SPRINT AND T-MOBILE TO COMBINE, ACCELERATING 5G INNOVATION & INCREASING COMPETITION

SoftBank Group Corp. (“SBG”) announced today that on April 29, 2018 (EST) Sprint Corporation (“Sprint”), a U.S. subsidiary of SBG, and T-Mobile US, Inc. (“T-Mobile”) have entered into a definitive agreement (the “Business Combination Agreement”) to merge in an all-stock transaction at a fixed exchange ratio of 0.10256 T-Mobile shares for each Sprint share (or the equivalent of 9.75 Sprint shares for each T-Mobile share). Based on closing share prices on April 27, 2018, this represents a total implied enterprise value of approximately $59 billion for Sprint and approximately $146 billion for the combined company. The new company will have a strong closing balance sheet and a fully funded business plan with a strong foundation of secured investment grade debt at close.

The transaction is subject to Sprint and T-Mobile stockholder approval, regulatory approvals and other customary closing conditions. The transaction is expected to close no later than the first half of 2019.

Upon completion of the transaction, the combined company is expected to become an equity method associate of SBG, and Sprint will no longer be a subsidiary of SBG.

1. Merger Rationale

SBG believes the transaction will benefit SBG shareholders by giving SBG an equity interest in a stronger and more competitive combined company that itself will benefit from significant expected synergies.

The combined company will be named T-Mobile US, Inc. (“New T-Mobile”), and it will be a force for positive change in the U.S. wireless, video, and broadband industries. The combination of spectrum holdings, resulting network scale, and expected run rate cost synergies of $6+ billion, representing a net present value (NPV) of $43+ billion, will supercharge T-Mobile's Un-carrier strategy to disrupt the marketplace and lay the foundation for U.S. companies and innovators to lead in the 5G era.

The New T-Mobile will have the network capacity to rapidly create a nationwide 5G network with the breadth and depth needed to enable U.S. firms and entrepreneurs to continue to lead the world in the coming 5G era, as U.S. companies did in 4G. The new company will be able to light up a broad and deep 5G network faster than either company could separately. T-Mobile deployed nationwide LTE twice as fast as Verizon and three times faster than AT&T, and the combined company is positioned to do the same in 5G with deep spectrum assets and network capacity.

The combined company will have lower costs, greater economies of scale, and the resources to provide U.S. consumers and businesses with lower prices, better quality, unmatched value, and greater competition. The New T-Mobile will employ more people than both companies separately and create thousands of new American jobs.

Following closing, the new company will be headquartered in Bellevue, Wash., with a second headquarters in Overland Park, Kan. John Legere, current President and Chief Executive Officer of T-Mobile and the creator of T-Mobile's successful Un-carrier strategy, will serve as Chief Executive Officer, and Mike Sievert, current Chief Operating Officer of T-Mobile, will serve as President and Chief Operating Officer of the combined company. The remaining members of the new management team will be selected from both companies during the closing period. Tim Höttges, current T-Mobile Chairman of the Board, will serve as Chairman of the Board for the new company. Masayoshi Son, current SBG Chairman & CEO, and Marcelo Claure, current Chief Executive Officer of Sprint, will serve on the board of the new company.

2. Transaction Details and Financial Profile

The new company expects to create substantial value for T-Mobile and Sprint stockholders through an expected $6+ billion in run rate cost synergies, representing a net present value (NPV) of $43+ billion, net of expected costs to achieve such cost synergies. This transaction will also enhance the financial position of the combined company. Highlights include:

- Pro Forma 2018E Service Revenue *1 of $53-57 billion

- Pro Forma 2018E Adjusted EBITDA *1*2 of $22-23 billion

- Pro Forma 2018E Adjusted EBITDA *1*2 Margin of 40-42% with a longer-term target of 54-57%

- Pro Forma Net Debt *3 of $63-65 billion with a streamlined single-silo corporate debt structure

- Fully funded business plan with significant liquidity at close

The Boards of Directors of T-Mobile and Sprint have approved the transaction. The transaction is structured as an all-stock transaction involving two consecutive and related mergers.

- *1 Proforma service revenue and Adjusted EBITDA measures do not include the impacts of ASC606 revenue recognition accounting changes.

- *2 T-Mobile is not able to forecast net income on a forward looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, income tax expense, stock based compensation expense and interest expense. Adjusted EBITDA should not be used to predict net income as the difference between the two measures is variable.

