Merger of Subsidiaries

SoftBank Group Corp. (“SBG”) announced that on January 25, 2017 its Board of Directors passed a resolution merging its wholly-owned subsidiaries SoftBank Group International GK (“SBGI”) and SoftBank Group Japan GK (“SBGJ”) in a merger through absorption (the “Merger”), effective as of April 1, 2017 (tentative), as follows.

1. Purpose of the Merger

As announced in “Reorganization of Group Companies” dated March 7, 2016, SBG established SBGI, a global operations management company, and SBGJ, a domestic operations management company to clarify the roles and responsibilities as well as realize flexible group management. SBG transferred the certain shares of operating companies held by SBG to each operations management company. In consideration of a vacancy for president of SBGI accompanying Nikesh Arora's resignation from the position of the Director of the Board of SBG in June 2016 (currently has an advisory role at SBG), SBG has decided to merge SBGI and SBGJ with SBGI being a surviving company and SBGJ being dissolved.

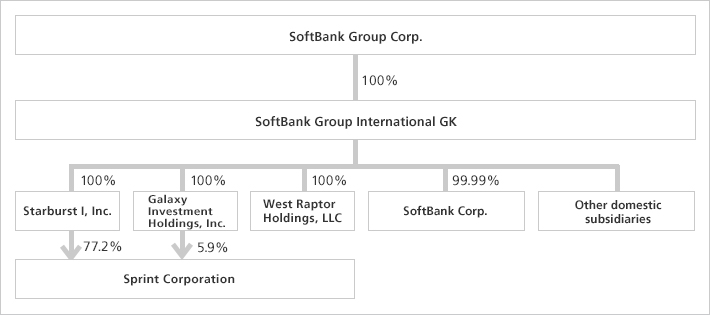

The remaining shares of the operating companies held by SBG will be transferred to SBGI as necessary, which may include a method of contributions in kind. As a part of this transaction, all the shares of Starburst Ⅰ, Inc. held by SBG (holding ratio: 29.6%) is expected to be transferred to SBGI in the form of contribution in kind. As a result, SBGI will own all the shares of Starburst Ⅰ, Inc. and Galaxy Investment Holdings, Inc., both of which are wholly-owned subsidiaries of SBG and own 3,311,815,903 shares in total of Sprint Corporation (voting rights ratio: 83.1% as of the end of December 2016), a mobile communication operator in US.

2. Summary of the Merger

(1) Timeline

| Merger resolution by the Board of Directors of SBG | January 25, 2017 |

|---|---|

| Merger resolution (resolution by the members at SBGI and the consent of all members at SBGJ) | January 25, 2017 |

| Merger agreement by SBGI and SBGJ | January 25, 2017 |

| Public notice period | From January 27, 2017 to February 27, 2017 (tentative) |

| Effective date of the Merger | April 1, 2017 (tentative) |

(2) Merger method

Merger through absorption with SBGI being the surviving company. SBGJ will be dissolved.

(3) Allotment of shares and other assets upon the Merger

No allotment of shares or other assets upon the Merger since SBG owns all the equity of SBGJ and SBGI.

(4) Treatment of stock acquisition rights and bonds with stock acquisition rights of the dissolving company

Not applicable

3. Outline of the Companies Subject to the Merger

| Surviving Company | Dissolving Company | ||

|---|---|---|---|

| (1) Trade name | SoftBank Group International GK | SoftBank Group Japan GK | |

| (2) Address | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo | |

| (3) Name of representative | Masayoshi Son, President (Chairman & CEO of SBG) | Ken Miyauchi, President (Representative director, president & COO of SBG) | |

| (4) Nature of business | Holding company | Holding company | |

| (5) Share capital | JPY 22 million | JPY 21 million | |

| (6) Founded | January 26, 2001 | June 14, 1991 | |

| (7) Equity holder and its equity ratio | SoftBank Group Corp.: 100% | SoftBank Group Corp.: 100% | |

| (8) Fiscal year-end | March 31 | March 31 | |

| (9) Relations with SBG | Capital | SBG is the parent company that owns 100% equity of the company. | SBG is the parent company that owns 100% equity of the company. |

| Personnel | Masayoshi Son, chairman & CEO of SBG, also serves as president of the company. | Ken Miyauchi, representative director, president & COO of SBG also serves as president of the company. | |

| Business | None | None | |

| (10) Non-consolidated financial position and operating results for the fiscal year ended March 2016 (Millions of yen) | |||

| Net assets | 299,387 | 7 | |

| Total assets | 1,104,207 | 8 | |

| Net sales | - | - | |

| Operating loss | (1) | (0) | |

| Ordinary loss | (819) | (0) | |

| Net loss | (820) | (2) | |

4. Situation after the Merger (April 1, 2017 tentative)

| (1) Trade name | SoftBank Group International GK |

|---|---|

| (2) Address | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo |

| (3) Name and title of representative | Masayoshi Son, Chairman Ken Miyauchi, President |

| (4) Nature of business | Holding company |

| (5) Share capital | JPY 22 million |

| (6) Fiscal year-end | March 31 |

| (7) Equity holder and its equity ratio | SoftBank Group Corp.: 100% |

5. Future Outlook

The impact of the Merger, contribution in kind of shares of Starburst Ⅰ, Inc. by SBG, and transfer of shares to other subsidiaries on SBG's consolidated and non-consolidated financial results for the fiscal year ending March 31, 2017 will be minor.

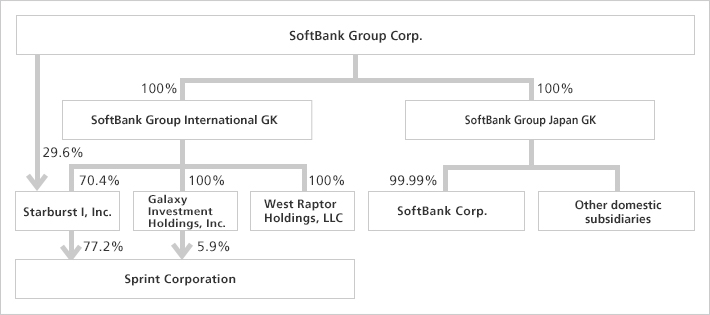

(Reference)

Before the Merger

After the Merger

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.