It all began with a photo

In January 1975, when I was 17 and living in San Francisco, I came across a photo in a magazine that changed the course of my life. It looked like a blueprint of a futuristic city or an intricate geometric pattern—mysterious and captivating. What I was actually seeing was a tiny microcomputer chip: small enough to rest on a fingertip, yet powerful enough to reshape the future. At the time, I had just begun learning to program on an IBM computer and believed computers were massive, expensive machines far removed from everyday people. Yet, this little chip held countless transistors printed on a silicon wafer, packed with the full power of a computer. In that moment, my finger trembled. I was so overwhelmed with emotion that I could not stop crying. It felt as if I were witnessing the instant when humanity began creating something more intelligent than itself. That feeling etched itself deeply into my memory. I cut out the photo, stored it in a folder, carried it with me every day, and even slept with it under my pillow. I was completely captivated by that chip—drawn to it with the same intensity others might feel for a childhood hero. After this surreal experience, I immersed myself in computer studies, attended exhibitions, and devoted myself to programming.

50 years have passed since then, and now at the age of 67, the journey that began with that photo continues to guide my every step. The emergence of intelligence surpassing that of humans, which was once considered unattainable, is now on the verge of becoming reality. The commitment I made back then, to eventually play a meaningful role in this field, is finally taking shape and beginning to materialize.

The vision that shaped SoftBank

The term ASI—Artificial Super Intelligence— may still be unfamiliar to some. While AI, or artificial intelligence, is already widely known, ASI refers to artificial intelligence that surpasses the human brain, as the term “super” suggests. Although ASI has now become an accepted and common term in the industry, I have believed in this concept for the past 50 years. From the moment I first saw that photo of the microcomputer chip, I felt certain that humanity would one day witness the emergence of intelligence beyond its own. That belief has never wavered and has been at the foundation of SoftBank. We have always aimed to lead the Information Revolution and bring happiness to everyone. And among our goals, none shines brighter than the realization of ASI. That is why I feel compelled to share this belief once again. I feel strongly that the moment has finally come to discuss the future in earnest.