- *3 Proforma net debt reflects total expected debt (excluding tower obligations, premiums, discounts and issuance costs) less cash and cash equivalents

- *1

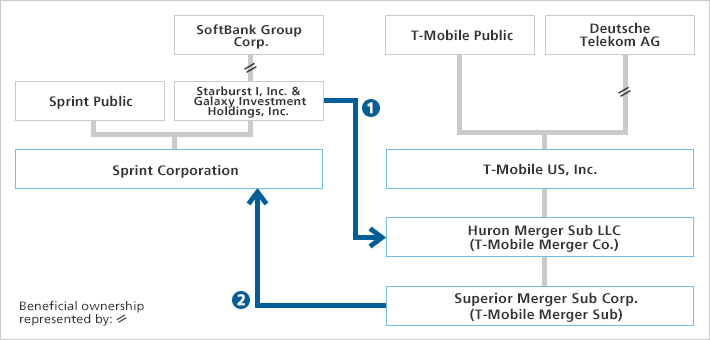

Establishment of T-Mobile Merger Subsidiaries

In connection with the transaction, T-Mobile has formed two special purpose vehicles: Huron Merger Sub LLC, a U.S. subsidiary owned directly by T-Mobile (“T-Mobile Merger Co.”), and Superior Merger Sub Corp. (“T-Mobile Merger Sub”), a U.S. subsidiary owned directly by T-Mobile Merger Co.

Mergers

A. Merger Transactions

Following receipt of Sprint and T-Mobile stockholder and regulatory approvals and the satisfaction or waiver of the other closing conditions to the transaction, each of Starburst I, Inc. (“Starburst”) and Galaxy Investment Holdings, Inc. (“Galaxy”) will merge with and into T-Mobile Merger Co., with T-Mobile Merger Co. as the surviving corporation (the “HoldCo Mergers”).

Immediately following the HoldCo Mergers, T-Mobile Merger Sub will merge with and into Sprint, with Sprint as the surviving corporation (such merger together with the HoldCo Mergers, the “Merger Transactions”).

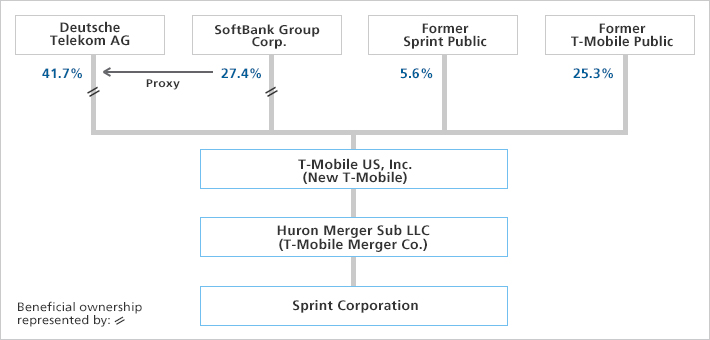

As a result of the Merger Transactions:

- Sprint will become an indirect wholly-owned subsidiary of New T-Mobile;

- SBG will beneficially own approximately 27.4% of the fully-diluted common stock of New T-Mobile;

- Current Sprint stockholders other than SBG and its subsidiaries will own, in the aggregate, approximately 5.6% of the fully-diluted common stock of New T-Mobile; and

- Each option to purchase Sprint common shares (other than under Sprint's employee stock purchase plan) will be converted into an option to purchase common stock of New T-Mobile.

B. Other Key Terms

Fees and expenses:

- Subject to certain conditions, if T-Mobile terminates the Business Combination Agreement due to certain credit rating related matters, T-Mobile will pay Sprint $600 million;

- Sprint and T-Mobile will share, in various proportions, costs and expenses incurred in connection with certain SEC, antitrust, and FCC filings;

- Certain fees and expenses incurred in relation to certain bondholder consents and pre-merger financing transactions will be apportioned between the parties; and

- Otherwise, the parties will pay their respective fees and expenses.

- The transaction is subject to regulatory approvals and other customary closing conditions. Key closing conditions include regulatory approvals from the FCC and applicable state public utility commissions, expiration or termination of the Hart-Scott-Rodino waiting period, and completion of CFIUS review.

- Pursuant to the Business Combination Agreement, SBG (as a beneficial owner of Sprint shares), Deutsche Telekom AG (“Deutsche Telekom”) (as a beneficial owner of T-Mobile shares), and certain of their respective affiliates will enter into support agreements to vote their respective shares in favor of the transaction in connection with the required Sprint and T-Mobile stockholder approvals.

Post-transaction

Post-closing, Deutsche Telekom and SBG are expected to hold approximately 41.7% and 27.4% of diluted economic ownership of the combined company, respectively, with the remaining approximately 30.9% held by the public.

The Board will consist of 14 directors: 9 nominated by Deutsche Telekom and 4 nominated by SBG, including Masayoshi Son, Chairman and CEO of SoftBank, and Marcelo Claure, CEO of Sprint. John Legere, CEO of the New T-Mobile, will also serve as a director. Upon consummation of the transaction, the combined company is expected to trade under the “TMUS” symbol on the NASDAQ.

