Commencement of Tender Offer by SoftBank Corp. for Shares of Yahoo Japan Corporation (Securities Code: 4689) and Acquisition by Yahoo Japan Corporation of its Own Shares by way of Self-Tender Offer

SoftBank Group Corp. (“SBG” or the “Company”) announces today that SoftBank Corp. (“SBKK”), a subsidiary of SBG, decided on July 10 to implement a tender offer (the “Tender Offer”) for 613,888,888 shares of common shares (equivalent to 221 billion yen, shareholding ratio *1 : 10.78%) of Yahoo Japan Corporation (“YJ”), a subsidiary of SBG, for the purpose of acquiring a portion of the common shares of YJ held by Altaba Inc. (“Altaba”). Please see Attachment 1 for further details. This decision was made by Ken Miyauchi, SBKK's President and CEO, who was delegated the authority to decide whether to implement such acquisition at the meeting of the board of directors held on July 9. YJ also resolved at a meeting of its board of directors held on July 10, 2018 to: (ⅰ) express its support for the Tender Offer and its intention to leave the decision of whether to participate in this Tender Offer up to individual investors; and (ⅱ) to acquire its own shares by way of a self-tender offer (the “Self-Tender Offer”) as set forth in Attachment 2 .

The Company also decided on July 10, 2018 to accept the Self-Tender Offer and tender 611,111,111 common shares (equivalent to 220 billion yen, shareholding ratio: 10.73%) of YJ held by SoftBank Group Japan Corporation (“SBGJ”), a wholly-owned subsidiary of SBG. The background of the foregoing and overview of the participation in the Self-Tender Offer is described below.

In the event SBKK purchases the maximum number of shares to be tendered by Altaba in the Tender Offer, and YJ purchases all of the shares to be tendered by SBGJ in the Self-Tender Offer, the shareholding ratio *2 of YJ shares held by the Company and its subsidiaries (the “SBG Group”) is expected to be 48.17% in total. This transaction has no significant impact on the Company's consolidated results of operations.

Description

1. Background

Over the years, SBKK and YJ have strengthened their collaboration with an emphasis on e-commerce, expanded smartphone customer-targeted services, and strengthened the business relationship between the two companies. Under the belief that further expansion of the scope of collaboration going forward will increase the two companies' competitiveness, SBKK has been considering strengthening its capital relationship with YJ, through the establishment of a direct capital relationship with YJ.

Against this backdrop, on February 27, 2018, Altaba announced that it planned to sell the common shares of YJ it owns. SBKK subsequently commenced consideration of acquiring a portion of the common shares of YJ that Altaba intended to sell, and in early June 2018 conveyed to Altaba its intent to acquire, and at the same time conveyed SBKK's intent to YJ and engaged in consultations with YJ. As a result, in late June 2018, SBKK and YJ came to share the understanding that the alliance between the two companies would be strengthened through SBKK's purchase of a portion of the common shares of YJ owned by Altaba, and that more actively pursuing collaboration between the two companies would contribute to the further growth and development of both SBKK and YJ, leading to an increase in their respective corporate values going forward. As a result of the foregoing, SBKK, through its President and CEO Ken Miyauchi, who was entrusted with the decision at a board of director's meeting held the previous day, decided on July 10 to implement the Tender Offer and executed a tender offer agreement with Altaba, pursuant to which Altaba has agreed to participate in the Tender Offer and tender a portion of the common shares of YJ owned by Altaba. For details on the background of the Tender Offer, please also refer to the descriptions set forth in Attachment 1 .

In the meantime, YJ had for some time been considering an acquisition of its own stock as one method of strengthening shareholder returns and improving capital efficiency, and in light of SBKK's aforesaid intent to acquire the common shares of YJ, it engaged in consultations with SBKK. YJ then determined in late June 2018 that it would be prudent to implement the Self-Tender Offer simultaneously with the Tender Offer to maintain the SBG Group's shareholding ratio of the common shares of YJ at a certain level and maintain YJ's autonomy as a listed company while strengthening its alliance with SBKK, and YJ came to share this understanding with the Company and SBKK.

