Merger of Subsidiaries

SoftBank Corp. (the “Company”) announces that on January 23, 2015 its Board of Directors has resolved to consummate a merger among its subsidiaries SoftBank Mobile Corp. (“SoftBank Mobile”), SoftBank BB Corp. (“SoftBank BB”), SoftBank Telecom Corp. (“SoftBank Telecom”) and Ymobile Corporation (“Ymobile”) (the “Merger”), effective as of April 1, 2015 (tentative).

1. Purpose of the Merger

The four companies subject to the Merger are engaged in domestic telecommunications businesses within the SoftBank Group: SoftBank Mobile provides mobile communications services under the “SoftBank” brand, SoftBank BB provides broadband services under the “Yahoo! BB” brand, SoftBank Telecom provides telecommunications services such as fixed-line telephone and data communications services, and Ymobile provides mobile communications services under the “Y!mobile” brand, respectively. The four companies subject to the Merger have been working on mutually utilizing each other's communications networks, distribution channels and other resources, and enhancing the collaboration for the services.

Through the Merger, the Company will seek to maximize its corporate value by further concentrating business resources owned by the four companies subject to the Merger, and enhance competitiveness of the domestic telecommunications businesses. The new company will, under a corporate philosophy of “Information Revolution — Happiness for everyone,“ seek to create innovative services and improve operational efficiency through structural reforms. It will also expand its business jointly with other SoftBank Group companies, in areas such as IoT (Internet of Things), robotics, and energy.

Brand names of existing services will be maintained and mobile communications services will be continuously provided under the two brands: “SoftBank” and “Y!mobile.”

2. Summary of the Merger

(1) Timeline

| Resolution of the Board of Directors for the Merger (SoftBank Corp.) | January 23, 2015 |

|---|---|

| Resolution of the Board of Directors for the Merger, execution of the Merger agreement (companies subject to the Merger) | January 23, 2015 |

| Public notice period of the Merger | January 30 to February 28, 2015 (tentative) |

| Approval of the General Meetings of Shareholders for the Merger (companies subject to the Merger) | February 25, 2015 (tentative) |

| Date of the Merger (the effective date) | April 1, 2015 (tentative) |

(2) Method of the Merger

The Merger will be an absorption-type merger where SoftBank Mobile will be the surviving company and SoftBank BB, SoftBank Telecom and Ymobile will be dissolved.

(3) Details of Allotment of Shares upon the Merger

| SoftBank Mobile (Surviving Company) | SoftBank BB (Merged Company) | SoftBank Telecom (Merged Company) | Ymobile*1 (Merged Company) | |

|---|---|---|---|---|

| Details of allotment of shares upon the Merger (merger ratio) | Common stock 1 | Common stock 0.0468 | Common stock 0.2761 | Class B Shares 0.7600 |

- *1The Company is planning to request Ymobile to acquire all 342,777 shares of Ymobile Class A Shares (without voting rights) held by the Company and in exchange to acquire 342,777 shares of Ymobile Class B Shares (with voting rights) from Ymobile, on February 24, 2015. As a result of this, the outstanding shares of Ymobile will only be 344,426 shares of Class B Shares. SoftBank Mobile shares will be allotted and delivered to each of the shareholders of Ymobile as at the end of the day preceding the date of the Merger in the ratio of 0.7600 shares of SoftBank Mobile common stock to 1 Ymobile Class B Share.

- *1

(4) Treatment of Stock Acquisition Rights and Bonds with Stock Acquisition Rights of the Merged Companies

Not applicable.

(5) Rights and Obligations Assumed by Surviving Company

The surviving company will assume all rights and obligations of the merged companies including assets and liabilities, and contractual statuses (including joint and several guarantee agreements regarding borrowings and bonds of the Company) in accordance with the Merger agreement.

