Investor Relations

CFO Message—SoftBank Group Report 2023

Leveraging a Solid Financial

Base for Both Defense and Offense

Board Director, Corporate Officer, Senior Vice President, CFO & CISO

Head of Finance Unit,

Head of Administration Unit

SoftBank Group Corp.

Board Director, Corporate Officer, Senior Vice President, CFO & CISO, Head of Finance Unit, Head of Administration Unit

SoftBank Group Corp.

Yoshimitsu Goto

A new phase of the Information Revolution

In the SoftBank Group Report 2022, I reiterated our commitment to stand firm on our financial policy even in the face of volatile circumstances, as well as our primary focus for the time being to implement a prudent financial management approach of steadfast defense. Reflecting on the past year, we encountered continued turbulence, marked by significant geopolitical risks in Russia and China that showed no sign of abating, and interest rates continued to rise in both the U.S. and Europe. The latter half of the year brought other unexpected events such as the collapse of Silicon Valley Bank, fueling concerns of another financial crisis. Throughout these adversities, we played all-out defense—restricting investments and rigorously monetizing assets—to ensure our unwavering financial stability. We believe our steadfastness was well received and supported by our stakeholders.

While we fortified our defense, we continued to devise strategies under the leadership of Mr. Son, our Representative Director, Corporate Officer, Chairman & CEO. The dynamics of the Information Revolution differ greatly from those of the financial markets. Currently, we are witnessing remarkable advancements in the development of revolutionary technologies, such as generative AI represented by ChatGPT. Personally, I feel a similar sense of excitement and opportunity as I did during the emergence of the internet in the 1990s. At SBG, we define ourselves as a lifestyle company aiming to improve lives through the Information Revolution. We believe that now is the time to demonstrate foresight and take bold steps forward in our management approach. While we remain mindful of the market environment and continue to exercise prudent judgement, we also plan to resume necessary investments. With unwavering confidence in our financial stability established through our defensive strategy in fiscal 2022, we are well-positioned to transition into a balanced defense-offense approach in fiscal 2023. I sincerely hope that our stakeholders share my excitement about the developments and progress that the coming year will bring.

