SOFTBANK announces allotment of stock options (stock acquisition rights)

SOFTBANK CORP. (the “Company”) announces that the Board of Directors today decided the details of stock acquisition rights to be issued as stock options (the “Stock Acquisition Right(s)”) pursuant to Article 280-20, 280-21 of the Commercial Code of Japan and the special resolution at the 23rd ordinary annual general meeting of shareholders of the Company on June 24, 2003.

1. Class and number of shares to be issued upon exercise of Stock Acquisition Rights

1,400,000 shares of common stock of the Company

2. Total number of Stock Acquisition Rights

14,000

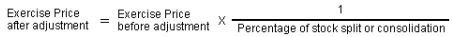

The number of shares to be allotted to each Stock Acquisition Right (the “number of shares to be allotted”) shall be 100 shares. In the case that the Company splits or consolidates outstanding shares, the number of shares to be allotted shall be adjusted in accordance with the following formula with any amount less than one share arising out of such adjustment to be discarded.

In the case that the Company merges with another company, performs a division or makes a reduction of paid-in capital or in other similar cases where the number of shares to be allotted needs to be adjusted, the number of shares to be allotted shall be appropriately adjusted.

3. Issue price and issue date of Stock Acquisition Rights

Free of charge

On December 9, 2003

4. Amount to be paid upon the exercise of each Stock Acquisition Right

To be determined on December 9, 2003

The amount to be paid upon the exercise of each Stock Acquisition Right shall be the amount to be paid per share, which is issued upon the exercise of the Stock Acquisition Rights (the “Exercise Price”) multiplied by the number of shares to be allotted.

The Exercise Price shall be (1) or (2), whichever is higher, multiplied by 1.03 with any amount less than one Japanese yen arising out of such calculation to be rounded upward to the nearest yen.

(1) The amount which is the average of the closing prices of the Company’s shares of common stock on the Tokyo Stock Exchange on each day (other than any day on which no sale is reported) of the month immediately preceding the month in which the date of the issue of the Stock Acquisition Rights falls.

(2) The closing price reported on the issue date of the Stock Acquisition Rights (the closing price of the immediately preceding day, in case no sale is reported on the day of the issue).

5. Adjustment of Exercise Price

(1) In case that the Company shall make a stock split or stock consolidation of its outstanding shares, the Exercise Price shall be adjusted in accordance with the following formula with any amount less than one Japanese yen arising out of such calculation to be rounded upward to the nearest yen.

(2) In case that the Company makes a reduction of paid-in capital, merges with another company, or performs a division or in other similar cases where the Exercise Price for the Stock Acquisition Rights needs to be adjusted, the Exercise Price for the Stock Acquisition Rights shall be appropriately adjusted.

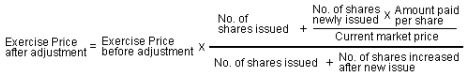

(3) In case that the Company issues new shares or disposes of its treasury stock at a price less than the current market price (other than shares issued upon exercise of stock acquisition rights or subscription rights pursuant to the provisions of the pre-Commercial Code Revision), the Exercise Price shall be adjusted in accordance with the following formula (the "adjustment formula for the Exercise Price") with any amount less than one Japanese yen arising out of such calculation to be rounded upward to the nearest yen.

The “number of shares issued” used in the adjustment formula for the Exercise Price shall be the number of issued shares of the Company after deducting the number of its treasury stock at that time. In the event that the Company disposes of its treasury stock, the “number of shares newly issued” used in the adjustment formula for the Exercise Price shall be read as meaning the “number of shares disposed of”.

6. Exercise Period of the Stock Acquisition Rights

From July 1, 2004, to June 30, 2009

7. Conditions for exercise of Stock Acquisition Rights

(1) In case individuals who are allotted the Stock Acquisition Rights (the "holders of the Stock Acquisition Rights") are the directors, executive officers or those who are scheduled to be employed as executive officers of the Company or the subsidiaries of the Company at the issue date, the Stock Acquisition Rights may be exercised according to the following conditions. Any amount less than one share of the exercisable number of the Stock Acquisition Rights to be discarded.

[1] None of the Stock Acquisition Rights may be exercised from July 1, 2004 to November 28, 2004.

[2] 25% of the Stock Acquisition Rights may be exercised from November 29, 2004 to November 28, 2005.

[3] 50% of the Stock Acquisition Rights may be exercised from November 29, 2005 to November 28, 2006.

[4] 75% of the Stock Acquisition Rights may be exercised from November 29, 2006 to November 28, 2007.

[5] All the Stock Acquisition Rights may be exercised from November 29, 2007 to June 30, 2009.

(2) In case the holders of the Stock Acquisition Rights are the employees or those who are scheduled to be employed of the Company or the subsidiaries of the Company at the issue date, the Stock Acquisition Rights may be exercised according to the following conditions.

[1] None of the Stock Acquisition Rights may be exercised from July 1, 2004 to November 28, 2005.

[2] All the Stock Acquisition Rights may be exercised from November 29, 2005 to June 30, 2009.

(3) Other conditions are under the provision of the year 2003 incentive program.

8. Events and conditions of cancellation of Stock Acquisition Rights

(1) In case an agenda for approval of a merger agreement, under which the Company is dissolved, is approved at a general meeting of shareholders of the Company, or in case an agenda for approval of a stock exchange agreement or an agenda for share transfer is approved at a general meeting of shareholders of the Company, the Company may cancel the Stock Acquisition Rights without compensation.

(2) In case holders of the Stock Acquisition Rights no longer fulfill the conditions for exercise of Stock Acquisition Rights, or holders of the Stock Acquisition Rights renounce a part of or all the Stock Acquisition Rights, the Company may cancel the Stock Acquisition Rights without compensation.

(3) Furthermore, the Company may, at any time, acquire and cancel the Stock Acquisition Rights without compensation.

9. Transfer restrictions on Stock Acquisition Rights

Any transfer of the Stock Acquisition Rights shall be subject to approval of the Board of Directors of the Company.

10. Issuance of certificates of Stock Acquisition Rights

Certificates of Stock Acquisition Rights shall be issued only upon the request from the holders of the Stock Acquisition Rights.

11. Total paid-in value of the shares of the common stock of the Company to be issued or transferred upon exercise of all the Stock Acquisition Rights

To be determined on December 9, 2003

12. Amount that is transferred into paid-in capital from the issue price of shares, in case new shares of common stock of the Company are issued upon exercise of Stock Acquisition Rights

The amount transferred to paid-in capital shall be the Exercise Price or the Exercise Price after adjustment in case the Exercise Price adjusted, multiplied by 0.5, and any amount less than one Japanese yen arising out of such calculation shall be rounded upward to the nearest yen.

13. Individuals who will be allotted the Stock Acquisition Rights

Directors and employees of the Company and its subsidiaries, and those who are scheduled to be employed by the Company and its subsidiaries as employees, 1,850 persons in total.

For your reference

- 1. Date of resolution of the Board of Directors that decided the proposal at the ordinary annual general meeting of shareholders

- May 9, 2003

- 2. Date of resolution of the 23rd ordinary annual general meeting of shareholders

- June 24, 2003

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.