Absorption-type Merger of Subsidiaries (Mobiletech Corporation and BB Mobile Corp.)

SoftBank Group Corp. (SBG) announces that on October 22, 2015 its Board of Directors has resolved to merge its wholly-owned subsidiary Mobiletech Corporation (“Mobiletech”) and Mobiletech's wholly-owned subsidiary BB Mobile Corp. (“BB Mobile”) in an absorption-type of merger (the “Merger”), effective as of December 1, 2015 as follows.

1. Purpose of the Merger

Mobiletech and BB Mobile are intermediate holding companies: Mobiletech holds shares of BB Mobile and BB Mobile holds shares of SoftBank Corp. SBG has decided on the Merger to pursue greater efficiency in management of its subsidiaries.

2. Summary of the Merger

(1) Timeline

| Merger resolution by the Board of Directors | October 22, 2015 |

| Date of the Merger agreement | October 23, 2015 (planned) |

| Date of the Merger (the effective date) | December 1, 2015 (planned) |

- *1Given the Merger is a short-form merger as provided in the Article 796-2 (as for SBG) and the Article 784-1 (as for Mobiletech and BB Mobile) of the Companies Act, the Merger will be conducted without seeking approval at the General Meeting of Shareholders of each company on the execution of the Merger agreement.

- *1

(2) Merger method

Absorption-type merger with SBG being the surviving company. Both Mobiletech and BB Mobile will be dissolved.

(3) Allotment of shares and other assets upon the Merger

Not applicable

(4) Treatment of stock acquisition rights and bonds with stock acquisition rights of the merged companies

All of the stock acquisition rights issued by BB Mobile, the dissolving company, is held by Mobiletech, the dissolving wholly-owning parent company of BB Mobile. Therefore no stock acquisition rights are to be issued by SBG, the surviving company, to the stock acquisition rights holders of BB Mobile, nor any money, etc. is to be delivered in exchange for the stock acquisition rights accompanying the Merger.

3. Outline of the Companies Subject to the Merger

| Surviving Company | Dissolving Company | Dissolving Company | |

|---|---|---|---|

| (1) Trade name | SoftBank Group Corp. | Mobiletech Corporation | BB Mobile Corp. |

| (2) Address | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo | 1-9-1 Higashi-shimbashi, Minato-ku, Tokyo |

| (3) Name and title of representative | Masayoshi Son, Chairman and CEO | Ken Miyauchi, Representative Director | Ken Miyauchi, Representative Director |

| (4) Nature of business | Pure holding company | Intermediate holding company | Intermediate holding company |

| (5) Share capital | JPY 238,772 million | JPY 315,966 million | JPY 315,155 million |

| (6) Founded | September 3, 1981 | November 9, 1999 | June 21, 2001 |

| (7) Shares outstanding | 1,200,660,365 shares | 4,223,513 shares | 4,203,102 shares |

| (8) Fiscal year-end | March 31 | September 30 | June 30 |

| (9) Principal shareholders and their shareholding ratio |

| SoftBank Group Corp.: 100% | Mobiletech Corporation: 100% |

| (10) Financial position and operating results for the previous fiscal year (Millions of yen) | |||

| Fiscal year ended March 2015 (Consolidated) | Fiscal year ended September 2014 | Fiscal year ended June 2015 | |

| Total equity (Net assets) | 3,853,177 | 664,546 | 2,067,356 |

| Total assets | 21,034,169 | 664,592 | 2,073,080 |

| Equity per share attributable to owners of the parent (Shareholders' equity per share) (Yen) | 2,393.47 | 157,344.40 | 725,234.40 |

| Net sales | 8,504,135 | - | - |

| Operating income (loss) | 918,720 | (46) | (27) |

| Ordinary income | - | 32,407 | 1,361,367 |

| Net income attributable to owners of the parent (Net income) | 668,361 | 32,406 | 1,361,367 |

| Basic earnings per share attributable to owners of the parent (Net income per share) (Yen) | 562.20 | 7,672.75 | 622,810.38 |

- *2SBG adopts International Financial Reporting Standards (IFRSs) and Mobiletech and BB Corp. adopt JGAAP. Items where terminology differs between IFRSs and JGAAP are presented together, with JGAAP shown within brackets.

- *3Amounts are rounded off to the nearest units.

- *4SBG's net sales and operating income are presented based on the amounts from continuing operations only.

- *2

4. Situation after the Merger

SBG's trade name, address, name and title of representative, nature of business, share capital and fiscal year-end will remain unchanged after the Merger.

5. Future Outlook

As the Merger involves a merger of SBG's two wholly-owned subsidiaries, the impact of the Merger on SBG's consolidated financial results will be minor.

Reference: Forecasts on the consolidated results for the fiscal year ending March 2016 (as disclosed on August 6, 2015) and the actuals for the preceding fiscal year

| Net sales | Operating income | Net income attributable to owners of the parent | |

|---|---|---|---|

| Forecast for the fiscal year ending March 2016 | - | - | - |

| Actual for the fiscal year ended March 2015 | 8,504,135 | 918,720 | 668,361 |

- *Currently it is difficult to provide forecasts on the results in figures due to a large number of uncertain factors affecting the earnings. SBG will announce its forecasts on the consolidated results of operations when it becomes possible to make a rational projection.

- *5SBG's revenue and operating income for the fiscal year ended March 2015 are presented based on the amounts from continuing operations only.

- *

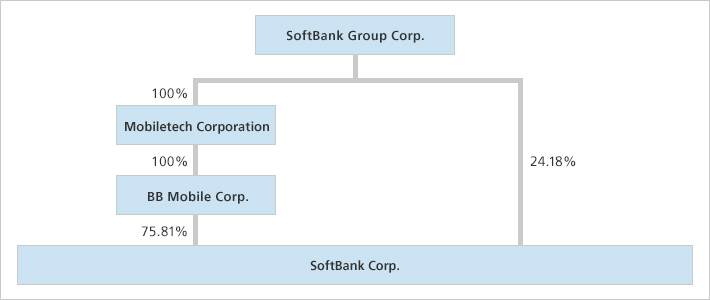

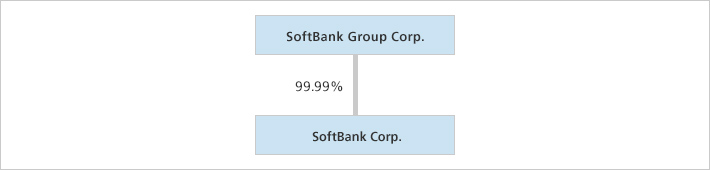

(Reference) Structure before & after the Merger

Before the Merger

After the Merger

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.