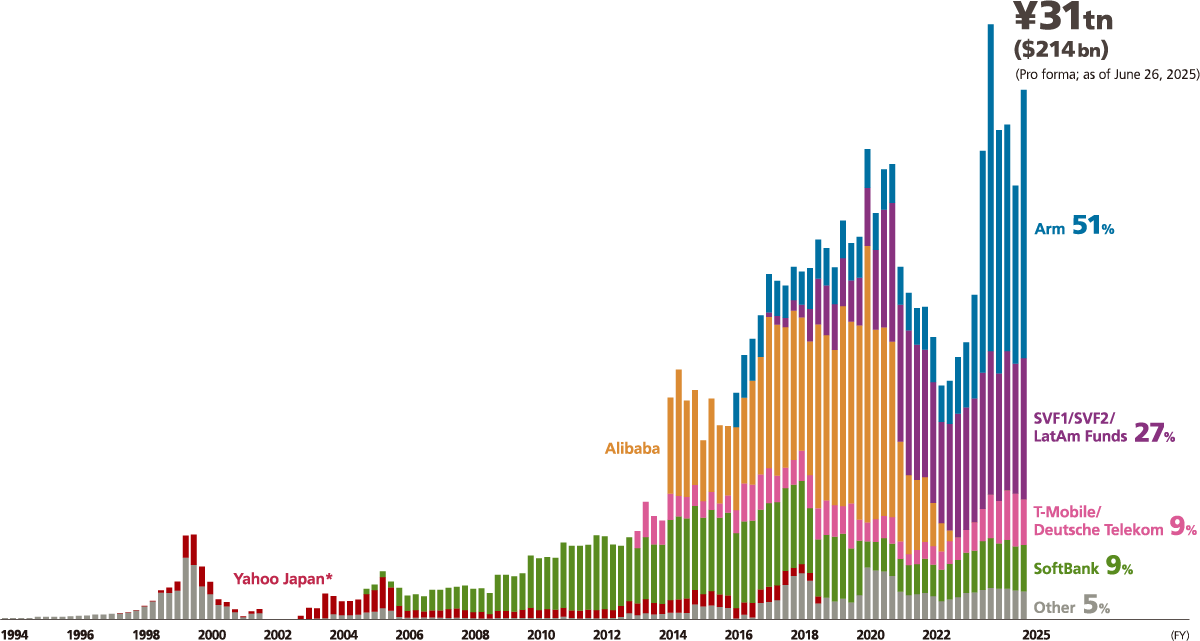

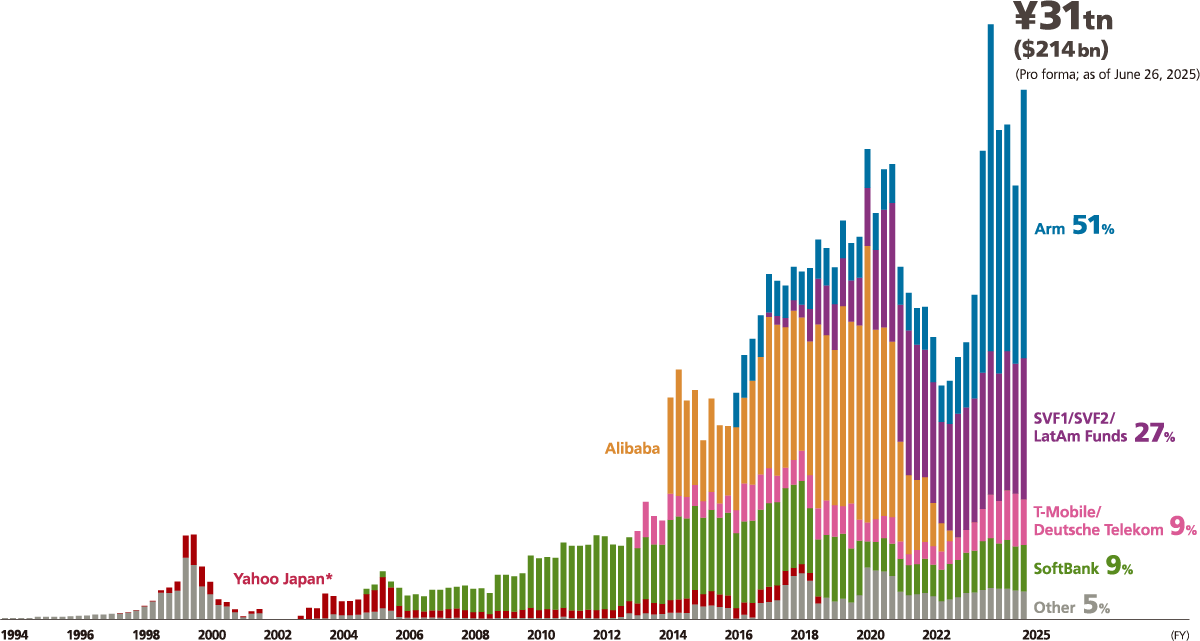

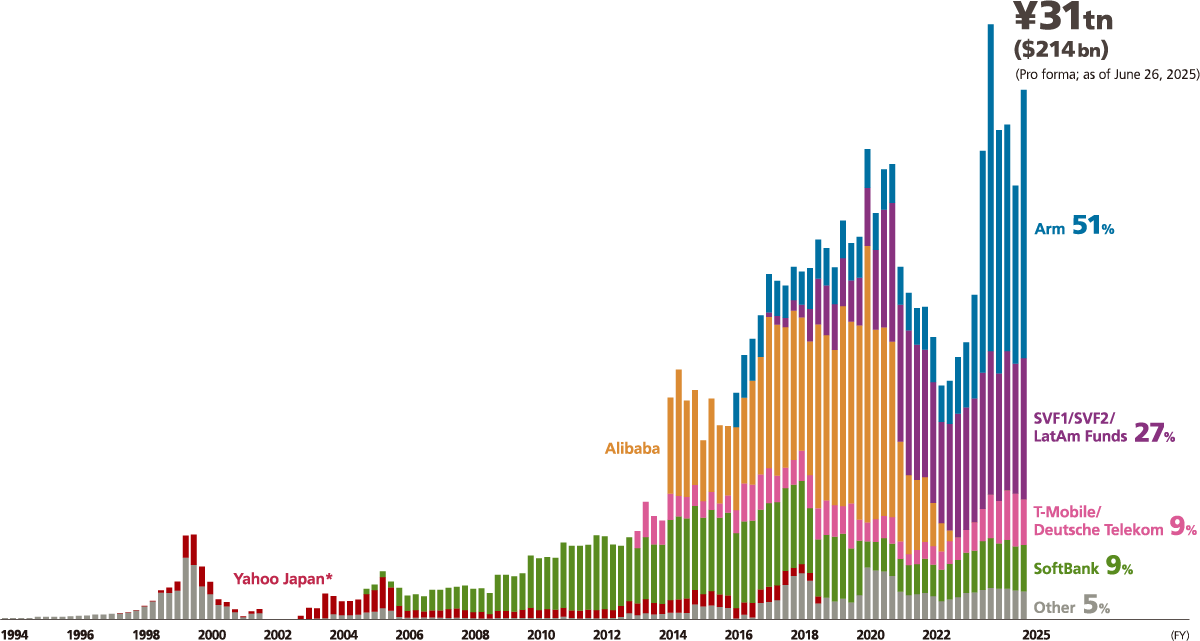

Over the years, we have strategically and frequently pivoted our business focus. And each time, we faced criticism for being unclear about our direction or perceived as likely to go out of business soon. However, looking back on our journey, it is clear our Net Asset Value (NAV)—which is the value of our equity holdings minus net debt—has steadily grown, despite some volatility (see Figure 1). We started with PC software distribution. Then came the dawn of the Internet era—when we invested in Yahoo! Inc., jointly launched Yahoo! JAPAN, and brought broadband to households across Japan through Yahoo! BB. Recognizing the rise of mobile broadband, we acquired Vodafone’s Japanese arm and helped introduce the iPhone to Japan. Later, we acquired Sprint in the U.S. and merged it with T-Mobile, which would become the world’s largest telecom company by market capitalization. As investors, we became the largest shareholder of Alibaba and launched SoftBank Vision Funds to invest in AI-driven companies around the world. We have also acquired Arm, a global leader in semiconductor intellectual property (IP), and have helped accelerate its growth. As of June 26, 2025, our NAV stands at approximately ¥31 trillion. Our market capitalization is about ¥14 trillion, roughly half the value of our assets. While our stock price and market capitalization are obviously important, they are not my ultimate goal. What matters more is having a bold vision and pursuing it with unwavering conviction. If we do that, I believe the numbers will follow.

Figure 1: Shareholder value (NAV)

-

1. NAV data for each quarter-end and as of June 26, 2025. The NAV data are the Company’s estimates based on available information, and the accuracy or completeness of the information is not guaranteed as the figures have not been audited. NAV trends are not a guarantee of future figures and are not indicative of the price of SBG’s common shares or any securities held by the Company and should not form the basis of investment decisions. The figures are based on data before considering taxes unless otherwise stated.

-

2. Shareholder value (NAV) for each investment is allocated based on the proportionate share of equity holdings value for each time period.

-

* Yahoo Japan Corporation (currently LY Corporation) became a subsidiary of SoftBank Corp. in June 2019.

(Pro forma; as of June 26, 2025)

-

1. Share prices: Closing prices on June 26, 2025, for Arm, SoftBank Corp., T-Mobile, Deutsche Telekom, and Alibaba, and March 31, 2025, for all other listed shares

-

2. Exchange rate: $1 = ¥144.80

-

3. Number of shares: As of March 31, 2025

-

