Investor Relations

CFO Message—SoftBank Group Report 2024

We Will Maintain Our Active Investment

Approach

to Further Grow NAV

Board Director, Corporate Officer, Senior Vice President, CFO & CISO

Head of Finance Unit,

Head of Administration Unit

SoftBank Group Corp.

Board Director, Corporate Officer, Senior Vice President, CFO & CISO, Head of Finance Unit, Head of Administration Unit

SoftBank Group Corp.

Yoshimitsu Goto

Fiscal 2023 in review

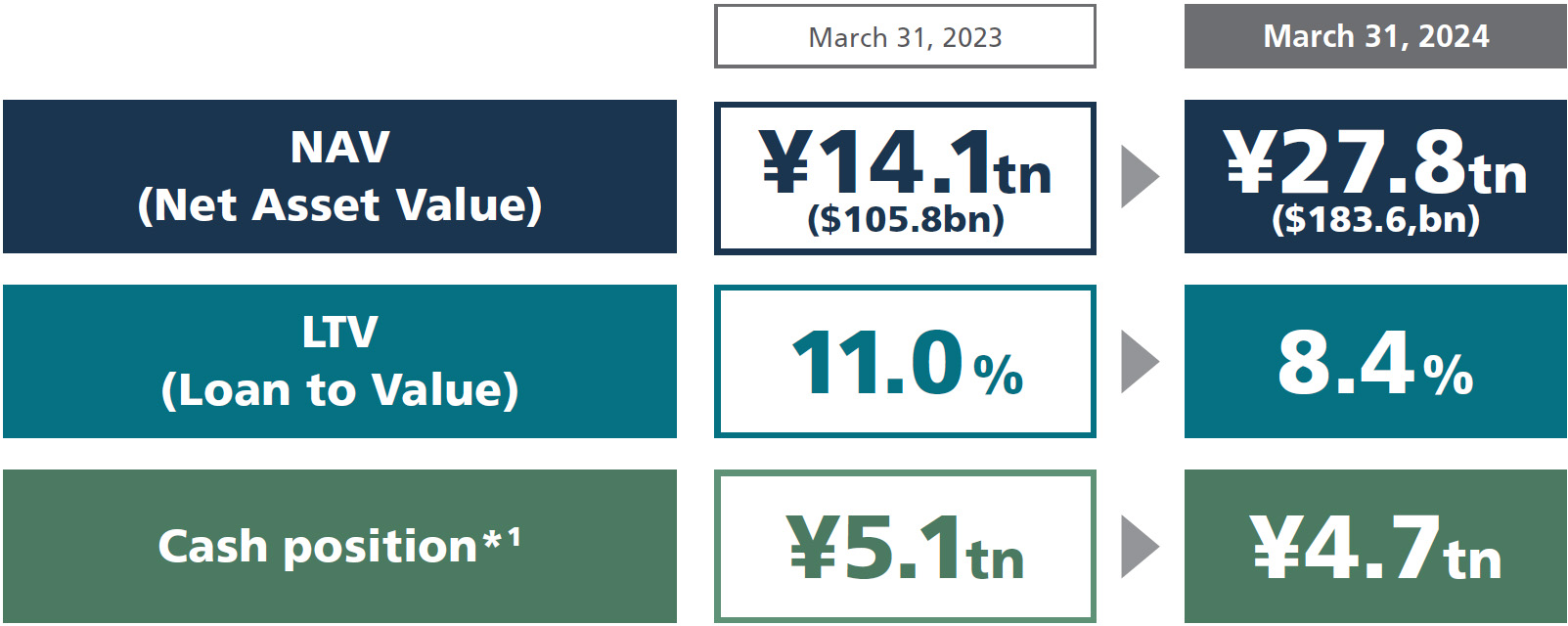

Throughout its history of over 40 years, SBG has consistently adapted its core business to the changing times. Our current focus is on our investment business. Our value as an investment company is best measured by our Net Asset Value (NAV). At the end of March 2024, our NAV had grown to ¥27.8 trillion, almost double the value at the end of the previous fiscal year. This remarkable value creation was largely driven by Arm, which went public in September 2023 and remains central to our strategy in the emerging AI era. We would like our stakeholders to look forward to our ongoing evolution with Arm, as we continue to enhance corporate value.