As a result of the foregoing, YJ decided on July 10, 2018 to express its support for the Tender Offer and to implement the Self-Tender Offer. For details on the background, etc. of the implementation of the Self-Tender Offer and expression of approval of the Tender Offer by YJ, please also refer to the descriptions set forth in Attachment 2 .

In light of the fact that the SBG Group's shareholding ratio of common shares of YJ will increase after consummation of the Tender Offer, after taking into consideration that YJ is already a consolidated subsidiary, that SBG is smoothly operating its group business, and from the standpoint of capital efficiency of the group, SGB determined that there was no need to increase the number of common shares of YJ owned, and as SGB came to share an understanding with YJ to implement the Tender Offer simultaneously with the Self-Tender Offer, it decided to tender, on the condition that the Tender Offer is consummated, 611,111,111 shares (equivalent to 220 billion yen, shareholding ratio: 10.73%) of the common shares of YJ owned by SBGJ into the Self-Tender Offer.

SBG hopes that further development of e-commerce and other collaborations between SBKK and YJ under a new capital relationship will foster business growth and increase the corporate values of both companies, and ultimately contribute to increasing the corporate value of the SBG Group as a whole.

In executing the tender offer agreement between SBKK and Altaba, on July 10, 2018, SBG, SBGJ and SBBM on the one hand, and Altaba, on the other hand, terminated an agreement among the parties (the “Joint Venture Agreement”) which provided for terms relating to a right of first refusal regarding the common shares of YJ and the appointment of directors.

-

*

SBG owns common shares of YJ (total 2,445,487,300 shares, shareholding ratio: 42.95%) through SBGJ and SBBM.

-

*

Masayoshi Son, Chairman & CEO of SBG said:

“This series of transactions represents an outstanding outcome for SoftBank Group, SoftBank, and Yahoo Japan. I have strong confidence in the future performance of Yahoo Japan and I'm excited about the significant synergies between SoftBank and Yahoo Japan, which are consistent with SoftBank Group's broader strategic synergy group initiative.”

2. Overview of the Tender to the Self-Tender Offer by YJ

(1) Overview of the Tender

| (1) Number of Tendered Shares | Owned by SBGJ: | 611,111,111 shares of common shares of YJ (shareholding ratio: 10.73%) |

|---|---|---|

| (2) Tender Offer Price | 360 yen per share | |

| (3) Tender Offer Period | From July 11, 2018 to August 9, 2018 | |

| (4) Settlement Commencement Date | August 31, 2018 | |

(2) Changes in the Number of Shares Held by the Company through the Self-Tender Offer

| (1) Number of shares held before the Self-Tender Offer | 2,445,487,300 shares (indirectly held) |

|---|---|

| (2) Number of shares tendered to the Self-Tender Offer | 611,111,111 shares (indirectly held) |

| (3) Number of shares held after tender to the Self-Tender Offer *3 | 2,448,265,077 shares (indirectly held) (shareholding ratio *2 : 48.17%) |

-

*1

“Shareholding ratio” is the ratio of the shares owned by an entity against the number of outstanding shares (5,694,069,615 shares), obtained by subtracting the number of treasury stock held by YJ as of June 18, 2018 (2,835,585 shares) (excluding the number of shares obtained through the purchase of shares less than one unit by YJ during the period from June 1, 2018 to June 18, 2018), from the total number of shares outstanding as of June 18, 2018 (5,696,905,200 shares) as disclosed in YJ's “Annual Securities Report for the 23rd fiscal year (April 1, 2017 through March 31, 2018)” submitted on June 18, 2018 (excluding the number of shares issued through the exercise of stock acquisition rights by YJ during the period from June 1, 2018 to June 18, 2018), rounded to the nearest hundredth (0.01) percentage point. The same applies wherever the shareholding ratio is indicated in this disclosure document.

