The world’s most pervasive compute platform

Arm is a global leader in the development of semiconductor technology, and we are defining the future of computing. A future that is being built by one of the most successful technology ecosystems in the world combining Arm, the leading CPU designer, and over 1,000 companies that partner with Arm to create billions of digital electronics products.

We fueled the smartphone revolution, and now we are redefining what is possible in cloud computing, transforming the automotive industry, enabling a thriving IoT economy, and making artificial intelligence (AI) a reality everywhere from data centers to edge computing. Through our focus on energy efficiency and our history of continuous innovation, we have enabled new categories of “smart” consumer electronics. Today, power efficiency is not only important for enterprises and consumers reducing their energy bills but also critical in achieving sustainability for our planet. This makes Arm’s CPU technology ideal for computing applications everywhere as the demands for increasing performance are insatiable, especially as more applications adopt AI, while the need for energy efficiency remains critical.

Arm’s business model

Arm licenses CPU designs to leading technology companies that incorporate Arm’s design into their computer chips. Customers pay a license fee to gain access to our technology and a royalty on every chip that uses one of our technology designs.

The value of the license fee typically depends on the amount of Arm technology being licensed, how advanced the technology is, and the period over which access is being granted. In recent years, Arm introduced Arm Total Access, a subscription-like business model where customers get access to a large proportion of Arm’s technology portfolio. Most Arm Total Access agreements are signed for three years, and then renewed, providing for Arm license revenue for many years to come.

The value of the royalty fee can be related to the selling price of the chip and will typically increase as more Arm processors are included on the chip and as Arm’s most advanced processors are included. As an example, Arm’s latest CPU technology, Armv9, is gradually replacing the previous generation Armv8*, especially in smartphones and data center servers. For fiscal 2023, the typical royalty fee for Armv9 was around double the fee for Armv8.

Each Arm technology design is suitable for a range of end applications and can be reused in a variety of products to address multiple markets. Each new product generates a new stream of royalties. An Arm design can be used in many different chips, and certain Arm-designed products continue to generate royalty revenue 25 years after their initial development.

-

For the quarter ended March 2024, Arm estimates that Armv9 provided around 20% of royalty revenues, Armv8 around 50%, and older architectures around 30%.

Investing for the long term

In our fast-paced world, new applications, device categories, and markets are continually emerging, many of which require advanced semiconductor chips to provide their capabilities. In contrast, it can take many years to develop the technology that is used in these new devices. Arm is investing currently for products that it expects consumers and enterprises will start using in 5 –10 years.

Arm has been investing to develop new technology to

- Gain or maintain share in long-term growth markets, such as smartphones, consumer electronics, cloud servers, automotive, and embedded computing.

- Increase the value of Arm processors in every smart device by providing additional functionality, higher performance, higher efficiency, and more specialized designs.

- Expand our product offerings to include more complete systems, such as Compute Subsystems (CSS), which are a pre-integrated platform of Arm IP, that further increase the value of our products to our customers.

- Invest in next-generation technologies such as artificial intelligence and machine learning.

- Expand access to Arm products through our flexible business model, creating new ways for customers to include Arm technology in their products.

Revenues today are from investments made many years ago

It takes Arm’s customers time to develop the complex chips that contain Arm technology. Licenses signed today are not expected to yield royalty revenue for at least 2–3 years. However, if the chips are commercially successful, they can bring additional royalty revenue streams that could last for years, and even decades, to come.

