Issuance of New Shares through a Third-Party Allotment and Acquisition of Shares through Tender Offer by Subsidiary Yahoo Japan Corporation, and Tender in the Tender Offer by a Subsidiary

SoftBank Group Corp. (“SBG”) announces that its subsidiary Yahoo Japan Corporation (Securities Code: 4689, Tokyo Stock Exchange First Section; “YJ”) resolved at its board of directors' meeting held on May 8, 2019 to (ⅰ) issue 1,511,478,050 new shares to SoftBank Corp. (Securities Code: 9434, Tokyo Stock Exchange First Section; “SBKK”), a subsidiary of SBG, through a third-party allotment (the “Third-Party Allotment”), and, (ⅱ) effect a repurchase of its shares by means of an issuer self-tender offer (the “Tender Offer,” and together with the Third-Party Allotment, the “Transactions”) as set forth in Attachment A.

Furthermore, on May 8, 2019, Ken Miyauchi, President & CEO of SBKK, pursuant to an entrustment by its board of directors' meeting held on May 7, 2019, decided to purchase new shares issued by YJ for JPY 456.5 billion in the Third-Party Allotment, with the intention of making YJ a consolidated subsidiary, as set forth in Attachment B.

SBG also determined on May 8, 2019 to accept the Tender Offer and tender its entire holding of 1,834,377,600 common shares of YJ (equivalent to JPY 526.5 billion, shareholding ratio*1: 36.08%), held by its wholly owned subsidiary SoftBank Group Japan Corporation (“SBGJ”).

The background of the foregoing and overview of the tender in the Tender Offer are described below.

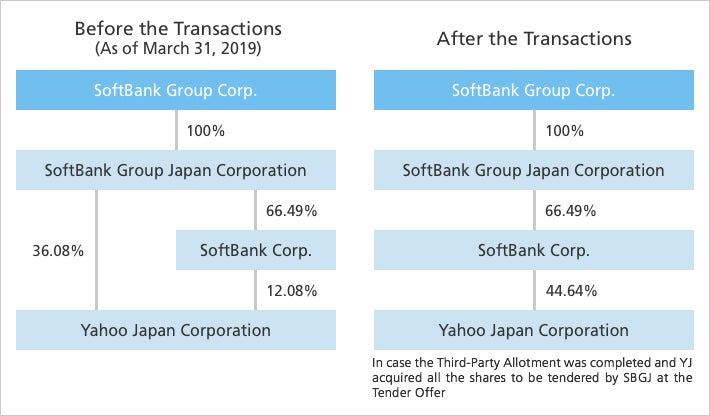

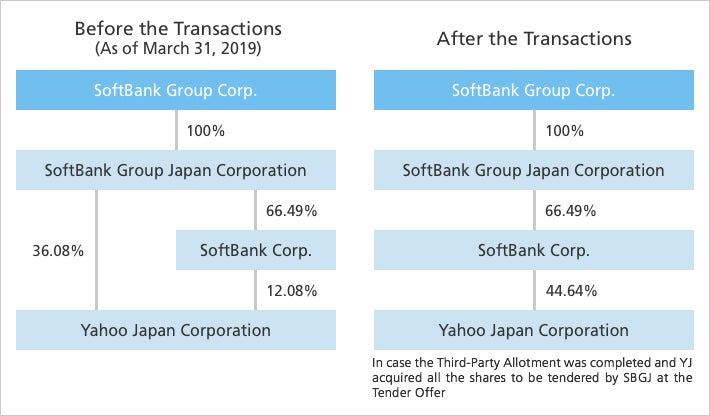

In the event that SBKK purchases the shares of YJ through the Third-Party Allotment, and YJ purchases all of the shares to be tendered by SBGJ in the Tender Offer, SBG's ownership in YJ's common shares is expected to be 44.64%*2 (all of which are indirect holdings through SBKK), compared with 48.16% (all of which are indirect holdings through subsidiaries, including SBKK's shareholding of 12.08%) as of March 31, 2019. As a result of the Transactions, YJ is expected to become a subsidiary of SBKK, which will be deemed to effectively control the company, considering its dispatch of officers to YJ as board members. Consequently, YJ will remain a subsidiary of SBG in SBG's consolidated financial results. SBG's economic interests in YJ are expected to drop from 44.11% to 29.68% in accordance with an increase in non-controlling interests.

