Investor Relations

CFO Message—SoftBank Group Report 2025

Powering the ASI Vision

with Strategic Financial Support

Board Director, Corporate Officer,

Senior Vice President, CFO, CISO & GCO

Head of Finance Unit, Head of Administration Unit,

Head of Legal Unit

SoftBank Group Corp.

Board Director, Corporate Officer, Senior Vice President, CFO, CISO & GCO Head of Finance Unit, Head of Administration Unit, Head of Legal Unit

SoftBank Group Corp.

Yoshimitsu Goto

Fiscal 2024 summary—The year we set ASI in motion

Guided by our corporate philosophy of Information Revolution—Happiness for everyone, we have steadily invested in high-growth companies for the AI era. Over the past three years, generative AI has begun reshaping daily life and increasing AI’s presence across society. For the entire Group, this period has also marked a time of deep reflection and strategic redefinition—what Mr. Son, our founder and CEO, calls a “second founding”—to fully develop and refine a new business vision.

We viewed fiscal 2024 as a pivotal turning point, a year when we made our bold leap toward realizing ASI through large-scale, strategic investments. We increased our investments year over year, and we may continue investing deliberately and strategically as we progress into the ASI era. To support these efforts, we remain committed to maintaining and strengthening a robust financial foundation that enables us to respond flexibly and actively advance our ASI ambitions.

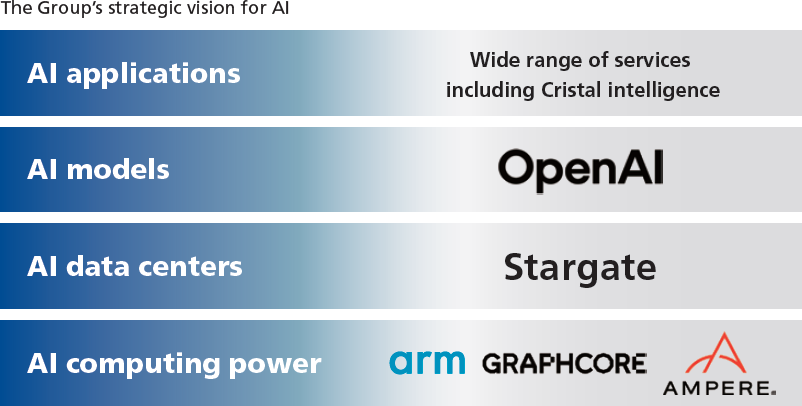

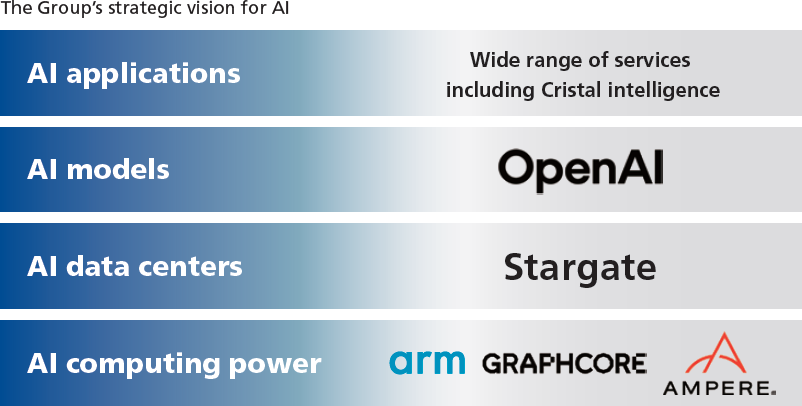

Growth investment vision takes shape

To fully understand the rationale behind each major investment, it’s essential to see how we are laying the groundwork for ASI. We are doing so across four strategic fronts. The first is semiconductor chips development, which is the core of AI, anchored by Arm. We aim to scale and strengthen our AI chips and semiconductor businesses. The second is AI-powered robotics. The third is building data centers to support these technologies; even breakthrough innovations like generative AI from OpenAI cannot progress without robust infrastructure. And the final one is securing power supplies, which are critical to operating the data centers that underpin AI’s continued advancement.

Stargate Project

In January 2025, together with OpenAI and Oracle, we announced the Stargate Project, a plan to build next-generation AI data centers in the U.S. for OpenAI.

For the information revolution to truly permeate society, three elements are essential: technological innovation, service deployment, and supporting infrastructure. Historically, growth during the Internet Revolution was driven by technological breakthroughs, the rise of new business models, and the expansion of broadband and mobile infrastructure.