-

See page 20 for details of NAV.

Avoiding change is our greatest risk

We have consistently evolved our business over time while remaining true to our founding philosophy: Information Revolution—Happiness for everyone. As a leader in the cutting-edge technology field, avoiding change is our greatest risk. From our founding to our public offering in 1994 (over-the-counter market), when we were listed, our main business was software wholesaling. Since then, our core business has undergone significant changes while growing steadily. Today, the Information Revolution means something very different than it did 40 years ago when Mr. Son (Masayoshi Son, Representative Director, Corporate Officer, Chairman & CEO) founded the company. Back around 2000, when everyone was just starting to get their own communication devices, we foresaw the inevitable AI revolution and predicted that it would be unprecedented in scale. With considerable confidence in this belief, we have made our decisions accordingly. SBG is essentially a revolutionary force in the field of information and communication. Therefore, our most important risk mitigation strategy is continuous transformation. Change makes us stronger and enhances our value, while stagnation poses a risk. This mindset has brought us to where we are today.

Supporting Arm’s successful IPO

The process leading to the IPO

Looking back at fiscal 2023, Arm’s IPO on the Nasdaq Global Select Market in September 2023 was undoubtedly the highlight. Amid the economic uncertainty caused by the COVID-19 pandemic in 2020, we made the strategic decision to prioritize a defensive strategy by monetizing ¥4.5 trillion worth of assets. This decision ultimately led to the successful monetization of ¥5.6 trillion in just six months. These assets were all highly valuable, but we believed it was necessary to proceed with the monetization in order to safeguard our future.

Arm was also part of this monetization plan. Considering the future potential of Arm and our overall AI strategy, we originally planned to sell Arm shares to NVIDIA in a stock and cash transaction. Although the deal ultimately did not receive regulatory approval and did not go through, we still believe that our decision at that uncertain time was the right one. Now, a few years later, the fact that the deal did not go through has turned out to be a significant benefit, as it ultimately preserved a valuable asset for SBG.

NVIDIA is a company with significant growth potential, but even for them, Arm has become an indispensable part of their strategy. Having Arm, which is positioned at the top of the semiconductor supply chain, as a core part of our portfolio will accelerate our AI strategy. If the NVIDIA deal had gone through, the increase in NVIDIA’s share price would have boosted our NAV beyond its current level. However, looking out 20 years, I believe the value of having Arm in our portfolio might well surpass the potential gains from the NVIDIA deal. We feel that this has become a strong tailwind for us.

Steady rise in Arm’s share price since the IPO

Arm priced its IPO price at $51 per ADS, which I believe is a reasonable level. While the valuation of a company naturally incorporates its future value, I question the inclusion of uncertainty factors in potential future outcomes, as this can lead to overvaluation. Therefore, I believe that the IPO price reasonably reflected the value of Arm’s strategies that are likely to be realized in the future. Investors have various expectations for Arm’s future, and as the largest shareholder, we are in the best position to understand and appreciate these expectations.

Prior to Arm’s IPO, SoftBank Vision Fund 1, which held 24.99% of Arm’s shares, proposed that SBG purchase these shares. Although some stakeholders questioned the agreed acquisition price of approximately ¥2.3 trillion that was ultimately about 20% higher than Arm’s IPO price, we considered the price reasonable, as we believe in Arm’s future growth potential more than anyone and agreed to the deal. As we expected, Arm’s value has steadily increased since the IPO, and we believe that those who were initially skeptical are now pleased with our decision. Meanwhile, the deal was also successful from SoftBank Vision Fund 1’s perspective, as it sold its shares at a higher price than the IPO price.

Creating a new ecosystem with Arm

As a public traded company, Arm will detail its own future growth strategies and ambitions. We are confident that the world’s leading companies will increasingly leverage AI to advance in their respective fields. As Mr. Son has stated, “AI will redefine all industries.” In this evolving landscape, Arm, with its dominant market share in key AI chip designs, will continue to see the expanded shipments of Arm-based chips and grow as a company. By collaborating with other Group companies, we can generate synergies that will lead to the creation of new businesses, industries, and ecosystems. Arm is at the heart of this transformation, and we aim to continue to be a hub that connects Arm to businesses and industries around the world, while also leading the way in changing lifestyles through the Information Revolution. I personally look forward to growing together with Arm and delivering for our stakeholders by enhancing investment performance.