4. The $7.5 billion investment in OpenAI, executed after April 2025, is included in SVF2’s equity value of holdings; the equivalent amount of borrowing is included in net debt.

At the forefront of ASI

While I have reflected on the past, what truly matters is the future. Ten years from today, when someone asks, “What has SoftBank accomplished? What difference has it made in people’s lives?”, I want to be prepared to answer with this point: “We became the world’s No.1 ASI platform provider.” To be a platform provider means being at the core of an industry. Just as Google, Apple, Microsoft, Amazon, and Meta have defined the digital age, I want SoftBank to become the foundational company in ASI—a completely new industry. I believe there are two types of companies: Those with diminishing returns and shrinking margins over time; and those such as the global tech giants mentioned above—often referred to as GAFAM,*1 that increase returns and expand their influence and profitability as they scale. For the past 30 years, much of Japanese industry has largely been stuck in the former category. However, SoftBank is determined to join the latter category and become a platform provider powered by increasing returns—worthy of standing alongside the giants.

We are strategically positioned with core assets in place. Among them is Arm, a cornerstone of our platform strategy. At the time of our acquisition in 2016, Arm primarily focused on chips for mobile phones. Today, its designs are used across PCs, automobiles, IoT devices, and cloud computing. As of the end of June 2025, more than 325 billion Arm-based chips had been shipped globally. What is particularly striking is the growth in chip shipments for cloud computing. In 2025, up to 50% of new server chips adopted by leading hyperscalers are expected to be Arm-based. In July 2024, we acquired Graphcore, a company with deep expertise in chip design, which further builds on Arm’s leadership in semiconductor IP. We are also set to complete our acquisition of another chip-design company, Ampere, in the second half of fiscal 2025. With these investments, we are incorporating the technology stack needed for end-to-end chip design into our Group, solidifying our position as a key player in the AI chip space.

OpenAI represents another cornerstone of our ASI platform strategy. Since its launch in November 2022, ChatGPT has gained 500 million weekly active users in just two and a half years. Its models now perform at a level that can pass PhD-level exams. Beyond simply understanding information, these models are beginning to reason, make decisions, and take action, signaling the dawn of the AI agent era. We have committed to investing up to $32.2 billion*2 in OpenAI. It is a massive amount, but I firmly believe that OpenAI is on track to become the most valuable company on the planet.