1. Background

Over the years, YJ and SBKK have formed a collaborative relationship mainly in e-commerce, working to improve overall value of telecommunications and related services and to differentiate their services through expanding services for smartphone customers. The companies also endeavored to expand new businesses including mobile payment service, PayPay. YJ and SBKK have had continued discussions on various measures to enhance both companies' corporate value, especially after YJ and SBKK strengthened their relationship through a capital tie-up by SBKK acquiring a portion of the common shares of YJ (613,888,900 shares, shareholding ratio: 12.08%) on August 15, 2018, as announced in “Results of Tender Offer by SoftBank Corp. for Shares of Yahoo Japan Corporation (Securities Code: 4689)” dated on August 9, 2018.

Against this backdrop, YJ and SBKK have reportedly had continued discussions on additional acquisition of YJ's common shares by SBKK in order to maximize synergies through deepening current collaborative relationship. As a result, YJ and SBKK shared an understanding that if SBKK acquires additional common shares of YJ through the Third-Party Allotment and makes YJ a consolidated subsidiary of SBKK, both companies could strengthen the tie between them and promote collaboration in an integrated and active manner, thereby contributing to further growth and development of YJ and SBKK and enhancing their corporate value.

At YJ, while making a tender offer for its shares from July to August 2018, it was reportedly looking for ways to enhance returns to shareholders and improve capital efficiency, and as a means to do so, YJ was considering acquisition of its shares. Given that, through YJ's acquisition of a larger number of its shares from SBGJ than the number of new shares to be issued through the Third-Party Allotment simultaneously, it is possible to keep the SoftBank Group's shareholding of the common shares at around the current level and maintain independence of YJ as a listed company, as well as reinforce the tie between YJ and SBKK, YJ determined that executing the Transactions would benefit its shareholders. At SBG, it has judged that SBKK's additional acquisition of YJ's common shares through the Third-Party Allotment and YJ becoming a consolidated subsidiary of SBKK will lead to an enhancement of the entire group's corporate value. As for the Tender Offer, SBG has determined and informed YJ that it is unnecessary to increase its group-wide shareholding in YJ given that the current shareholding ratio is sufficient for the SoftBank Group to consolidate YJ and to operate the group's businesses smoothly and is also ideal from a capital efficiency perspective. For further details on the background of the Transactions, please refer to the descriptions set forth in Attachment A.

As a result of the foregoing, YJ reached a conclusion with SBKK and SBG to execute the Third-Party Allotment and the Tender Offer, respectively. SBG also determined to accept the Tender Offer and tender the entire common shares of YJ indirectly held through SBGJ. On May 8, 2019, SBGJ entered into a tender offer agreement with YJ setting forth, among other things, that in the event the Tender Offer is implemented by YJ, SBGJ will tender its entire holding of 1,834,377,600 common shares of YJ (shareholding ratio: 36.08%).

SBG wishes that the collaboration between YJ and SBKK in a further integrated and active manner under a new capital relationship will contribute to further growth and development of both companies and enhancement of their corporate value, and ultimately contribute to increasing the corporate value of the SoftBank Group as a whole.

2. Overview of the Tender by SBG to the Tender Offer by YJ

(1) Overview of the tender

| (1) Number of shares to be tendered | 1,834,377,600 common shares of YJ indirectly held through SBGJ (shareholding ratio: 36.08%) |

|---|---|

| (2) Price of the Tender Offer | JPY 287 per share |

| (3) Period of the Tender Offer | From May 9, 2019 to June 5, 2019 |

| (4) Commencement date of settlement | June 27, 2019 |

(2) Changes in SBG's ownership of YJ common shares before and after the Tender Offer

| (1) Number of shares indirectly held before the Tender Offer | 2,448,266,500 shares |

|---|---|

| (2) Number of shares to be tendered to the Tender Offer | 1,834,377,600 shares |

| (3) Number of shares indirectly held after the tender to the Tender Offer*3 ((1) - (2)) | 613,888,900 shares |

(Reference) Changes in SBG's ownership of YJ common shares before and after the Transactions

| (a) Number of shares indirectly held by SBG after the tender to the Tender Offer*3 | 613,888,900 shares |

|---|---|

| (b) Number of shares to be allocated to SBKK by the Third-Party Allotment | 1,511,478,050 shares (Ratio to the total shares issued before the Third-Party Allotment: 29.73%) |

| (c) Number of shares indirectly held by SBG after the Transactions*3 ((a) + (b)) | 2,125,366,950 shares (shareholding ratio*2: 44.64%) |

“Shareholding ratio” indicates a ratio to 5,083,750,615 shares of YJ, an amount derived by subtracting the number of treasury stock as of March 31, 2019 (67,879,000 shares) from the number of shares issued as of March 31, 2019 (5,151,629,615 shares) as disclosed in “Results for the Fiscal Year Ended March 31, 2019 [IFRSs]” by YJ, rounded to two decimal place. The same applies to any references to shareholding ratio hereinafter except the one defined in note 2.