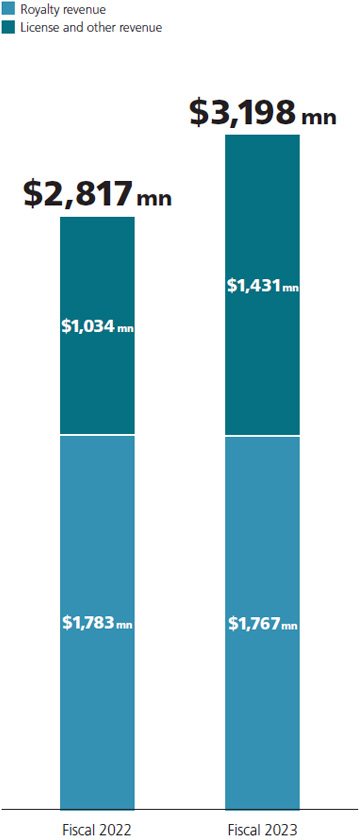

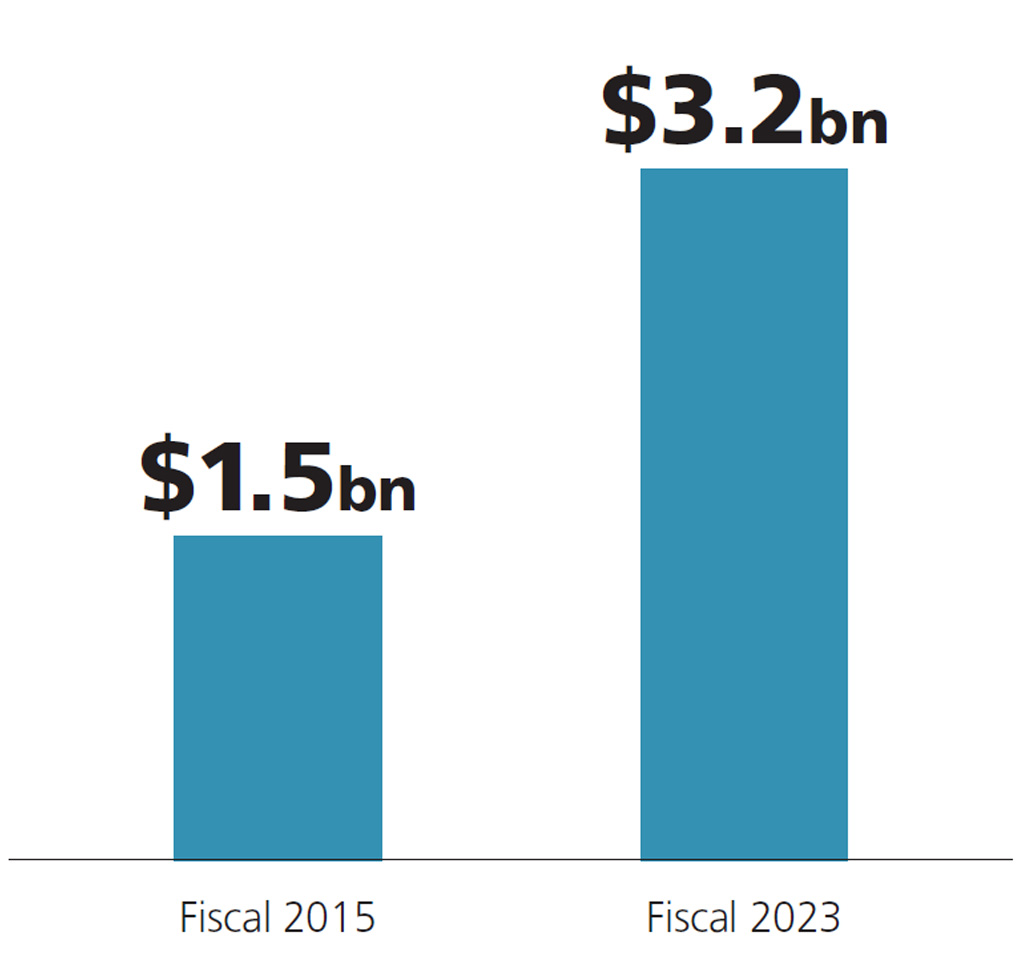

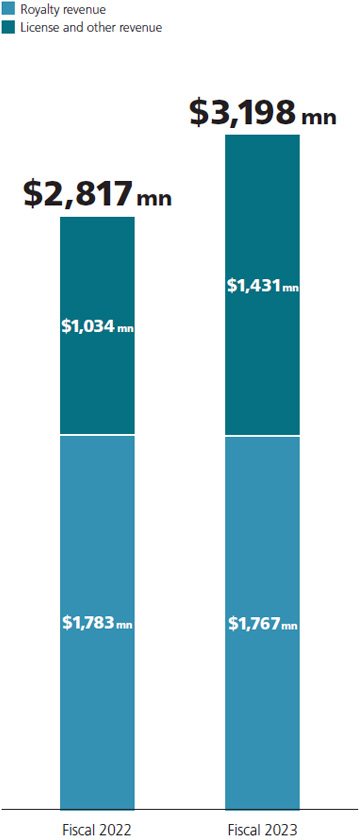

After several years of accelerated investments, in fiscal 2023 Arm saw record revenue growing 13.6% year on year (U.S. dollar–based) as its latest products came to market.

Arm’s license and other revenue in fiscal 2023 grew 38.5% year on year as leading technology companies aligned their future roadmaps with Arm’s product portfolio, many signing long-term, high-value Arm Total Access agreements. This demand has been accelerated by the need for energy-efficient AI capability across a wide range of end markets, from servers to smartphones to sensors, which only Arm’s technology can provide.

Arm’s royalty revenue in fiscal 2023 was down slightly year on year as a decline in the number of smartphones sold was offset by Arm’s latest technologies, which typically command a higher royalty fee per chip, being deployed in high-end smartphones, and market share gains in automotive applications and cloud servers.

Starting a new chapter in Arm’s story

For me, the highlight of the year was the Arm IPO on September 14, 2023, when we listed on the Nasdaq Global Select Market. This was a historic event for the company and its employees, one that we celebrated across all our offices around the globe. Arm has been developing leading technology for over 30 years, but so much has changed in just the past few years since SBG acquired Arm in 2016.

SBG will continue to play a major role in Arm’s future. Masa (Masayoshi Son, Representative Director, Corporate Officer, Chairman & CEO of SBG) maintains his position as Arm’s Chair and continues to provide leadership to Arm’s strategy. Also, SBG currently holds a large proportion of Arm shares and so will directly benefit from any appreciation in Arm’s valuation.

Together, we will benefit from the growth of the semiconductor industry, the increasing deployment of AI capability in chips from cloud to edge computers, and the higher value per chip from the latest Arm technology. These are trends that enable Arm to grow for years, if not decades to come.