-

CISO: Chief Information Security Officer

Looking back on fiscal 2022

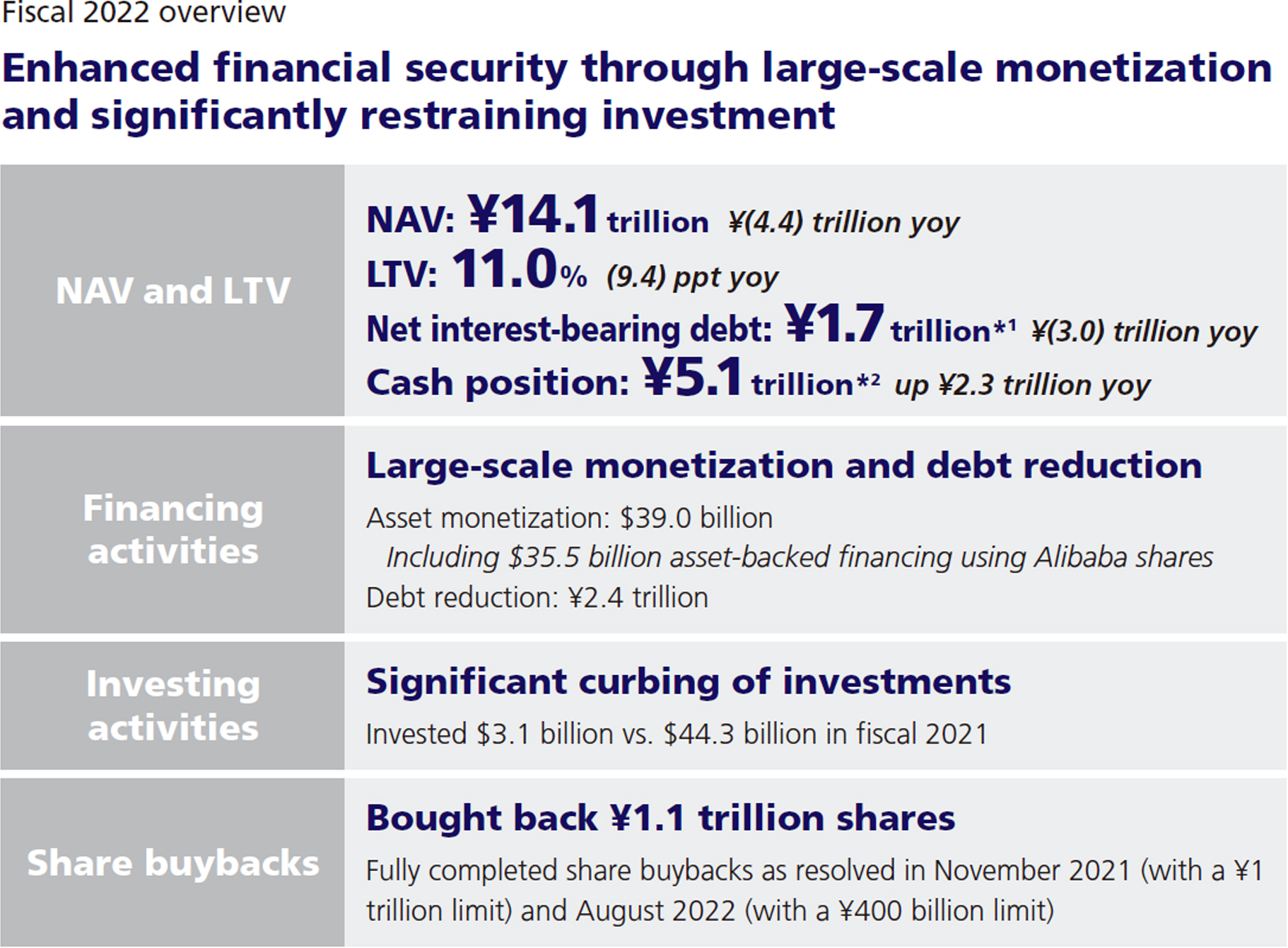

In summarizing fiscal 2022, I am pleased to highlight our significant accomplishments in bolstering defensive capabilities, both through continuous monetization and by curbing new investments. This is evident in our key financial figures as of March 31, 2023. Net debt*1 was ¥1.7 trillion (down ¥3.0 trillion yoy), cash position*2 was ¥5.1 trillion (up ¥2.3 trillion yoy), and LTV, one of our key indicators, improved by 9.4 percentage points year on year to a safer level of 11.0%. However, our NAV declined to ¥14.1 trillion, down ¥4.4 trillion from a year ago. This decrease primarily resulted from a decline in the value of our assets caused by a downturn in the stock market. Throughout the years, we have managed our business with a clear focus on offense and defense phases. In this respect, I take great pride in the solid financial performance of our defensive strategy in fiscal 2022.

-

See pages 20-21

for definitions of NAV and LTV.

-

*1 Consolidated net interest-bearing debt (excluding PayPay Banks’s deposits for banking business and cash and equivalents), net of net interest-bearing debt of self-financing entities, etc. and other adjustments

-

*2 Cash and cash equivalents + short-term investments recorded as current assets + undrawn commitment line. SBG stand-alone basis. Excludes SB Northstar. Undrawn commitment line was equivalent to ¥649.8 billion as of March 31, 2023.

