Results of Self-Tender Offer by Yahoo Japan Corporation (Securities Code: 4689) and Results of the Tender by the Company's Subsidiary to Self-Tender Offer

As announced on July 10, 2018 (“ Commencement of Tender Offer by SoftBank Corp. for Shares of Yahoo Japan Corporation and Acquisition by Yahoo Japan Corporation of its Own Shares by way of Self-Tender Offer ”), Yahoo Japan Corporation (Securities Code: 4689 First Section of the Tokyo Stock Exchange; “Yahoo Japan”), a subsidiary of SoftBank Group Corp. (“SBG” or the “Company”), commenced a tender offer to acquire its own shares (the “Self-Tender Offer”) on July 11, 2018. As the Self-Tender Offer ended on August 9, 2018, the Company announces the results as per the attached .

SoftBank Group Japan Corporation (“SBGJ”), a wholly-owned subsidiary of the Company, tendered the shares of Yahoo Japan's common shares that it owns. As a result, 611,109,700 of these shares will be sold to Yahoo Japan, the particulars of which are announced by the Company as set forth below.

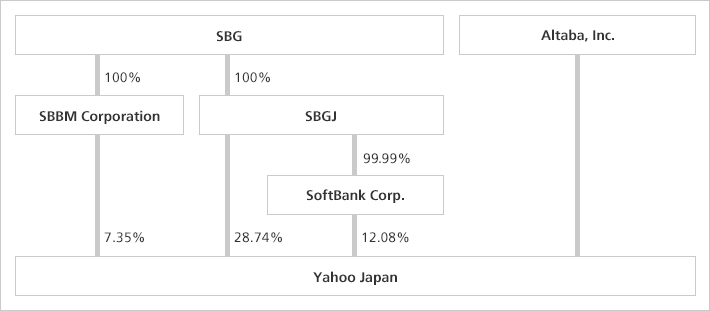

As a result of the foregoing, after settlements pertaining to the Self-Tender Offer and the tender offer of Yahoo Japan's common shares by SoftBank Corp. (the “Tender Offer;” please refer to the Announcement on “ Results of Tender Offer by SoftBank Corp. for Shares of Yahoo Japan Corporation ” dated August 9, 2018, the shareholding ratio of the Company and its subsidiaries for Yahoo Japan's common shares (after the Self-Tender Offer) *1 is expected to be 48.17% (of which SoftBank Corp.'s shareholding ratio of Yahoo Japan's common shares (after the Self-Tender Offer) is expected to be 12.08%). This transaction has no significant impact on the Company's consolidated financial results.

Overview of the Results of the Tender to the Self-Tender Offer by Yahoo Japan

| (1) Number of shares held before the Self-Tender Offer | 2,445,487,300 shares (indirectly held) |

|---|---|

| (2) Number of shares to be sold as a result of the tender to the Self-Tender Offer | 611,109,700 shares (indirectly held) |

| (3) Number of shares held after the tender to the Self-Tender Offer |

2,448,266,500 shares (indirectly held)

(shareholding ratio (after the Self-Tender Offer): 48.17%) |

-

*1

“Shareholding ratio (after the Self-Tender Offer)” is the ratio of the shares owned by an entity against the number of outstanding shares (5,082,958,415 shares), obtained by subtracting the sum of the number of treasury stock held by Yahoo Japan as of June 18, 2018 (2,835,585 shares) (excluding the number of shares obtained through the purchase of shares less than one unit by Yahoo Japan during the period from June 1, 2018 to June 18, 2018) and the number of its own shares Yahoo Japan has acquired in the Self-Tender Offer (611,111,200 shares) (the sum being 613,946,785 shares), from the total number of shares outstanding as of June 18, 2018 (5,696,905,200 shares) as disclosed in the Yahoo Japan's “Annual Securities Report for the 23rd fiscal year (April 1, 2017 through March 31, 2018)” submitted on June 18, 2018 (excluding the number of shares issued through the exercise of stock acquisition rights by Yahoo Japan during the period from June 1, 2018 to June 18, 2018), rounded to the nearest hundredth (0.01) percentage point.

-

*1

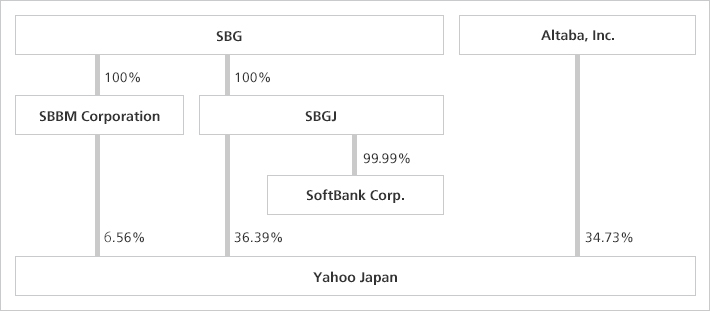

[Overview of the Shareholding Ratio]

(As of July 10, 2018)

The Company's shareholding ratio of Yahoo Japan's common shares *2 : 42.95% (indirectly held)

(After settlements pertaining to the Tender Offer and the Self-Tender Offer)

The Company's shareholding ratio of Yahoo Japan's common shares (after the Self-Tender Offer): 48.17% (indirectly held)

-

*2

“Shareholding ratio” in this chart is the ratio of Yahoo Japan shares owned by an entity against the number of outstanding Yahoo Japan shares (5,694,069,615 shares), obtained by subtracting the number of treasury stock held by Yahoo Japan as of June 18, 2018 (2,835,585 shares) (excluding the number of Yahoo Japan shares obtained through the purchase of shares less than one unit by Yahoo Japan during the period from June 1, 2018 to June 18, 2018), from the total number of Yahoo Japan shares outstanding as of June 18, 2018 (5,696,905,200 shares) as disclosed in the Yahoo Japan's “Annual Securities Report for the 23rd fiscal year (April 1, 2017 through March 31, 2018)” submitted on June 18, 2018 (excluding the number of Yahoo Japan shares issued through the exercise of stock acquisition rights by Yahoo Japan during the period between June 1, 2018 and June 18, 2018), rounded to the nearest hundredth (0.01) percentage point.

-

*2

Unless otherwise specified, all procedures relating to the Self-Tender Offer shall be conducted entirely in Japanese. While some or all of the documentation relating to the Self-Tender Offer will be prepared in English, if there is any inconsistency between the English documentation and the Japanese documentation, the Japanese documentation will prevail.

This press release contains “forward-looking statements” as defined in Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the U.S. Securities Exchange Act of 1934. Known or unknown risks, uncertainties and other factors could cause actual results to differ substantially from the projections and other matters expressly or impliedly set forth herein as “forward-looking statements.” None of Yahoo Japan, SoftBank Group Corp, or any of their affiliates assures that such express or implied projections set forth herein as “forward-looking statements” will eventually prove to be correct. The “forward-looking statements” contained in this press release have been prepared based on the information held by Yahoo Japan and SoftBank Group Corp., as of the date hereof and, unless otherwise required under applicable laws and regulations, none of Yahoo Japan, SoftBank Group Corp., or any of their affiliates assumes any obligation to update or revise this press release to reflect any future events or circumstances.

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.