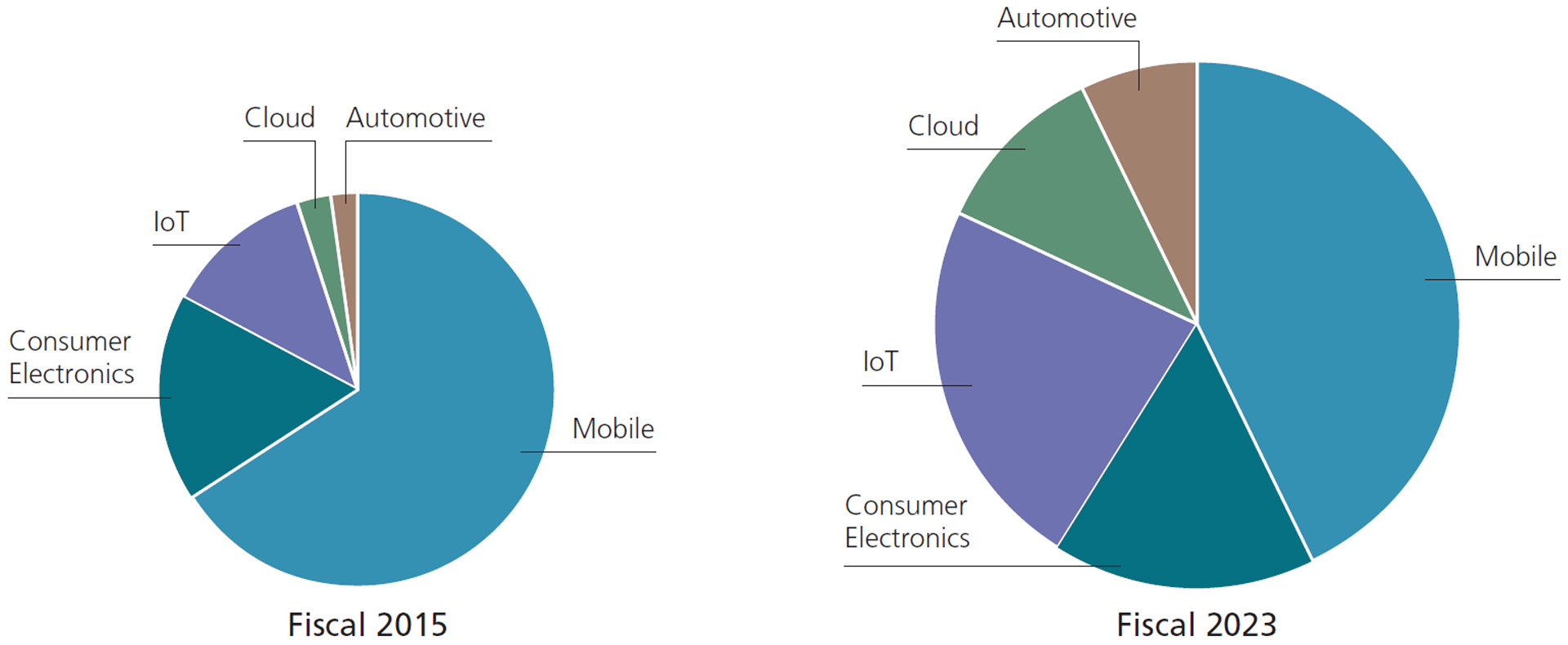

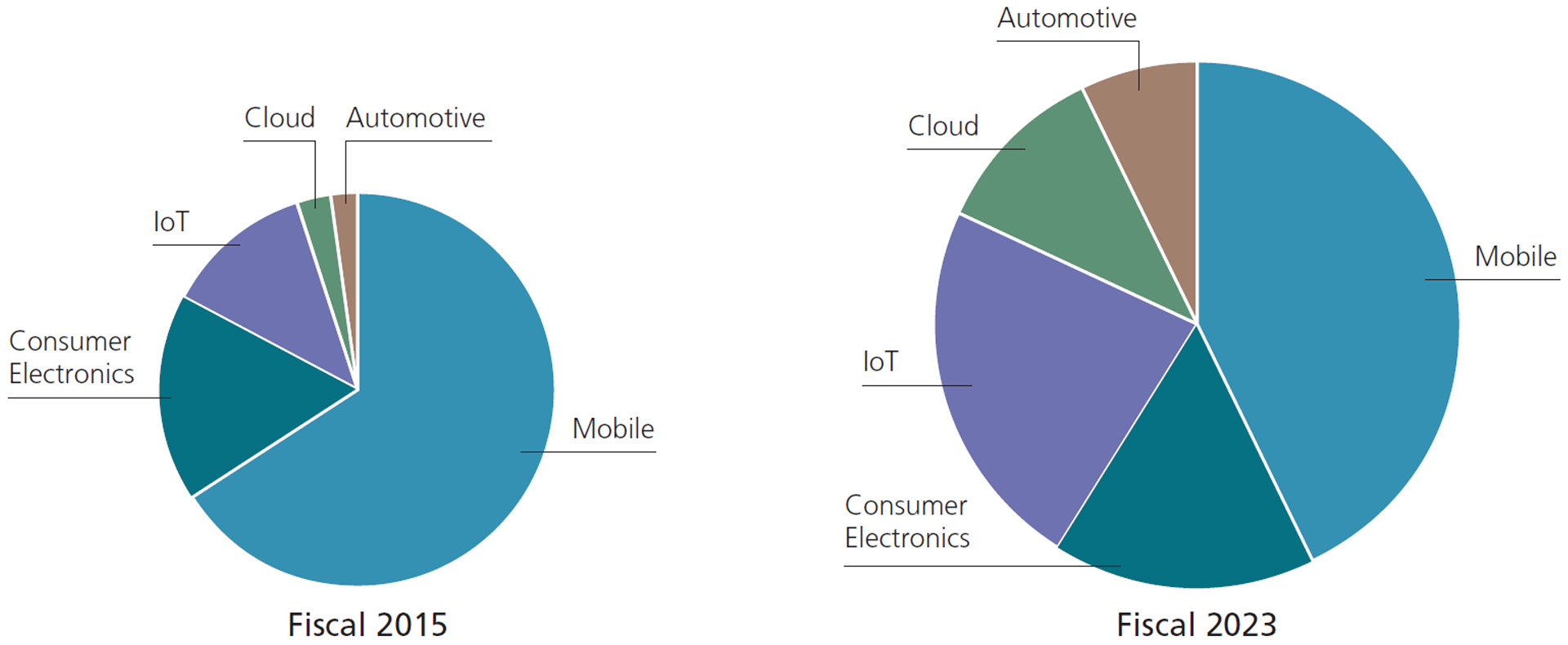

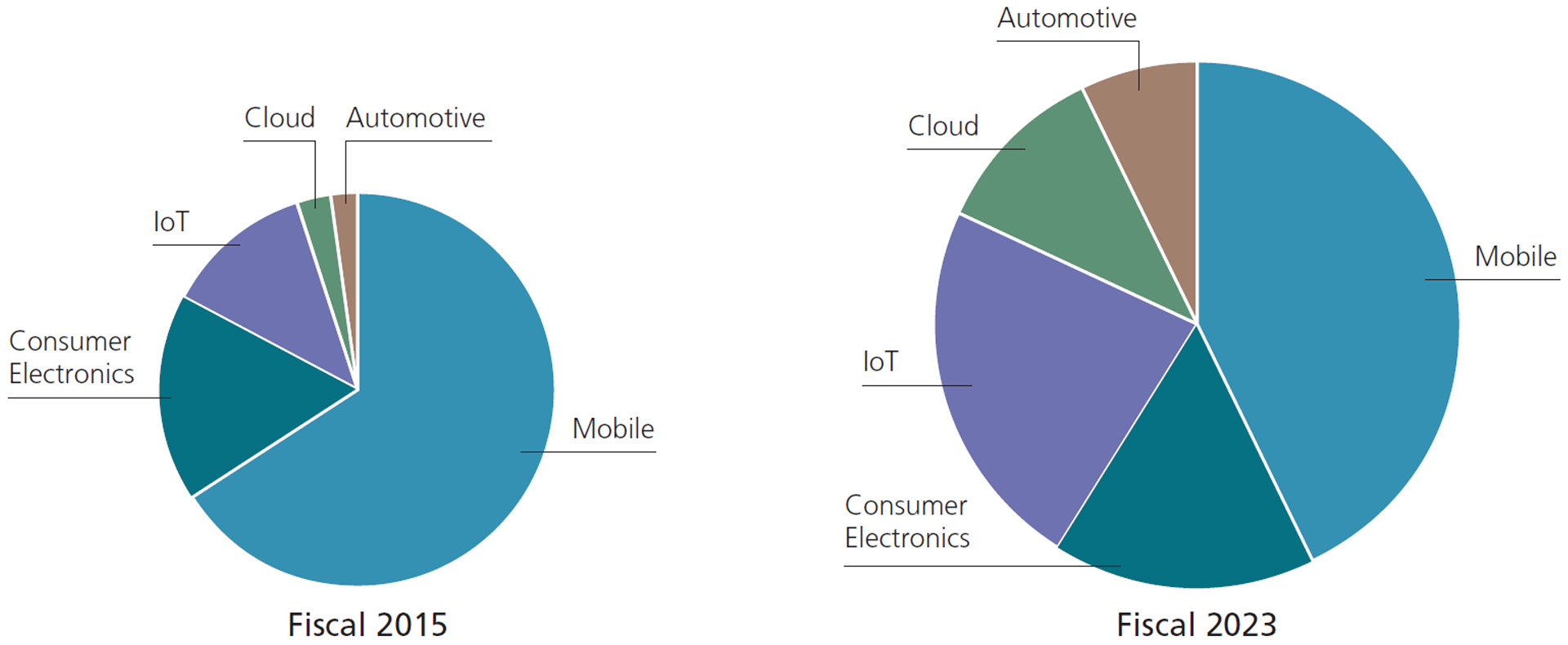

Royalty revenue split

within end markets

-

Based on accounting standards and fiscal year at the time. Revenue refers to revenue reported by Arm.