-

*2

“Shareholding ratio” in this section is the ratio of the shares owned by an entity against the number of outstanding shares (5,082,958,504 shares), obtained by subtracting the total sum of the treasury stock (613,946,696 shares) of (ⅰ) the number of treasury stock held by YJ as of June 18, 2018 (2,835,585 shares) (excluding the number of shares obtained through the purchase of shares less than one unit by YJ during the period from June 1, 2018 to June 18, 2018) and (ⅱ) the number of treasury stock YJ will acquire in the event that YJ purchases, etc. all the shares to be tendered in the Self-Tender Offer (611,111,111 shares), from the total number of shares outstanding as of June 18, 2018 (5,696,905,200 shares) as disclosed in YJ's “Annual Securities Report for the 23rd fiscal year (April 1, 2017 through March 31, 2018)” submitted on June 18, 2018, (excluding the number of shares issued through the exercise of stock acquisition rights by the Target during the period from June 1, 2018 to June 18, 2018), rounded to the nearest hundredth (0.01) percentage point.

-

*3

The number indicated is the number of shares to be held by SBG in the event the Self-Tender Offer is consummated, that SBKK purchases all of the shares it plans to purchase, and all 611,111,111 shares of the common shares of YJ tendered through SBGJ's Self-Tender Offer are purchased. The Self-Tender Offer sets 611,111,111 shares as the maximum number of YJ shares to be purchased. As such, depending on acceptance by other shareholders of YJ, not all of the 611,111,111 shares tendered by SBGJ may be purchased.

-

*1

End

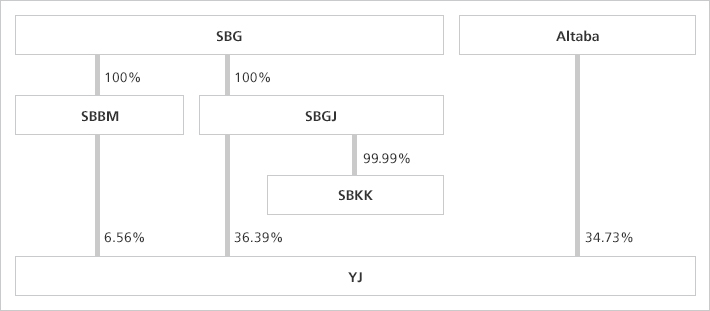

Outline of Shareholding Structure

(Current)

SBG owns common shares of YJ (total 2,445,487,300 shares, shareholding ratio: 42.95%) through its wholly-owned subsidiaries, SBGJ and SBBM.

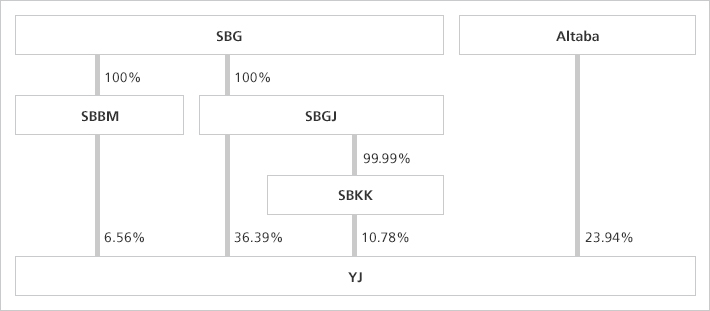

(Tender Offer by SBKK)

The Tender Offer for YJ common shares by SBKK, implemented on the condition that Altaba will tender a portion of their YJ common shares (shareholding of the respective companies is conditional to acquisition by SBKK of all of the shares to be tendered by Altaba through the Tender Offer).