Today, the AI revolution similarly demands robust infrastructure to transform cuttingedge AI technologies into practical and scalable services. In particular, building data centers with large-scale computing capacity has become an urgent priority.

With this in mind, we are leading the Stargate Project to construct large-scale data centers in the U.S.—the epicenter of generative AI innovation—over the coming few years. We view this as a core strategic investment to help shape the foundational infrastructure of the AI era.

Cristal intelligence

In February 2025, we announced a partnership with OpenAI to jointly develop and commercialize advanced enterprise AI under the concept of Cristal intelligence.* We are the first company globally to implement these solutions at scale across an entire corporate group. As a leader in generative AI, we plan to deploy these technologies to work internally as a key driver of profitability. At our joint venture with OpenAI, we are also preparing to launch full-scale AI agents to accelerate the growth of enterprise services. The company will hold exclusive distribution rights in Japan. Drawing on the expertise gained through domestic service deployment, we aim to expand these solutions into global markets.

-

Cristal intelligence is a provisional name, not an official designation.

Follow-on investments in OpenAI

In March 2025, we committed to making follow-on investments in OpenAI. Based on the assumption that a syndicate will be formed to support the full investment amount, we plan to invest up to $30 billion in the company.

To fully unlock our potential as a leading company in the AI era, Arm’s leadership in semiconductors and OpenAI’s cutting-edge AI technologies are essential. Deepening our capital partnership with OpenAI, an organization with unmatched AI capabilities, is vital to building the strength we envision for the Group.

This was a bold investment decision, but one we believe will generate substantial mutual benefits. OpenAI’s growth will help Arm further enhance its value, while OpenAI will be able to expand its opportunities through collaboration with Arm and the broader our ecosystem. As OpenAI grows, so does the upside potential of our equity stake in both the company and Arm, positioning this large-scale portfolio as a powerful engine for the growth of our Net Asset Value (NAV).

Our journey in the Information Revolution has been marked by several turning points— from becoming Japan’s first OTC-registered software wholesaler in 1994, to our early investment in and transformative partnership with Yahoo! and the creation of its Japanese operation. Now, we face what may be the most profound technological shift yet: the AI revolution. We believe this wave will surpass all past innovations and might well be the most consequential we will ever experience. Our investment in Yahoo! was a daring bet at the time, given our scale. In contrast, our decision today to invest up to $30 billion in OpenAI is backed by our strong NAV. We are confident in our financial capacity to fully support this ambitious step forward.

Decision to acquire Ampere

In March 2025, we announced our decision to acquire Ampere, a U.S.-based semiconductor design company specializing in cloud and AI, for $6.5 billion. We view Ampere as a critical piece in supporting the continued growth of Arm, which leads our semiconductor strategy. The transaction is expected to close in the second half of fiscal 2025. As a strategic investment holding company, we will continue to invest in a broad range of businesses that complement Arm’s growth and technology roadmap. At the same time, we will further strengthen and expand our Group-wide semiconductor strategy by effectively integrating our diverse internal resources to maximize strategic impact.

Summary of fiscal 2024 performance

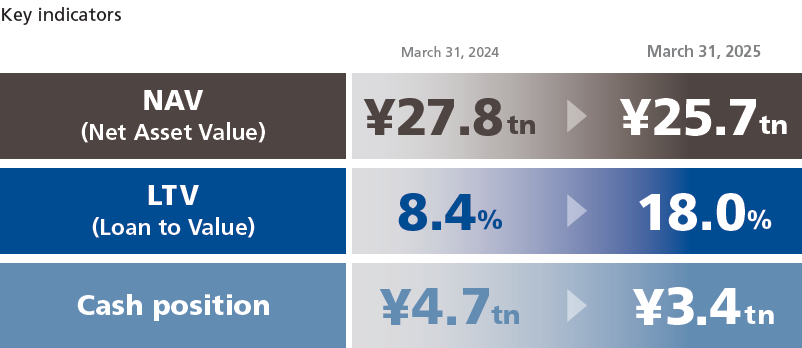

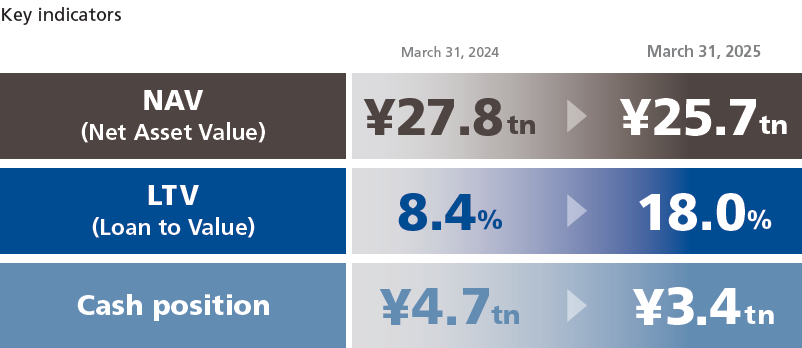

Fiscal 2024 was characterized by heightened market volatility, primarily driven by a sharp decline in U.S. tech stocks. As of March 31, 2025, our NAV stood at ¥25.7 trillion, down ¥2.1 trillion from the previous fiscal year-end. Despite this decline, we believe SBG remains the only company in Japan with a NAV of this scale backed by highly liquid assets.