-

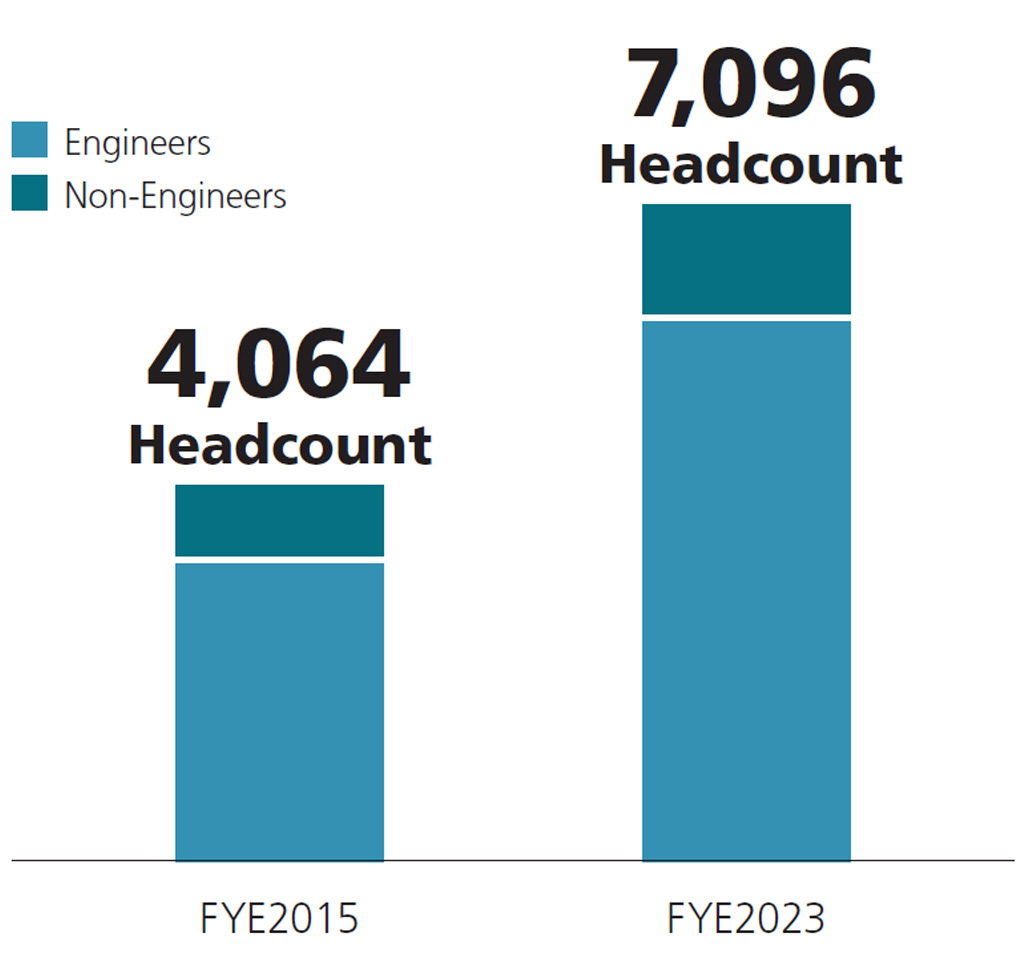

Personnel (the number of employees) is as of March 31, 2016, and March 31, 2024. “Engineers” and “Non-Engineers” are based on job type. Engineers in fiscal 2015 includes program management, technical support, and other technical positions. Engineers in fiscal 2023 does not include those positions.

-

This page is based on the information as of July 29, 2024.

-

Click here to check the company names or abbreviations used in this page.

Related Contents