3. Outline of the Companies Subject to the Merger

| Surviving Company | Merged Company | Merged Company | Merged Company | ||

|---|---|---|---|---|---|

| (1) Trade name | SoftBank Mobile Corp.*1 | SoftBank BB Corp.*1,2 | SoftBank Telecom Corp. | Ymobile Corporation*1,3 | |

| (2) Address | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo | 1-9-2 Higashi-shimbashi, Minato-ku, Tokyo | |||

| (3) Name and title of representative | Masayoshi Son Chairman & CEO | Eric Gan Representative Director, President and CEO | |||

| (4) Nature of business | Provision of mobile communications services, sale of mobile devices | Provision of ADSL and IP telephony services | Provision of fixed-line telephone, data transmission, and dedicated line services | Provision of mobile communications services, sale of mobile devices, wholesale of ADSL lines, provision of ADSL services | |

| (5) Share capital | JPY 177,251 million | JPY 100,000 million | JPY 100 million | JPY 43,286 million | |

| (6) Founded | December 9, 1986 | May 16, 2000 | October 9, 1984*4 | November 1, 1999 | |

| (7) Shares outstanding | Common stock 4,443,429 shares*5 | Common stock 6,227,041 shares | Common stock 3,132,100 shares | Class B Shares 344,426 shares | |

| (8) Shareholder and its share of voting rights | SoftBank Corp. 100% (of which 100% is held indirectly) | SoftBank Corp. 100% | SoftBank Corp. 100% | SoftBank Corp. 99.68% | |

| (9) Fiscal year end | March 31 | March 31 | March 31 | March 31 | |

| (10) Financial position and operating results for fiscal year ended March 2014 (Japan GAAP) (Millions of yen*6) | |||||

| eAccess Ltd. | WILLCOM, Inc. | ||||

| Net assets | 1,679,987 | 159,467 | 310,558 | 85,535 | 4,816 |

| Total assets | 3,455,898 | 231,174 | 552,045 | 296,887 | 148,919 |

| Net assets per share (Yen) | 307,905 | 25,608.90 | 99,153.44 | 317,469.64 | 16,054.58 |

| Net sales | 2,517,489 | 149,316 | 468,480 | 203,805 | 162,925 |

| Operating income | 471,956 | 23,080 | 75,114 | 27,019 | 3,138 |

| Ordinary income | 464,789 | 23,083 | 74,600 | 19,012 | 2,315 |

| Net income | 286,339 | 14,593 | 43,711 | 8,876 | 4,516 |

| Net income per share (Yen) | 57,383 | 2,343.54 | 13,955.87 | 32,945.03 | 15,053.85 |

| Dividends per share (Yen) | Common stock: - Class 1 Preferred Shares: 38,570 | - | 14,086 | - | 186,043 |

- *The companies fall under the category of “specified subsidiary.”

- *2On April 1, 2014 SoftBank BB split its commerce & service business (incorporation-type of company split) and the newly-incorporated SoftBank Commerce & Service Corp. (“SoftBank C&S”) assumed the business, and at the same time, SoftBank BB granted all of its SoftBank C&S shares to the Company as a payment of dividends of surplus, as announced in the press release “Announcement on Strategic Reorganization of Commerce & Service Business” on February 18, 2014. The table shows the information regarding SoftBank BB as of April 1, 2014 (after the split effectuated). “(10) Financial position and operating results for fiscal year ended March 2014” provides the financial position of SoftBank BB as of April 1, 2014 (after the split effectuated) and the operating results of the broadband business out of the results of SoftBank BB for the fiscal year ended March 31, 2014 (before the split).