Subject to certain exceptions, (ⅰ) New T-Mobile shares beneficially owned by SBG and its controlled affiliates will be subject to a proxy granted to Deutsche Telekom in order to enable Deutsche Telekom to consolidate New T-Mobile into Deutsche Telekom's financial statements following the consummation of the Merger Transactions, certain transfer restrictions, and a right of first refusal in favor of Deutsche Telekom; and (ⅱ) New T-Mobile shares beneficially owned by Deutsche Telekom and its controlled affiliates will be subject to a right of first refusal in favor of SBG and certain transfer restrictions. Furthermore, SBG and Deutsche Telekom (in each case, including certain of their respective affiliates) will be subject to certain non-compete restrictions until such time as their respective ownership in New T-Mobile has been reduced below an agreed threshold.

The transaction is expected to close no later than the first half of 2019. The business will be headquartered in Bellevue, Washington with a second headquarters in Overland Park, Kansas.

3. Schedule Regarding the Merger

| Resolution of Board of Directors of SBG *1 | April 26, 2018 |

|---|---|

| Definitive agreement between Sprint and T-Mobile | April 29, 2018 (EST) |

| Closing of the transaction | The transaction is expected to close no later than the first half of 2019. |

- *1 Approval of the transaction resolved by the Board of Directors of SBG was subject to a resolution by the Board of Directors of Sprint. The final approval of the transaction, and the final decision with respect to the final terms of the agreements of the transaction to the extent SBG is related, was delegated to Masayoshi Son, Chairman & CEO of SBG.

- *1

4. About Sprint

| (1) Name | Sprint Corporation | ||

|---|---|---|---|

| (2) Headquarters | Overland Park, Kansas | ||

| (3) Name and title of representative | Chief Executive Officer Marcelo Claure | ||

| (4) Nature of business | Telecommunications | ||

| (5) Common stock | USD 40 million (As of December 31, 2017) | ||

| (6) Founded | November 15, 1938 | ||

| (7) Major shareholders and their holdings *1 (as of April 25, 2018) | SBG 83.02% | ||

| (8) Relations between SBG and Sprint | Capital *1 | SBG as the parent company owns 83.02% of Sprint shares as of April 25, 2018. | |

| Personnel | Masayoshi Son, Chairman & CEO of SBG, serves as Chairman of the Board at Sprint. | ||

| Business | SBG's subsidiary SoftBank Corp. has an international voice and data roaming partnership agreement with Sprint. | ||

| (9) Consolidated operating results and financial position in the past three years (U.S. GAAP) | |||

| Fiscal year ended March 2015 | Fiscal year ended March 2016 | Fiscal year ended March 2017 | |

| Net operating revenue | 34,532 | 32,180 | 33,347 |

| Operating income (loss) | (1,895) | 310 | 1,764 |

| Net loss | (3,345) | (1,995) | (1,206) |

| Total equity | 21,710 | 19,783 | 18,808 |

| Total asset | 82,841 | 78,975 | 85,123 |

| Net loss per common share (USD) | (0.85) | (0.50) | (0.30) |

| Dividend per share (USD) | - | - | - |

Unit: million USD (excluding per share data)

- *1 Figures represent shares beneficially owned and include warrants.

- *1

5. About T-Mobile

| (1) Name | T-Mobile US, Inc. | ||

|---|---|---|---|

| (2) Headquarters | Bellevue, Washington | ||

| (3) Name and title of representative | President and Chief Executive Officer John Legere | ||

| (4) Nature of business | Telecommunications | ||

| (5) Major shareholders and their holdings *1 (as of April 25, 2018) | Deutsche Telekom 62.28% | ||

| (6) Relations between SBG and T-Mobile | Capital | None | |

| Personnel | None | ||

| Business | SBG's subsidiary SoftBank Corp. has an international voice and data roaming partnership agreement with T-Mobile. | ||

| (7) Consolidated operating results and financial position in the latest year (U.S. GAAP) | |||

| Fiscal year ended December 2017 | - | - | |

| Revenues | 40,604 | - | - |

| Operating income | 4,888 | - | - |

| Net income attributable to common stockholders | 4,481 | - | - |

| Total stockholders' equity | 22,559 | - | - |

| Total assets | 70,563 | - | - |

| Earnings per share (USD) | 5.20 | - | - |

| Dividend per share (USD) | - | - | - |

Unit: million USD (excluding per share data)

- *1 Figures represent shares beneficially owned.

- *1

6. About New T-Mobile

| (1) Name | T-Mobile US, Inc. |

|---|---|

| (2) Headquarters | Bellevue, Washington Overland Park, Kansas (second headquarters) |

| (3) Name and title of representative | Chief Executive Officer John Legere |

| (4) Nature of business | Telecommunications |

| (5) Major shareholders and their approximate holdings *1 | Deutsche Telekom 41.7% SBG 27.4% |

- *1 This is an estimate based on fully diluted shares inclusive of the exercise of SBG's existing warrants to acquire shares of Sprint. Figures represent shares beneficially owned.