Continuous monetization and curbing new investments

On the asset monetization front, in order to maintain a balanced and secure investment portfolio, we have strategically reduced our exposure to Chinese equities, which have a significantly higher country risk. In fiscal 2022, this was demonstrated by the reduction of our ownership in Alibaba from 24.4% to 13.7%. This reduction was primarily driven by the early physical settlement of the prepaid forward contracts using Alibaba shares. As of May 2023, we have used nearly all of our shareholding in the company for such contracts and other financing schemes, effectively completing the process of monetizing the shares. Since our initial investment in Alibaba back in 2000, we have invested a total of ¥7.4 billion. The investment has delivered remarkable results, generating a total return of ¥9.7 trillion*3 over the past 23 years. This impressive performance translates to an internal rate of return (IRR) of 57%.*4 It is important to note that when Mr. Son decided to invest in Alibaba, the company had zero revenue. Under the exceptional management skills of Mr. Jack Ma, the company flourished in the Chinese market. The partnership between Masa (Masayoshi Son) and Jack has been a monumental win-win relationship that will be remembered in history. We thank Alibaba for its significant contributions to our investment success. Capital relationships are just one part of our Cluster of No. 1 strategy, so we will continue to work with Alibaba as a like-minded partner.

Furthermore, we substantially reduced new investments made through SoftBank Vision Funds to $3.1 billion in fiscal 2022 from $44.3 billion in the previous year. This shift demonstrated our heightened investment discipline and defensive strategy.

-

*3 Net of costs associated with the monetization, such as option premiums on derivative transactions and cash settlements. Excludes amounts not yet monetized as of May 11, 2023

-

*4 Calculated based on actual investments and monetization from 2000 to May 11, 2023. Before tax consideration