AI investment strategies and challenges

In fiscal 2023, we doubled down on our belief that AI will redefine all industries and sought investment opportunities in areas where AI can significantly enhance people’s lives, such as logistics, robotics, and autonomous driving. On the other hand, large corporations like SBG that are leading the AI world, including hyperscalers, now face greater challenges. While generative AI provides a road map for a rapid technological and theoretical growth trajectory, existing data centers are unable to provide the immense computing power required to power the actual services. In addition, we are entering an era that will require an unprecedented amount of electricity, far beyond what is available on a daily basis. To keep the AI revolution moving forward, we are committed to addressing these challenges and believe we are at the starting line of this critical endeavor.

Review of financial strategies for fiscal 2023

Offense leads to a stronger defense

As an investment company, we are often seen as being all about offense. However, as Mr. Son himself has said, “I’m good at offense, but my greatest strength is retreat.” This illustrates that our strength lies in our ability to halt offensive moves in order to strengthen our defense. In fiscal 2023, we shifted from the defense-first approach we adopted in fiscal 2022 to a balanced approach that integrates both offense and defense. As a result of this shift in strategy, our NAV doubled over the year to a record high level, while maintaining strong financial discipline. Although our net interest-bearing debt*2 increased by ¥0.8 trillion to ¥2.6 trillion, our Loan to Value (LTV) improved by 2.6 ppt to 8.4%, and we maintained a consistently safe cash position*1 of ¥4.7 trillion. To enhance our value as an investment company, we need to make investments that boost NAV. Therefore, in fiscal 2023, we invested nearly $4 billion without deteriorating our financial position, maintaining liquidity at a similar level and strengthening our financial security. This was an ideal financial outcome where our commitment to financial security was reinforced by our offensive approach.

-

Key Indicators

-

Japan’s household financial assets (Bank of Japan’s flow of funds Accounts Statistics)

-

*1 Cash and cash equivalents + Short-term investments recorded as current assets + Undrawn commitment line + Bond investments. On an SBG stand-alone basis. Excludes SB Northstar but includes its cash and cash equivalents and bond investments.

-

*2 Consolidated net interest-bearing debt – Net interest-bearing debt of self-financing entities, etc. – Other adjustments. Bank deposits and cash position at PayPay Bank Corporation are excluded.

-

See pages 20-21 for definitions of NAV and LTV.