- *1

7. Number of Shares Held by SBG Before and After the Merger Transactions *1

| (1) Number of shares of Sprint held before the Merger Transactions (as of April 25, 2018) | 3,445,374,483 shares (number of voting rights: 3,445,374,483) (voting ratio: 83.02%) |

|---|---|

| (2) Number of shares of New T-Mobile held after the Merger Transactions *2 | 353,357,607 shares (number of voting rights: 353,357,607) *3 (voting ratio: 27.4%) |

- *1 Figures represent shares beneficially owned and include warrants.

- *2 This is an estimate based on fully diluted shares assuming cash exercise of SBG's existing warrants to acquire shares of Sprint.

- *3 SBG's voting rights will be subject to proxy arrangements granted in favor of Deutsche Telekom.

- *1

8. Advisors

Mizuho Securities Co., Ltd. and SMBC Nikko Securities Inc. acted as financial advisors to SBG.

9. Impact on SBG Financial Results

Upon completion of the transaction, New T-Mobile is expected to become an equity method associate of SBG and Sprint will no longer be a subsidiary of SBG. The principal impact of the transaction on SBG's consolidated financial results is as follows. SBG will provide further details once they become certain.

Net sales (for customers) and operating income (segment income) for the fiscal year ended March 2017

| Consolidated | Sprint segment | |

|---|---|---|

| Net sales (for customers) | Millions of yen 8,901,004 | Millions of yen 3,459,142 |

| Operating income (segment income) | Millions of yen 1,025,999 | Millions of yen 186,423 |

Interest-bearing debt and net interest-bearing debt as of December 31, 2017

| Consolidated | Sprint | |

|---|---|---|

| Interest-bearing debt | Millions of yen 14,703,035 * | Millions of yen 4,136,490 |

| Net interest-bearing debt | Millions of yen 11,525,150 * | Millions of yen 3,613,829 |

- * Excludes derivative financial liabilities related to variable prepaid forward contract for Alibaba shares and interest-bearing debt of SoftBank Vision Fund and Delta Fund.

- *

(Reference) Consolidated financial results forecast for the fiscal year ending March 2018 (as disclosed in May 10, 2017) and actual for the fiscal year ended March 2017

| Net sales | Operating income | Net income attributable to owners of the parent | |

|---|---|---|---|

| Forecast for the fiscal year ending March 2018 | Millions of yen - | Millions of yen - | Millions of yen - |

| Actual for the fiscal year ended March 2017 | Millions of yen 8,901,004 | Millions of yen 1,025,999 | Millions of yen 1,426,308 |

SBG does not give forecasts of consolidated results of operations as they are difficult to project due to numerous uncertainties affecting earnings.

Cautionary Statement Regarding Forward Looking Statements

This document contains “forward-looking statements”. You should not place undue reliance on these statements. These forward-looking statements include statements that reflect the current expectations, estimates, beliefs, assumptions, and projections of SBG's senior management about future events with respect to Sprint's and T-Mobile's businesses and their industry in general. Statements that include words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “potential,” “continue,” “goals,” “targets” and variations of these words (or negatives of these words) or similar expressions of a future or forward-looking nature identify forward-looking statements. In addition, any statements that refer to projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Although SBG believes the expectations reflected in any forward-looking statements are reasonable, they involve known and unknown risks and uncertainties, are not guarantees of future performance, and actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Any or all of SBG's forward-looking statements may prove to be incorrect. Consequently, no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, SBG, Sprint, T-Mobile or their businesses or operations. Factors which could cause SBG's actual results to differ from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: the ability of the parties to consummate the merger transaction in a timely manner or at all; satisfaction or waiver of the conditions precedent to consummation of the merger transaction, including the ability to secure regulatory approvals in a timely manner or at all; the possibility of litigation and other unknown liabilities; the parties' ability to successfully integrate their operations, product lines, technology and employees and realize synergies and other benefits from the merger transaction; the potential impact of the announcement or consummation of the merger transaction on the parties' relationships with customers, suppliers and other third parties; and other risks described in SBG's public disclosures and Sprint's and T-Mobile's filings with the SEC. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in SBG's most recent Annual Report (which you may obtain for free at SBG's website , Sprint's and T-Mobile's most recent Annual Reports on Form 10-K and more recent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC (which you may obtain for free at the SEC’s website or on Sprint’s website or on T-Mobile’s website). SBG can give no assurance that the conditions to the merger will be satisfied. SBG does not intend, and assumes no obligation, to revise or update any forward-looking statements.

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.