- *3Ymobile changed its trade name from eAccess Ltd. (“eAccess”) on July 1, 2014. Preceding this, eAccess merged with WILLCOM, Inc. (“WILLCOM”) on June 1, 2014. The table shows the information regarding Ymobile as of July 1, 2014 (except in respect of “(7) Shares outstanding,” “(8) Shareholder and its share of voting rights,” and “(10) Financial position and operating results for fiscal year ended March 2014”). As described under “2. Summary of the Merger (3) Details of Allotment of Shares upon the Merger,” the Company is planning to request Ymobile to acquire all 342,777 shares of Ymobile Class A Shares (without voting rights) held by the Company and in exchange to acquire 342,777 shares of Ymobile Class B Shares (with voting rights) from Ymobile, on February 24, 2015. Due to this, “(7) Shares outstanding” and “(8) Shareholder and its share of voting rights” describe the number of shares and share of voting rights of Ymobile after the acquisition of 342,777 shares of Ymobile Class B Shares by the Company on February 24, 2015. Also, “(10) Financial position and operating results for fiscal year ended March 2014” provides the respective results of eAccess and WILLCOM for the fiscal year ended March 2014.

- *4On February 1, 2007 SoftBank Telecom implemented an absorption-type merger with SoftBank Telecom Sales Corp. as the surviving company and (former) SoftBank Telecom Corp. as the merged company and SoftBank Telecom Sales Corp. changed its trade name to “SoftBank Telecom Corp.” The table shows the date of incorporation of Japan Telecom Co. Ltd., a predecessor of (former) SoftBank Telecom Corp which is the surviving company in its substance.

- *5BB Mobile Corp., a subsidiary of the Company, of which the Company holds 100% of the voting rights, is planning to request SoftBank Mobile to acquire all 1,335,771 shares of SoftBank Mobile Class 1 Preferred Shares (without voting rights) held by BB Mobile Corp. and in exchange to acquire 351,307 shares of SoftBank Mobile common stock from SoftBank Mobile, on February 25, 2015. Due to this, “(7) Shares outstanding” describes the number of shares of SoftBank Mobile after the acquisition of 351,307 shares of common stock by BB Mobile Corp. on February 25, 2015.

- *6Amounts less than one million yen are rounded down.

- *

4. Status after the Merger (as of April 1, 2015, tentative)

| (1) Trade name | SoftBank Mobile Corp. |

|---|---|

| (2) Address | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo |

| (3) Name and title of representatives | Chairman Masayoshi Son President Ken Miyauchi |

| (4) Nature of business | Provision of mobile communications services, sale of mobile devices, provision of fixed-line telecommunications and ISP services |

| (5) Share capital | JPY 177,251 million |

| (6) Fiscal year end | March 31 |

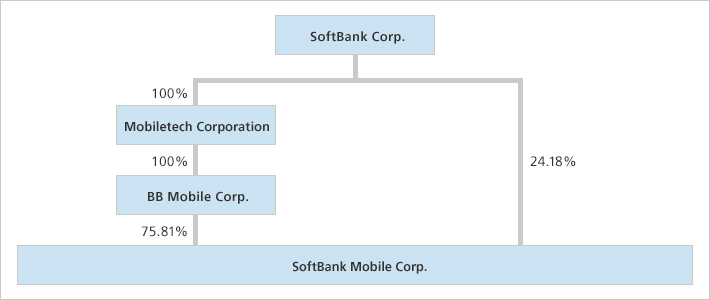

| (7) Shareholder and its share of voting rights | SoftBank Corp. 99.99% (of which 75.81% is held indirectly) |

5. Future Outlook

The impact of the Merger on the Company's consolidated financial results for the fiscal year ending March 2016 will be minor.

Reference

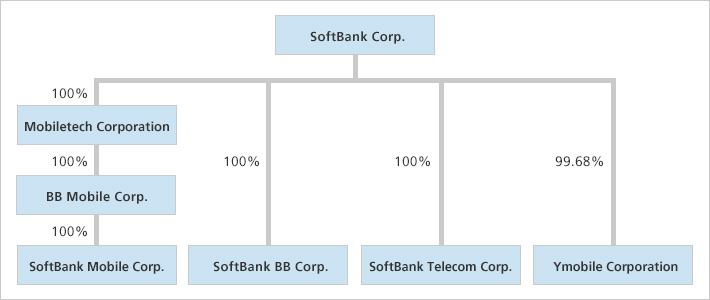

Before the Merger

After the Merger

- *The above shareholding ratio is based on the number of voting rights.

- *

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.