Investor Relations

Message from Arm CEO—SoftBank Group Report 2025

The world’s most pervasive compute platform

Arm is a global leader in semiconductor technology, and we are defining the future of computing through one of the world’s most successful technology ecosystems. As the leading provider of compute platforms, we collaborate with more than 1,000 partners to power billions of digital devices.

We fueled the smartphone revolution and are now driving advancements in cloud computing, automotive, IoT, and AI. Our energy-efficient technology and our history of continuous innovation are essential for reducing energy costs and achieving sustainability, while delivering the performance needed for more demanding applications, making the Arm compute platform ideal across all industries, particularly as AI adoption grows.

Arm’s business model

Arm licenses its technology designs to leading technology companies that incorporate Arm’s design into their chips. Customers pay a license fee to gain access to our technology and a royalty on every chip that uses one of our technology designs.

The value of the license fee typically depends on the amount of Arm technology being licensed, how advanced the technology is, and the period over which access is being granted. There are mainly two licensing models: Arm Total Access (ATA), a subscription-like business model where customers get access to a large portion of Arm’s technology portfolio, and Arm Flexible Access (AFA), a pay-as-you-go model that offers access, design rights, and support with per-project manufacturing fees due only at tape-out. In recent years, many of our larger customers have shifted to the ATA model to access a broader range of Arm technology and future-proof their designs against the fast-changing demands of AI. In addition, because ATA is a multiyear subscription-based licensing model, Arm is able to secure long-term revenue growth.

The value of the royalty fee is often tied to the selling price of the chip and typically increases when more Arm processors are integrated or when more advanced Arm processors are used. As an example, Arm’s latest CPU technology, Armv9, is gradually replacing the previous generation Armv8*, especially in smartphones and data center servers. For fiscal 2024, the typical royalty fee for Armv9 was around double the fee for Armv8. Furthermore, Arm’s Compute Subsystems (CSS), which are pre-integrated components based on the latest Arm technology and optimized for high performance and energy efficiency, can command even higher royalty revenue than Armv9 itself.

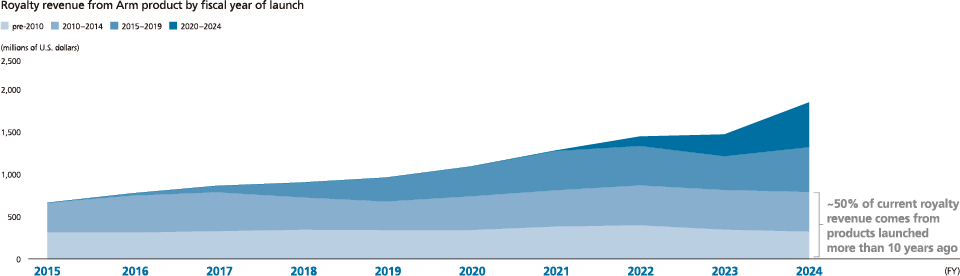

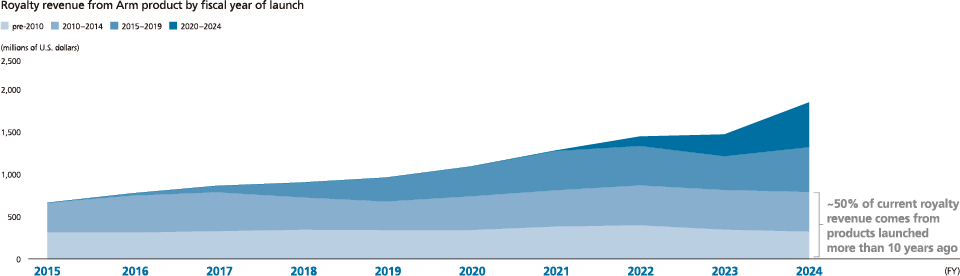

Each Arm technology design is suitable for a range of end applications and can be reused in a variety of products to address multiple markets. Each new product generates a new stream of royalties. An Arm design can be used in many different chips, and certain Arm-designed products continue to generate royalty revenue 30 years after their initial launch.

-

For the quarter ended March 2025, Arm estimates that Armv9 provided around 30% of royalty revenues, Armv8 around 45%, and older architectures around 25%.