This “shareholding ratio” indicates a ratio to 4,760,851,065 shares of YJ, an amount derived by subtracting 1,902,256,600 shares, which is the total of the number of treasury stock as of March 31, 2019 (67,879,000 shares) and the number of own shares to be acquired if YJ purchases all shares to be tendered by SBGJ in the Tender Offer (1,834,377,600 shares), from the number of shares issued as of March 31, 2019 (5,151,629,615 shares) as disclosed in “Results for the Fiscal Year Ended March 31, 2019 [IFRSs]” by YJ, and adding the number of new shares to be issued in the Third-Party Allotment (1,511,478,050 shares), rounded to two decimal place.

The number of shares indicates only for the case where all shares to be tendered by SBGJ in the Tender Offer are acquired. If the number of shares being tendered in the Tender Offer exceeds the number of shares planned to be purchased, the purchase will be implemented on a pro rata basis. As such, depending on the status of tenders made in the Tender Offer, SBGJ may continue to directly hold a portion of YJ's common shares after the Tender Offer.

Appendix: Outline of shareholding structure

This press release does not constitute an offer to purchase securities or a solicitation of an offer to sell any securities or an offer to sell or the solicitation of an offer to purchase any new securities, nor does it constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is unlawful.

Yahoo Japan Corporation (the “Tender Offeror”) is making the Tender Offer only by, and pursuant to, the terms of the Tender Offer Explanatory Statement for the Tender Offer. Stockholders must make their own decision as to whether to tender their shares and, if so, in what amount to tender. In any jurisdiction in which the blue sky or other laws require the Tender Offer to be made by a licensed broker or dealer, the Tender Offer will be deemed to be made on behalf of Yahoo Japan Inc. by the dealer manager, or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

Although the Tender Offer will be conducted in accordance with the procedures and information disclosure standards prescribed in the Financial Instruments and Exchange Act, these procedures and standards may differ from the procedures and information disclosure standards in the United States. In particular, Sections 13(e) and 14(d) of the U.S. Securities Exchange Act of 1934 (as amended, the “U.S. Securities Exchange Act of 1934”), and the rules prescribed thereunder, do not apply to the Tender Offer, and the Tender Offer does not conform to those procedures and standards. The financial information contained in this press release may not necessarily be comparable to the financial statements of U.S. companies. Also, it may be difficult to enforce any right or claim arising under U.S. federal securities laws because the Tender Offeror is incorporated outside the United States and its directors are non-U.S. residents. Shareholders may not be able to sue a company outside the United States and its directors in a non-U.S. court for violations of the U.S. securities laws. Furthermore, there is no guarantee that shareholders will be able to compel a company outside the United States or its subsidiaries and affiliated companies to subject themselves to the jurisdiction of a U.S. court.

Unless otherwise specified, all procedures relating to the Tender Offer shall be conducted entirely in Japanese. While some or all of the documentation relating to the Tender Offer will be prepared in English, if there is any inconsistency between the English documentation and the Japanese documentation, the Japanese documentation will prevail.

This press release contains “forward-looking statements” as defined in Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the U.S. Securities Exchange Act of 1934. Known or unknown risks, uncertainties and other factors could cause actual results to differ substantially from the projections and other matters expressly or impliedly set forth herein as “forward-looking statements.” Neither the Tender Offeror, nor any of its affiliates, assures that such express or implied projections set forth herein as “forward-looking statements” will eventually prove to be correct. The “forward-looking statements” contained in this press release have been prepared based on the information held by the Tender Offeror as of the date hereof and, unless otherwise required under applicable laws and regulations, neither the Tender Offeror, nor any of its affiliates, assumes any obligation to update or revise this press release to reflect any future events or circumstances.

-

Releases, announcements, presentations and other information available from this page and elsewhere on this website were prepared based on information available and views held at the time of preparation and speak only as of the respective dates on which they are filed or used by SoftBank Group Corp. or the applicable group company, as the case may be. Such information is subject to change and may become out-of-date. Such information may also contain forward-looking statements which are by their nature subject to various risks and uncertainties that may cause actual results and future developments to differ materially from those expressed or implied by such statements. Please read legal notices in its entirety prior to viewing any information available on this website.