Fundraising on track

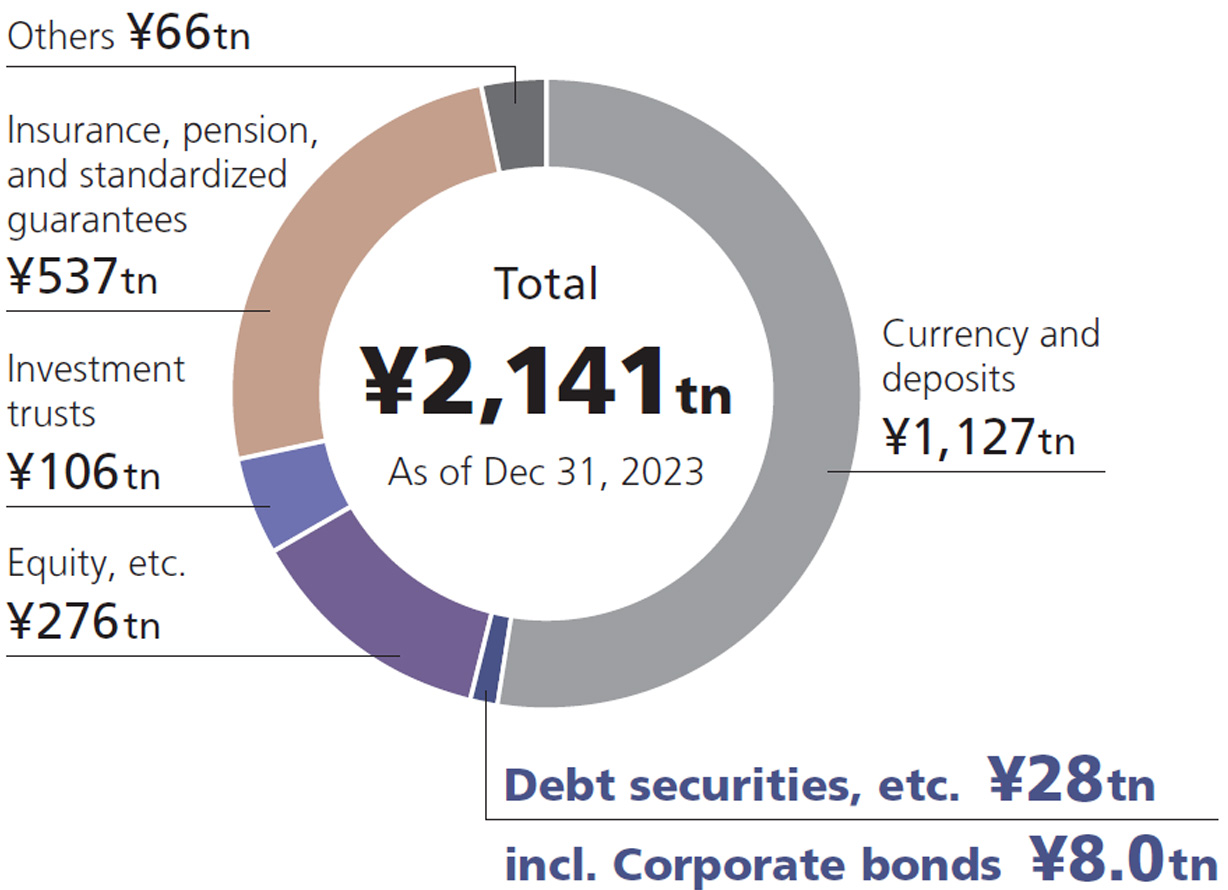

In terms of fundraising, we successfully completed bond issuances of ¥550 billion to retail markets in March 2024 and ¥100 billion to wholesale markets in April 2024. Due to strong demand, we issued another ¥550 billion bond to retail markets in June 2024. Currently, about half of Japan’s estimated ¥2.1 quadrillion in household financial assets*3 is held in cash and deposits, while less than 20% is invested in riskier assets such as equities and mutual funds. I have long believed that the Japanese market lacks sufficient middle-risk/middlereturn products to bridge the gap between cash deposits and risk assets. I also believe that the Japanese bond market is about 20 years behind global markets. For two decades, I have been dedicated to offering products that enhance investment opportunities for Japanese retail investors.

With our bond issue, JCR upgraded our rating by one notch from A- to A (stable) in April 2024, and S&P upgraded by one notch from BB to BB+ (stable) in May 2024. This was JCR’s first upgrade in 12 years, reflecting their recognition of our activities since becoming an investment company and our stable financial management. We have consistently maintained and adhered to our financial policies, and we believe that this disciplined financial management has now been recognized.

-

*3 Bank of Japan, Flow of Funds Accounts

Historical credit ratings of SBG (As of the date of the publication of this Annual Report)

Financial strategies for fiscal 2024

Financial strategies should not change frequently. The key is to align our financial management with our investment strategy, which is at the heart of our financial philosophy. While we aim to maximize corporate value, we must always adhere to our financial policies. In other words, maintaining a firm financial policy enhances managerial flexibility.

Of course, it is crucial to calmly analyze significantly fluctuating external factors, such as the economic and market conditions, and to create specific action plans. The ongoing and unfortunate conflicts around the world, rising diplomatic tensions, and the numerous elections in various countries and regions in fiscal 2024 will influence the political landscape. Despite these variables, the current market environment suggests that it is the right time to invest. In fiscal 2024, we will prioritize growth investments aimed at increasing our future NAV while maintaining financial stability and continuing an aggressive investment stance.

-

This page is based on the information as of July 29, 2024.

-

Click here to check the company names or abbreviations used in this page.