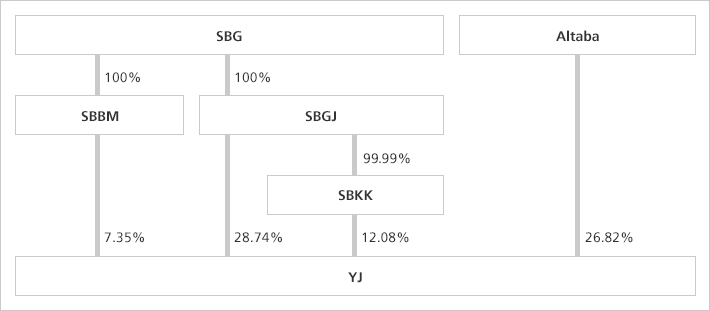

(Self-Tender Offer by YJ)

Self-Tender Offer by YJ for its own common shares. SBGJ executed a tender offer agreement with YJ regarding acceptance of the Self-Tender Offer (shareholding of the respective companies is conditional upon the acquisition by SBKK of all of the shares to be tendered by Altaba through the Tender Offer, and acquisition by YJ of all the shares to be tendered by SBGJ through the Self-Tender Offer).

The materials provided herein also serve as an announcement to be made pursuant to Article 30, Paragraph 1, Item 4 of the Order for Enforcement of the Financial Instruments and Exchange Act, based on the request made by SBKK (the Tender Offeror of the Tender Offer) to SBG (parent company of the Tender Offeror of the Tender Offer).

This press release does not constitute an offer to purchase securities or a solicitation of an offer to sell any securities or an offer to sell or the solicitation of an offer to purchase any new securities, nor does it constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is unlawful.

SoftBank Corp. and Yahoo Japan Corporation. (together, the “Tender Offerors”) are making the Tender Offer and the Self-Tender Offer (together, the “Tender Offers”), respectively, only by, and pursuant to, the terms of the respective Tender Offer Explanatory Statements for the Tender Offer and the Self-Tender Offer. Stockholders must make their own decision as to whether to tender their shares and, if so, in what amount to tender. In any jurisdiction in which the blue sky or other laws require the Tender Offers to be made by a licensed broker or dealer, the Tender Offers will be deemed to be made on behalf of SoftBank Corp. or Yahoo Japan Corporation, as the case may be, by the dealer manager, or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

Although the Tender Offers will each be conducted in accordance with the procedures and information disclosure standards prescribed in the Act, these procedures and standards may differ from the procedures and information disclosure standards in the United States. In particular, Sections 13(e) and 14(d) of the U.S. Securities Exchange Act of 1934 (as amended, the “ U.S. Securities Exchange Act of 1934 ”), and the rules prescribed thereunder, do not apply to the Tender Offers, and neither of the Tender Offers conforms to those procedures and standards. The financial information contained in this press release may not necessarily be comparable to the financial statements of U.S. companies. It may be difficult to enforce any right or claim arising under U.S. federal securities laws because the Tender Offerors are incorporated outside the United States and their directors are non-U.S. residents. Shareholders may not be able to sue a company outside the United States and its directors in a non-U.S. court for violations of the U.S. securities laws. Furthermore, there is no guarantee that shareholders will be able to compel a company outside the United States or its subsidiaries and affiliated companies to subject themselves to the jurisdiction of a U.S. court.

Unless otherwise specified, all procedures relating to Tender Offers shall be conducted entirely in Japanese. While some or all of the documentation relating to the Tender Offers will be prepared in English, if there is any inconsistency between the English documentation and the Japanese documentation, the Japanese documentation will prevail.

This press release contains “forward-looking statements” as defined in Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the U.S. Securities Exchange Act of 1934. Known or unknown risks, uncertainties and other factors could cause actual results to differ substantially from the projections and other matters expressly or impliedly set forth herein as “forward-looking statements.” Neither of the Tender Offerors, nor any of their affiliates assures that such express or implied projections set forth herein as “forward-looking statements” will eventually prove to be correct. The “forward-looking statements” contained in this press release have been prepared based on the information held by the Tender Offerors as of the date hereof and, unless otherwise required under applicable laws and regulations, neither of the Tender Offerors, nor any of their affiliates, assumes any obligation to update or revise this press release to reflect any future events or circumstances.

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.