproduction at investment business on an expanded scale,” we will establish a cycle of investment and recovery and raise funds to capture attractive investment opportunities. We believe that having a system in place that enables the timely execution of a variety of financing methods using appropriate leverage while synchronizing it with business management will minimize the loss of investment opportunities and ultimately maximize our corporate value. As we establish this cycle, I expect the recovered funds from the various mature investment businesses to start contributing more than the funds supplied by the holding company. However, even if we can manage our investment funds without debt financing, we would still choose to add a moderate level of leverage to further reduce the loss of investment opportunities.

In fiscal 2021, we expect to communicate with various markets, as we will have major bond redemptions coming up and need to raise strategic funds to expand and reproduce our investments at a greater scale. I would like to use this as an opportunity to meet many investors and communicate our strengths and strategies to increase our corporate value and hope to broaden the investor base who will support us.

Financial strategy for FY2021

Strengthening ESG perspectives throughout the Group

In fiscal 2020, to further strengthen ESG initiatives, we built an internal foundation and enhanced information disclosure. In June 2020, I was appointed as Chief Sustainability Officer (CSusO), and we newly established the Sustainability Committee. Since then, we have gained a better understanding of the environmental, social, and governance initiatives that had been undertaken separately by each Group company, and begun establishing Group-wide policies and targets. In May 2021, to incorporate ESG perspectives into our investment process, we revised the Portfolio Company Governance and Investment Guidelines Policy. We made it clear that both opportunities and risks arising from environmental and social factors should be evaluated within the investment and monitoring process. Both the stock and bond markets evaluate us from various angles including ESG perspectives. In the same way, we believe that proactively encouraging our portfolio companies to take ESG initiatives will lead to an increase in the value of our assets over the medium to long term.

In particular, we have made significant progress in corporate governance. We newly established the Nominating & Compensation Committee and improved the gender diversity of the Board of Directors by appointing a female director.

Also, in November 2020, we made a big step forward in strengthening the supervisory function of the Board of Directors by separating the management decision-making functions from the business execution functions, which also increased the ratio of External Board Directors to 44%. As of June 2021, External Board Directors now account for a majority of the Board as a result of our subsequent efforts to improve the effectiveness of governance.

We have been actively involved in contributing to the sustainable development and resilience of local communities. In fiscal 2020, in response to the COVID-19 pandemic we were among the first to procure and provide protective gear and antibody test kits to medical institutions and other places in need. In July 2020, we established a nonprofit PCR test center to support the prevention of the spread of the virus. In the future, we will continue to place importance on our ability to swiftly provide goods and services that are truly needed by society.

On the environmental front, our major subsidiaries have already taken proactive measures to fight climate change, such as expanding renewable energy businesses and setting targets for reducing greenhouse gas emissions. Against this backdrop, we have reaffirmed that maintaining and preserving the global environment is the foundation of the Group’s sustainability and growth, and in May 2021, we established the Environmental Policy as a Group policy. We will continue to monitor the progress of each Group company’s initiatives, promote information disclosure, and reduce environmental burdens throughout the Group.

We are now at the stage of implementation to realize our ESG-related goals and policies. In addition to further enhancing nonfinancial information disclosure, we will strive to strengthen our ESG initiatives throughout the Group so that we can report our progress to investors as appropriate.

Sustainability integration into investments

Related Contents

ANNUAL REPORT 2021(9.55MB/275 pages)

-

Information on this page is as of the end of July 2021.