Investing for the long term

In our fast-paced world, new applications, device categories, and markets are continually emerging. Arm invests in technology today that will power devices 5–10 years from now.

In fiscal 2024, our focus areas included

- Extending leadership in smartphones, consumer electronics, automotive, and embedded computing.

- Enhancing Arm CPUs with greater functionality, efficiency, and specialization.

- Evolving product offerings to deliver more complete system solutions.

- Advancing AI, machine learning, and next-generation technologies.

- Expanding access to serve more customers through flexible business models. For example, during the year we entered into a 10-year agreement with the Malaysian Government to supply technology for their AI-related initiatives.

Revenues today stem from past investments

It takes Arm’s customers time to develop the complex chips that contain Arm technology, with royalties typically materializing 2–3 years after licensing. Successful chips generate royalty revenue for years and even decades.

In fiscal 2024, Arm achieved record revenue of $4,007 million, growing 25.3% year on year, driven by new products. License and other revenue grew 28.5% year on year to $1,839 million, as top technology companies aligned with Arm’s roadmap, signing long-term agreements. Demand for our compute platform accelerated due to the need for energy-efficient AI across all markets.

Arm’s royalty revenue grew 22.7% year on year to $2,168 million, supported by the adoption of Armv9 in high-end smartphones, automotive growth, and an increased presence in cloud servers, partially offset by a decline of chip sales for industrial IoT and networking equipment.

-

Based on data derived from royalty reports provided by Arm’s customers. Royalty revenue refers to royalty revenue reported by Arm. Fiscal year refers to Arm’s fiscal year.

Advancing Arm’s strategy: Delivering innovation and growth

In fiscal 2024, Arm’s journey entered a new phase—one focused on accelerating investments in R&D to develop next-generation technologies and enhancing ecosystem support to help our customers get their Arm-based products to market even faster.

During the year, we increased investment in four key areas:

Expanding Our Leadership in AI

Arm’s compute platform powers AI workloads from the data center to the edge. In the data center, NVIDIA pairs its Arm-based Grace chip with its Blackwell GPU to accelerate training and inference. In edge devices, Arm-based chips enable AI applications in PCs, smartphones, smart cameras, and autonomous vehicles. To further support AI innovation, we introduced new CPUs and software frameworks. We also strengthened partnerships with key AI ecosystem players, including Meta and OpenAI, ensuring Arm remains the primary compute platform for AI workloads globally.

Deepening Our Automotive Market Engagement

Arm’s compute platform is widely used in in-vehicle infotainment (IVI) systems and advanced driver-assistance systems (ADAS) and in early-stage autonomous driving applications such as Renesas Electronics’ series of R-Car chips. During the year, Arm continued to work with leading automotive companies to develop software-defined vehicles (SDVs), an important step in the creation of fully autonomous vehicles. This included announcements of a new AI framework for SDVs based on Arm’s latest Armv9 compute platform with SOAFEE, an industry consortium co-founded by Arm, which now includes more than 120 automotive companies.

Strengthening Our Data Center Presence

Most of the world’s largest hyperscalers are either already deploying Arm’s compute platforms in their data centers or are developing their first Arm-based data center chips. During the year, Amazon announced that more than 50% of the server chips deployed in its data centers since 2023 were based on Arm’s compute platform. Also, Microsoft and Google both launched services powered by their first Arm-based data center chips, reinforcing Arm’s growing footprint in cloud computing.

Investing in Supporting Innovation Across Our Global Ecosystem

Our focus on software development enablement has helped developers bring solutions to market more quickly across IoT, mobile, and embedded segments. We estimate that more than 20 million software developers are writing applications for Arm’s compute platform, making it the largest software ecosystem in the world.

Our solid performance through fiscal 2024 confirms Arm’s strategic direction. Looking ahead, we remain committed to expanding our portfolio of high-performance, energy-efficient compute platforms; investing in robust software solutions; and deepening our ecosystem collaborations. By doing so, we position Arm not only to capitalize on current opportunities but also to shape the future of computing for years, if not decades, to come.

-

This page is based on the information as of July 28, 2025.

-

Click here to check the company names or abbreviations used in this page.