Announcement on Not Recognizing the Impairment Losses Related to Sprint in the Consolidated Financial Statements of the SoftBank Group

SoftBank Group Corp. (“SBG”) announces that it does not recognize impairment losses related to its U.S. subsidiary Sprint Corporation (“Sprint”) in its consolidated financial statements, while on May 7, 2019 (EST), Sprint announced that it recorded impairment losses of USD 2.0 billion (JPY 222.0 billion*) for the three-month period ended March 31, 2019 (the “fourth quarter”).

SBG will announce its consolidated financial results for the fiscal year ended March 2019 at 3:00 pm on May 9, 2019 (JST).

1. Impairment losses recorded at Sprint

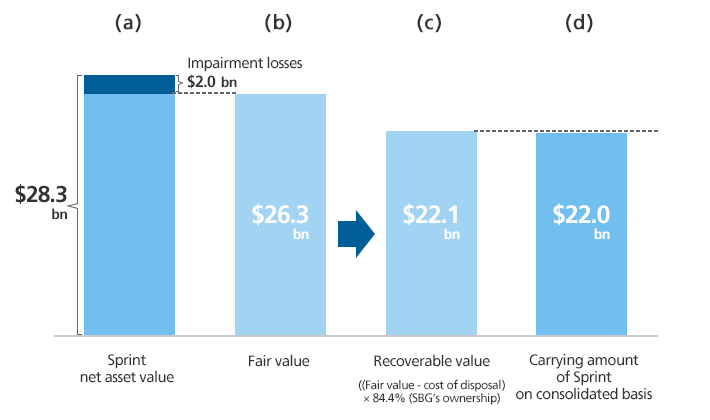

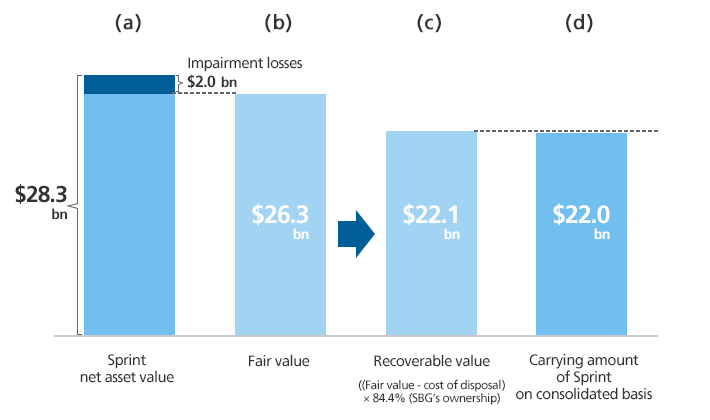

As a result of conducting impairment tests (calculating the fair value by a blend of DCF based on future business plans, EBITDA multiple, and M&A at other companies) in the fourth quarter, Sprint, which adopts US GAAP, recognized that the company's estimated fair value of USD 26.3 billion ((b) in the illustration on the next page) fell below its net asset value of USD 28.3 billion ((a) in the illustration on the next page) before recording the impairment losses. Consequently, Sprint recorded the difference of USD 2.0 billion as an impairment loss under operating expenses.

2. Accounting treatment of Sprint's impairment losses in SBG's consolidated financial statements

In the consolidated financial statements of SBG, which adopts IFRSs, the recoverable value of Sprint of USD 22.1 billion ((fair value - cost of disposal) × SBG's ownership of 84.4%, (c) in the illustration on the next page), was higher than its consolidated carrying amount of USD 22.0 billion at the end of the fourth quarter ((d) in the illustration on the next page). Therefore, SBG does not recognize an impairment loss related to Sprint in its consolidated financial statements.

Consolidated carrying amount of Sprint in SBG's consolidated financial statements ((d) in the illustration on the next page) is different from Sprint's net asset value before recording the impairment losses ((a) in the illustration on the next page). This is mainly due to the consideration of SBG's ownership of 84.4%, as well as the amount of hedge effect from forward exchange contracts at acquisition of Sprint (approximately USD 3.1 billion), which has being deducted from consolidated carrying amount of Sprint.

Comparisons: Sprint's net asset value to its fair value / carrying amount of Sprint on consolidated basis to its recoverable value

Calculated at exchange rate of USD = JPY 111.

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.