Another key indicator, our Loan-To-Value (LTV) ratio, rose to 18.0%, up approximately 10 points from 8.4% a year earlier. With our internal safety threshold set at 25%, we continue to operate comfortably within a range that ensures strong financial flexibility.

Due to our proactive investment approach, our cash position declined by ¥1.3 trillion year on year, to ¥3.4 trillion. Even so, we maintain ample liquidity.

Net income attributable to owners of the parent totaled ¥1.15 trillion, marking a return to profitability for the first time in four years. While NAV remains our core metric as an investment holding company, a return to profit is nonetheless a welcome development.

Financial preparation for large-scale investment

In fiscal 2024, we prioritized strengthening our financial foundation to ensure flexible and stable funding in anticipation of future large-scale investments. In recent years, we have relied heavily on bond issuance. Reaffirming the importance of indirect finance, we rebalanced our funding mix by gradually increasing loan-based financing over the past year.

This strategy proved effective on April 15, 2025 when we completed the first closing of our investment in OpenAI. Including the $6.5 billion required for the Ampere acquisition, we secured a total of $15 billion in loans. Despite a particularly challenging environment marked by significant market pressure stemming from U.S. tariff policies, we completed the financing just two weeks after the announcement of the follow-on investment in OpenAI—a pace rarely achieved under such conditions. This swift execution was made possible by the trust we have built with financial institutions over time and the improvements in our credit profile.

We also remain committed to enhancing our creditworthiness. We are optimizing cash allocation with a view to maintaining a sound financial position, while ensuring funding flexibility. We consistently strike a balance among three priorities: (1) growth investments, (2) shareholder returns, and (3) financial improvements. Of these, financial improvements play a critical role in earnings and maintaining the trust of credit investors. We believe that applying optimal leverage to drive corporate growth leads to optimal returns for shareholders. This is why we place equal emphasis on financial improvement and shareholder returns. The successful financing of the follow-on investment in OpenAI validates the long-term financial strategy we have consistently pursued.

In August 2024, we authorized a ¥500 billion share buyback in response to sharp market fluctuations. As we look ahead to fiscal 2025 and beyond, we see major investments on the horizon as we enter a phase where growth investments take precedence.

-

Cash position = Cash and cash equivalents + short-term investments recorded as current assets + bond investments + unused borrowing capacity (including commitment lines and margin loans secured by Arm shares). As of March 31, 2025, the full amount of the commitment line had been drawn, while $5.0 billion of the margin loan facility backed by Arm shares remained unused. Figures are on a SBG standalone basis.

Fiscal 2025 financial policy and strategy

Our financial policy for fiscal 2025 remains unchanged. We will continue to manage our LTV ratio below 25% under normal market conditions, with an upper threshold of 35% even in exigent circumstances. We will also maintain sufficient cash position to cover at least two years’ worth of bond redemptions. Our disciplined financial policy remains the same in fiscal 2025.

While some may suggest that we revise our financial policy to allow for more flexibility in response to changing business conditions and market fluctuations, we believe that a consistent approach is key. Our unwavering financial policy allows us to clearly and continuously demonstrate our commitment to financial soundness to all stakeholders, including retail investors. This is especially important for shareholders and debt investors, who form the core of our support base. By maintaining a clear and consistent policy, we believe we can build lasting trust and ultimately enhance both our creditworthiness and our corporate value.

Strategically, we will continue to balance caution with bold action as we navigate an increasingly uncertain environment, all while laying the groundwork for sustainable NAV growth. On the investment side, we will stay closely aligned with business development and respond swiftly to market changes. On the financing side, we will continue to diversify funding methods to ensure strategic flexibility. Finally, rigid control of our LTV remains central to our discipline. By further strengthening the financial foundation built over many years, we aim to remain resilient and adaptive in a changing world.

-

This page is based on the information as of July 28, 2025.

-

Click here to check the company names or abbreviations used in this page.