I am going all in—staking everything on the world of ASI. The Company encompasses a diverse spectrum of companies in line with our Cluster of No.1 Strategy. But among them, I see Arm and OpenAI as the two essential engines—together, they are indispensable to our ambition of becoming the No.1 platform provider in the age of ASI.

I believe that 10 years from now, a small number of ASI leaders will be generating value on a scale equivalent to at least 5% of global GDP—around ¥1,300 trillion.*3 Because these companies will follow the law of increasing returns, they may well achieve profit margins approaching 50%. I want SBG to be one of them—a leading ASI platform provider. This is a vision I carry with deep conviction.

-

*1 Google, Apple, Facebook (currently Meta), Amazon, and Microsoft

-

*2 The sum of SVF2’s initial investment in OpenAI in fiscal 2024 ($2.2 billion) and the effective amount of follow-on investment of up to $30 billion in OpenAI as announced on April 1, 2025. The second closing is subject to the completion of certain conditions at OpenAI Global, LLC, a for-profit subsidiary of OpenAI, Inc., including a recapitalization of its economic waterfall, the investment amount will be as follows, depending on the timing of such completion;

-

1. Up to $30 billion if completed by the end of 2025 or, in certain circumstances, early 2026

-

2. $10 billion if not completed by the end of 2025 or, in certain circumstances, early 2026

-

For details, please see the TSE release “Announcement Regarding Follow-on Investments in OpenAI” dated April 1, 2025.

-

*3 This estimate reflects SBG’s own projection, based on global GDP data published by the World Bank.

A historical turning point

Cristal intelligence was announced with OpenAI CEO Sam Altman (right) on February 3, 2025.

Cristal intelligence was announced with OpenAI CEO Sam Altman (right) on February 3, 2025.

We are working on several key initiatives with OpenAI, including the Stargate Project,*4 and Cristal intelligence.*5

Stargate is a plan to build next-generation AI infrastructure in the U.S., providing the vast computing power needed to support the continued evolution of OpenAI’s models. Cristal intelligence is a cutting-edge enterprise AI solution, designed to be tailored to each company’s needs. We are first deploying Cristal intelligence across 2,500 business systems within the Group, covering payroll, sales, inventory, engineering, and more. By the end of 2025, we aim to launch what will be one of the world’s largest AI agents across the Company. After thoroughly testing and refining it in-house, we plan to roll it out to other Japanese companies.

In the age of ASI, autonomous AI agents and physical robots will completely transform society at every level, across all types of occupations. We are now at an historic inflection point, one where the very nature of work, happiness, and our relationship with AI is being redefined.

-

*4 For details, see “Announcing The Stargate Project” dated January 22, 2025 and page 16 of this report.

-

*5 For details, see “OpenAI and SoftBank Group Partner to Develop and Market Advanced Enterprise AI” dated February 3, 2025 and page 16 of this report. Cristal intelligence is a tentative name.

Beyond superintelligence

The journey that began 50 years ago, when I first encountered a photo of a microcomputer chip, is now reaching a major turning point. I have discussed the emergence of the ASI era many times, but this is the first time I have ever declared my ambition to become the world’s No. 1 platform provider in this field. Aiming to be No. 1, whether it seemed possible or not, has always been my mindset. That belief has shaped how I have lived my entire life. Now, I have finally reached the stage where I can at last pursue the passion I have held for decades: to lead as a platform provider in the age of ASI.

But superintelligence alone is not enough. Processing power and computational speed may translate into raw intelligence, but what truly matters is something deeper. We need intelligence imbued with compassion, kindness, and a sense of humanity. Without these qualities, no matter how capable it is, such intelligence cannot be trusted, nor can it be respected.

When AI surpasses humans in its capabilities, if it does not possess empathy or care, it could pose significant risks. I do not, however, believe AI is that foolish. After all, AI was created and nurtured by humanity, and it should live alongside us as a partner on this planet.

The next 50 years will be a time when nearly everything is redefined: how we work, what we value as happiness, and how we relate to AI itself. The Information Revolution is the means to make this transformation possible. Its purpose is clear and unwavering: to bring happiness to everyone. I want to reaffirm this enduring belief. We will make SoftBank the world’s leading platform provider in the age of ASI. That is my ambition. Thank you for your continued support as we embark on this journey into the future.

June 27, 2025

Representative Director,

Corporate Officer, Chairman & CEO

Masayoshi Son

-

This page is based on the information as of July 28, 2025.

-

Click here to check the company names or abbreviations used in this page.

Related Contents