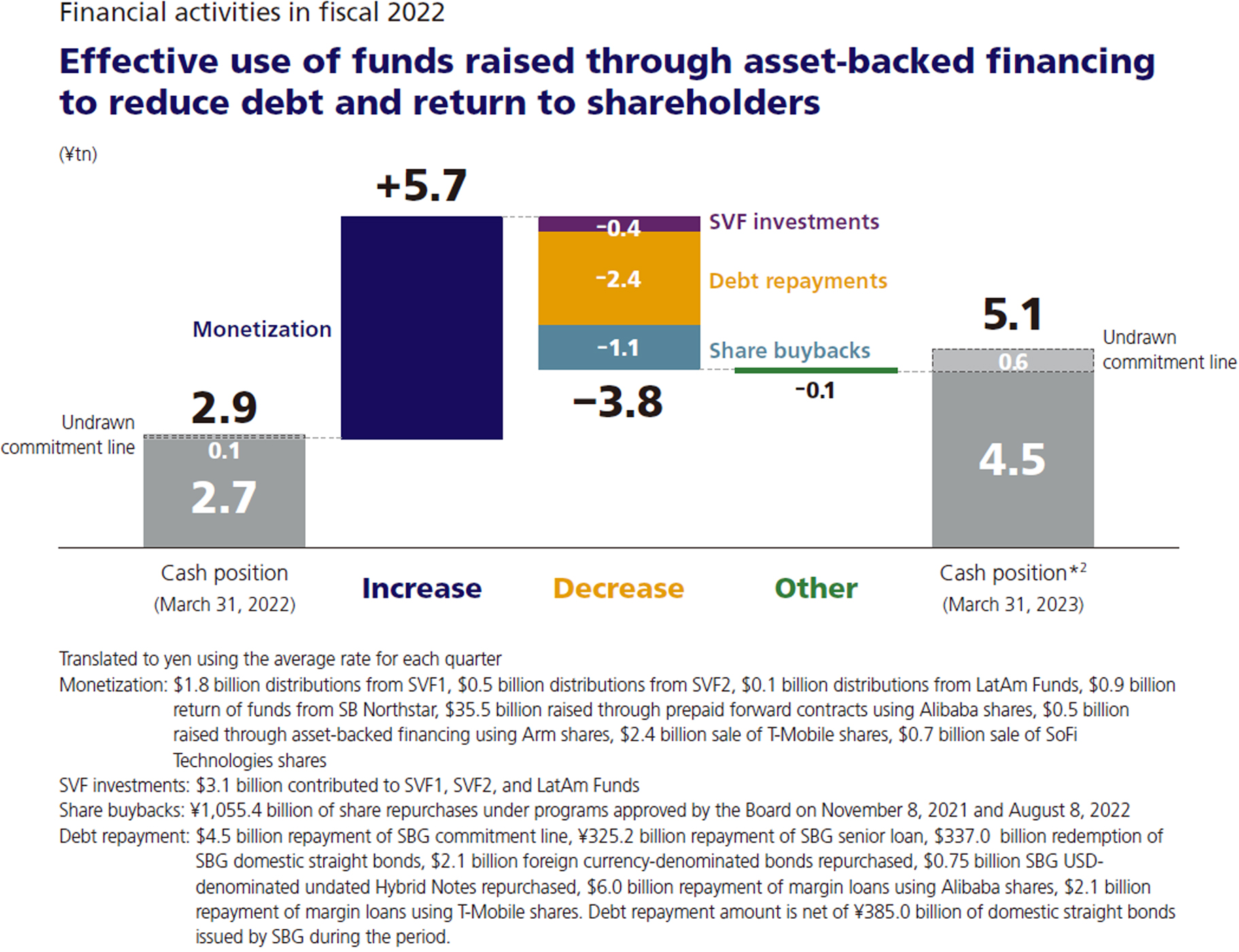

Gross debt reduction

Concurrent with our monetization strategy, we actively reduced our debt over the past year. Specifically, we repaid ¥1,007.8 billion in margin loans*5 and ¥915.9 billion in bank loans, and redeemed or repurchased ¥442.0 billion in bonds,*6 for a total debt reduction of ¥2.4 trillion.*7 In this regard, as we have monetized our assets into cash, we also made efforts to return funds to loan lenders and bond investors. We believe that these efforts have been highly appreciated and valued.

-

*5 Net of a $0.5 billion increase in asset-backed financing using Arm shares in the first quarter of fiscal 2022

-

*6 Face value. Excludes the 58th series of unsecured bonds (¥385 billion) issued in the third quarter of fiscal 2022

-

*7 Calculated based on the average exchange rate during each quarter

Share buybacks

At the same time, in fiscal 2022, we successfully implemented large-scale share buybacks totaling ¥1,055.4 billion.*8 It is widely acknowledged that in a challenging market environment, the prudent approach would be to exercise restraint in both share buybacks and new investments. However, despite the prevailing market conditions, we executed the buyback program through fiscal 2022. This initiative was carried out in accordance with the ¥1 trillion program approved by the Board in fiscal 2021, taking careful consideration of our financial balance. As evidenced by our substantial share buybacks totaling ¥4.5 trillion*9 over the past five years, we have demonstrated an unwavering commitment to increase value for both our shareholders and bond investors. We will continue to leverage share buybacks as one of the measures to showcase the true value of our company.

-

*8 Total amount acquired in fiscal 2022 under the Board resolutions of November 8, 2021 and August 8, 2022.

-

*9 See page 71

for the breakdown of ¥4.5 trillion buybacks.

Cash position

As a result of our initiatives over the past year, our cash position amounted to ¥5.1 trillion as of March 31, 2023, a significant increase from the previous year. Of the total cash position, ¥4.5 trillion was in cash and cash equivalents, while the cash balance attributable to SBG, excluding subsidiaries, was ¥3.5 trillion. Of this balance, 77% (¥2.7 trillion) is denominated in U.S. dollars. Our investment business now primarily focuses on investment opportunities denominated in U.S. dollar, making it the main currency for the business, and the majority of monetized assets were also denominated in U.S. dollars. As a result, our reserved cash in U.S. dollars has benefited from the strong dollar and the substantial rise in U.S. interest rates over the past year. In the fourth quarter of fiscal 2022, the average yield on our U.S. dollar deposits was 4.92%.

Approach to the risks of rising interest rates

As of March 31, 2023, 77% of our outstanding interest-bearing debt*10 had fixed interest rates, providing a degree of stability in our interest payments in the face of interest rate increases. Furthermore, when looking at the balance between funds managed and fund raised, we effectively manage the impact of higher interest payments, given that our interest income also increases as interest rates rise. We are proud of our successful navigation of these volatile financial market conditions.

In addition, we actively repurchased our outstanding fixed-rate foreign bonds and perpetual subordinated notes, when their prices declined due to rising interest rates. As a result of these actions, we achieved a gain on redemption of corporate bonds*11 of ¥44.1 billion in fiscal 2022. This result reinforces our confidence that there is little cause for concern regarding the financial risks to SBG associated with rising interest rates.

-

*10 Interest-bearing debt of SBG and fund procurement subsidiaries as of March 31, 2023. Includes margin loans and excludes prepaid forward contracts

-

*11 Excludes the difference of face value and purchase price associated with the $750 million buyback of U.S. dollar perpetual subordinated notes

Performance of SoftBank Vision Funds

SoftBank Vision Funds recorded another year of losses in fiscal 2022, bringing the cumulative investment loss since inception to $8.5 billion. While we are disappointed that the value of our investments is below the cost of investment, we are encouraged that the deficit has started to recover on a quarterly basis.

In SVF1, where the investment period has concluded, an investment of $89.6 billion has yielded a total investment return of $101.0 billion. Of this, $45.1 billion has been exited, and $20.6 billion has transitioned to the public market and can be monetized. We are assessing the potential upside of SVF1’s remaining $35.3 billion in private investments, including Arm, which is currently preparing for an IPO.

On the other hand, many of SVF2’s investments are still young—only two or three years into the initial investment—and it feels as though we have sown nearly 270 seeds across a large field. As we entered 2023, the market environment showed signs of improvement, and we are beginning to see clear signs of green shoots. Including the exited investments, the current value of SVF2’s $50.2 billion investments stood at $31.9 billion*12 as of March 31, 2023, reflecting challenging market conditions. In terms of the number of investments, SVF2 boasts a more diversified portfolio compared to SVF1. The performance of SVF2 investments will therefore serve as a valuable reference for our future investment hypothesis when we resume investing. With this in mind, we will continue to closely monitor the growth of SVF2’s portfolio companies.

SoftBank Vision Funds currently hold a portfolio of late stage and near-IPO investments, including Arm, worth over $37.0 billion. With the expectation of a recovering IPO market, we anticipate significant future growth.

-

*12 Includes sale price of exited investments.

-

*Note: The public/private classification of investments described herein is based on their status as of March 31, 2023.

Financial strategy for fiscal 2023

As we enter fiscal 2023, we remain fully committed to our existing financial policy. While some market turbulence has subsided, we remain mindful of ongoing geopolitical risks such as Russia’s invasion of Ukraine and China’s foreign and domestic policies, which continue to pose challenges. Given the prevailing market conditions, we believe it is prudent to maintain a defensive approach. Simultaneously, the rapid evolution of technology demands our attention. Innovative technologies, including generative AI, are advancing at an accelerated pace and surpassing our initial expectations. We recognize that these dynamics present an opportunity to invest in these groundbreaking technologies and we must seize the moment now.

Considering these factors, we believe it is the right time to cautiously resume investing. The prevailing financial market conditions do not inspire much optimism, and we anticipate a potential downturn. However, our strong financial position at the end of fiscal 2022 gives us confidence to adopt a balanced approach that encompasses both defensive and offensive strategies.

Arm is growing faster than we expected in terms of revenue and adjusted EBITDA. We believe that, as AI technology advances, Arm chips are poised to gain wider adoption, driving further company growth. Arm’s IPO preparations are on track and, if completed, we expect this would improve the quality of our portfolio.

We have sufficient cash reserves, eliminating the need to actively raise new funds. Regarding bond redemption, our strategy is to refinance on an ongoing basis to allow investors to reinvest in SBG, while ensuring adequate funds for redemption.

We have bolstered our financial position to an unprecedented level of safety. We will maintain close communication with investors and rating agencies to ensure that our financial stability receives due recognition.

-

This page is based on the information as of July 27, 2023.

-

Click here to check the company names or abbreviations used in this page.